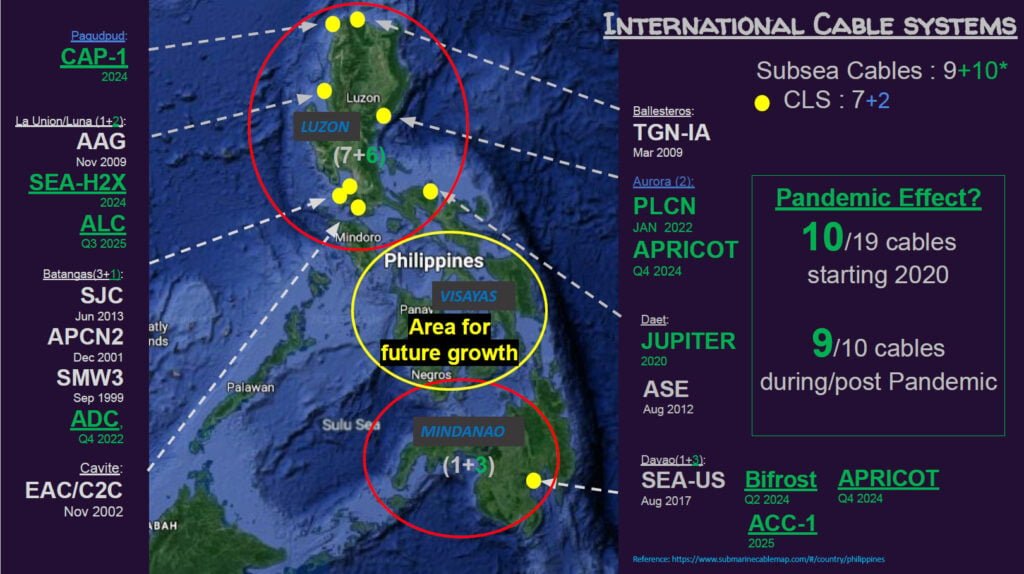

The Philippines is an archipelago comprising three major island groups: Luzon, Visayas, and Mindanao with 7,641 islands at high tide and a population of 113 million spread across roughly 2,000 of those islands. The Philippines has 10 international subsea cable systems, nine International Cable Landing Stations (CLS), 678 Autonomous System Numbers (ASNs), 10 local Internet Exchange Points (IXPs), and 14 data centres currently.

Figure 1 shows the current infrastructure with data centres and cable landing facilities. The majority of infrastructure lands in Luzon and serves the whole country. Being a tropical nation in the Pacific Ring of Fire we’re prone to natural disasters. Having redundancy where most of the population lies (Luzon) was prioritized but is now seen as important to further explore national redundancy, so efforts were refocused on Mindanao — where we currently have a growing number of subsea cables and stations.

One area for future growth is the Visayas. There are projects in the works that I can’t currently disclose but many initiatives were begun during the pandemic. Ten of the currently planned 19 subsea cable projects had begun by 2020 and the remaining nine projects began during the pandemic or just after.

ISPs

The majority of the IPv4 space is still managed by Globe and PLDT but growth and demand drive good competition (or vice versa). These two big providers actually manage a lot of smaller players that use subsets of their infrastructure. However, some new larger providers are coming in (Table 1).

| AS9299 | Philippine Long Distance Telephone Company | 3,024,128 |

| AS4775 | Globe Telecoms | 678,656 |

| AS17639 | Converge ICT Solutions Inc. | 461,824 |

| AS6648 | Bayan Telecommunications, Inc. | 366,592 |

| AS132199 | Globe Telecom Inc. | 338,176 |

| AS9658 | Eastern Telecoms Phils., Inc. | 267,776 |

| AS10139 | Smart Broadband, Inc. | 176,384 |

| AS7629 | EPLDT | 175,104 |

| AS23944 | SKYBroadband SKYCable Corporation | 131,072 |

| AS17970 | SKYBroadband SKYCable Corporation | 49,152 |

| AS55821 | RADIUS TELECOMS, INC. | 47,104 |

| AS23930 | IP-Converge Data Center, Inc. | 36,352 |

| AS18190 | SunValley New Oriental | 30,976 |

| AS3550 | Philippine Network Foundation, Inc (PHNet) | 30,720 |

| AS139831 | DITO TELECOMMUNITY CORP. | 19,968 |

On the rise are ISPs serving FTTH such as Radius, SourceTel (formerly Wifi City) and PT&T. Radius is interesting. Traditionally a power utility company (e-Meralco), they probably sought to capitalize on the fibre backbone they have all across the Philippines and leveraged that for broadband. Dito is another growing mobile service provider.

To give you a brief background on ISPs in the Philippines, historically it was perceived by consumers that only big telcos were capable of providing Internet services but over time several providers have moved into managing their own infrastructure, coincidently becoming service providers, such as:

- Telco ISPs — Multi-service providers / Mobile Operator.

