South Korea, located in East Asia, is home to over 51 million people and boasts a GDP of USD 32,236. The economy is divided into seven main cities and eight regional areas, with Seoul serving as the capital city.

South Korea is renowned for its rich history, vibrant culture, and technological advancements. From the bustling streets of Seoul to the serene landscapes of Busan, South Korea offers a diverse range of experiences for locals and tourists alike. Whether you’re exploring the ancient palaces, indulging in delicious Korean cuisine, or immersing yourself in K-pop culture, there’s something for everyone in this dynamic economy.

With its blend of tradition and modernity, South Korea continues to captivate the world with its unique charm and innovation. However, in this post, we’ll focus on South Korea’s Internet landscape.

Internet access and usage