- ISPs — Solely ISPs.

- Cable TV — Cable TV providers offering Internet Services. These providers grandfathered from cable TVs, which historically just provided a cable service but now provide Internet services in this niche. These are important because a lot of the movement in Autonomous System Numbers (ASNs) came from this sector.

- Enterprise — Managed infrastructure for business plays a big role across the Philippines.

- Academia — Managed infrastructure for schools/research often have different campuses across the economy. They usually home traffic to a large campus and it’s aggregated from there.

- Government — Managed infrastructure for government.

- Philippine Association of Private Telecommunications Companies (PAPTELCO) — Managed Infrastructure (Private) play an important role at the edges across the archipelago. The idea with PAPTELCO is collaboration. They include and encourage different players to work together to get their connections to the edge.

Others on this list, specifically Cable TV and PAPTELCO, were driven to service provision mainly by the need to improve service and the opportunity to capitalize on their existing capability.

These varying methods highlight the many different approaches to connectivity across the Philippine islands — fibre, wired, wireless, and copper coax.

ASNs

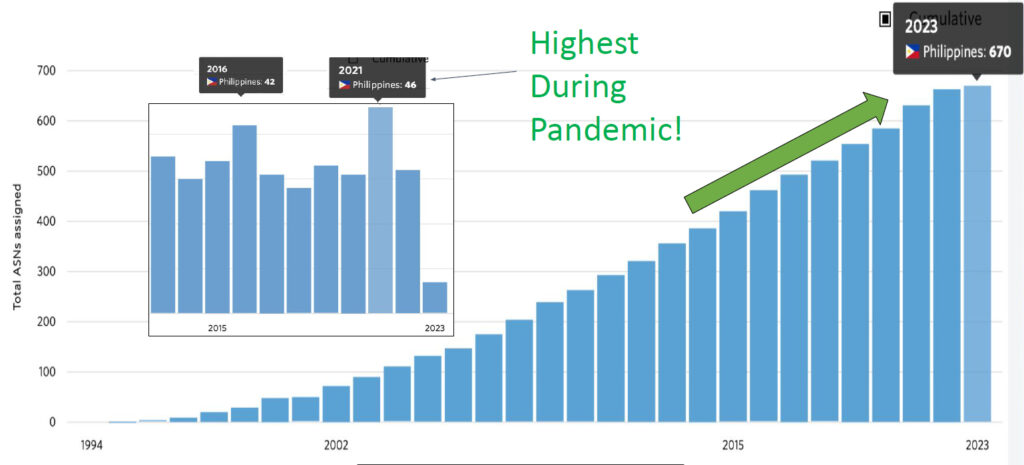

As Figure 2 shows, we’ve seen continuous growth in ASNs with a large jump in 2016 and a substantial growth in ASN applications during the pandemic in 2021 driven by the need to peer. So, the continuous growth of new networks is driven by peering.

From a community perspective, PhNOG was instrumental in educating the local community on the benefits of peering and now we see steady growth in ISP infrastructure — so they can peer. This is probably the reason why we see growth in the Internet Exchange Point (IXP) space.

IPv6

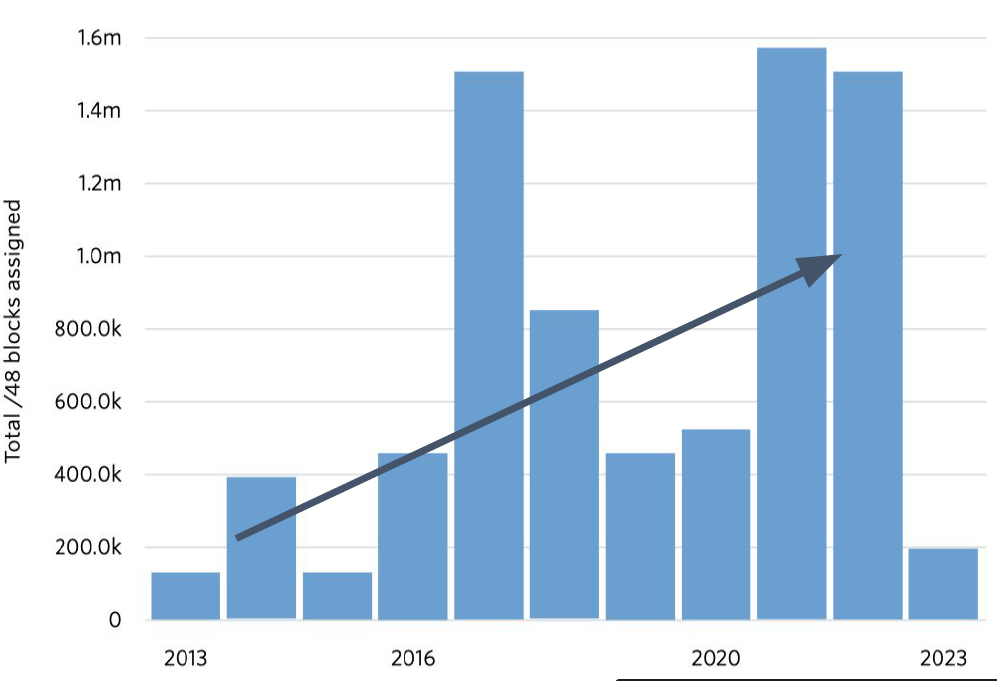

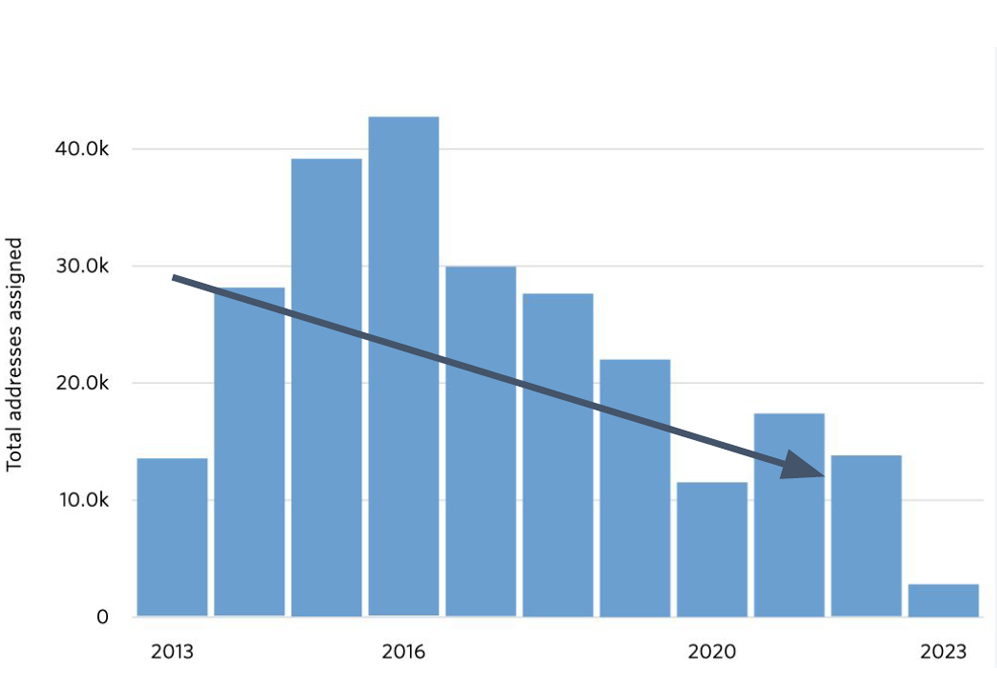

The Philippines lags a bit with IPv6, but we are seeing growth in adoption and some decline in IPv4 (Figures 3 and 4).

When PhNOG did IPv6 case studies, we saw lower requests for additional IPv4 addresses so we were expecting to see more deployed IPv6 but that didn’t happen. Instead, providers became better at managing their existing IPv4 resources. Digging deeper, we found there are several legacy devices being managed in their own systems, especially in billing systems that used IPv4 and there was no motivation to deploy IPv6. Right now, it’s still a work in progress, so we’ll monitor and provide help to the community.

IXPs and data centres

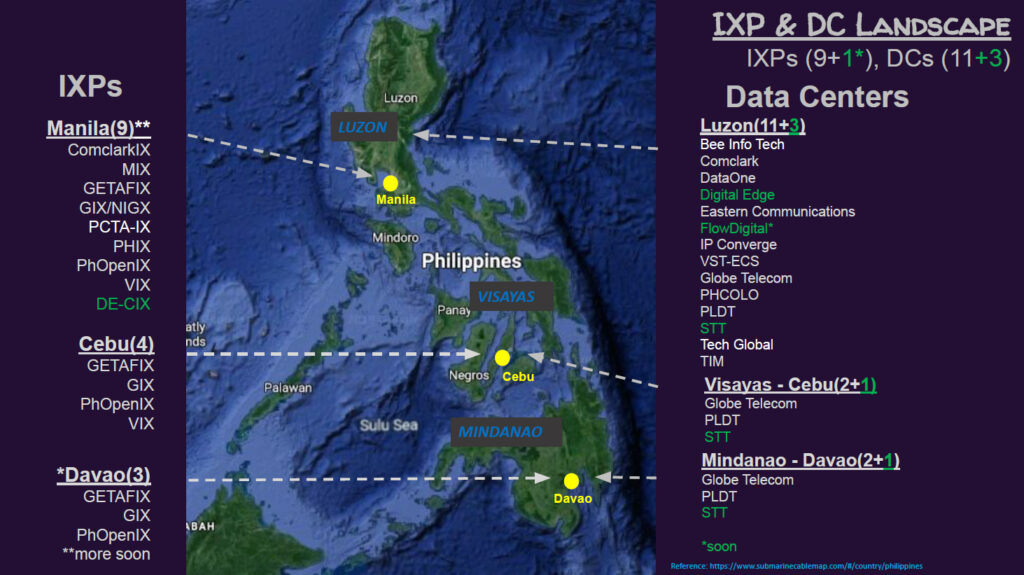

Many IXPs focus their efforts on Manila (Figure 5) where the population (including traffic) is dense and where initially most of the cable stations were, but we’ve seen growth in Cebu and Davao. PhNOG worked hard to improve visibility in the community to increase an understanding of how important redundancy is.

Listed on the right side of Figure 5 are the data centres (DCs). Historically, only large local players (Like Globe and PLDT) had their own DCs but as this list shows, other players are entering the market. The latest DCs coming from abroad are Digital Edge, Flow Digital and STT, which have sought to establish a presence in Visayas and Mindanao.

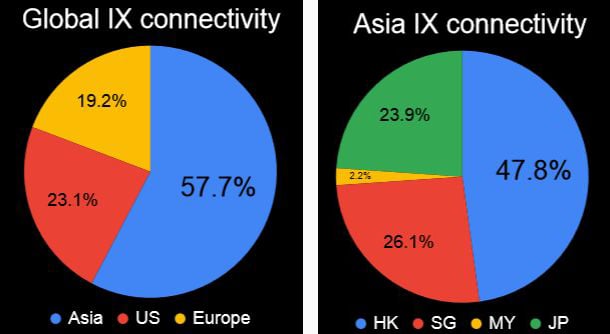

As much as possible, we want traffic to be local or localized, but we understand that traffic also needs to go out. Historically, local traffic has been US-centric but the current trend is Asia-centric driven by geography. Breaking that trend down further, Figure 6 shows Hong Kong plays an important role as the next gateway, based on its proximity to the Philippines, followed by Singapore and Japan.

Recently, we’ve seen a shift in some traffic due to the current geopolitical situation in Hong Kong. The trend is to build additional facilities in Singapore and Japan for redundancy purposes, and an overlay network for clean pipe services. This development has also strategically positioned the Philippines as the next regional hub!

We’ve seen local providers adapting to new trends that ultimately are changing the Internet landscape, such as port sizes of 100G (or nx100), new ASNs from Cable TV providers entering, an increase in openness to peering and an expansion in IXP connectivity, link diversity, and multiple sessions.

Lessons learnt

The pandemic taught us that you can be inspired by crisis. We saw providers move to host their own content, which helped us localize traffic, and we’ve seen an increase in international collaboration and local investment. We’ve seen joint ventures in Globe partnering with STT, new DCs coming from partnerships like Digital Edge and Flow Digital, and IXPs GetaFIX and DE-CIX in a connectivity collaboration.

As well as the growth in cable systems, we’ve seen Starlink begin operations in the Philippines, and community advocacy like US AID/Beacon, AORA (Open RAN) providing services that were not available with existing providers and an increasing sense of community.

Community is important because you can have a lot of initiatives, but you need something that pushes an agenda to have a cumulative effect from different initiatives. Currently, that space is filled by PhNOG. NOGs are neutral spaces where competitors can collaborate and share knowledge, so perhaps the biggest lesson is to get involved in your local NOG. Of course, behind the holistic push from NOGs, are the people who back up words with actions and the leaders who become role models to inspire the community.

Overall, the Philippines has a lot of potential for growth in its infrastructure and ISP landscape. With current initiatives, we are moving towards reliable Internet connectivity with greater redundancy, which is essential for its growth and development.

Finally, I’d like to sum up the Philippines’ Internet landscape with three local words: ‘Diskarte’, which means we’ll find a way (to make it happen), ‘walang katapusan’, which means there’s no finish line (there will always be a project to improve) and ‘konsyensya’, which I use to mean an Internet of conscience — it’s not just about beating your customers or competitors, what we do improves the Internet for everyone. Equally or even more important is what we don’t do, as that impacts everyone.

This material was presented at the APRICOT 2023 Peering Forum 2. Watch the video:

Vincent ‘Achie’ Atienza has been with Globe Telecom handling peering, interconnection, and strategy for almost 14 years now. Achie is active in the Philippine Internet community, the Chair of PhNOG (local host of APRICOT 2023, and virtually for APRICOT 202), and acts as a member of the Board of Trustees for the Internet Society Philippine Chapter (ISOC-PH).

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.

Good one Sir Achie ! Very informative and helps clarify a lot of misunderstanding of the Philippines Internet Landscape.

Cheers !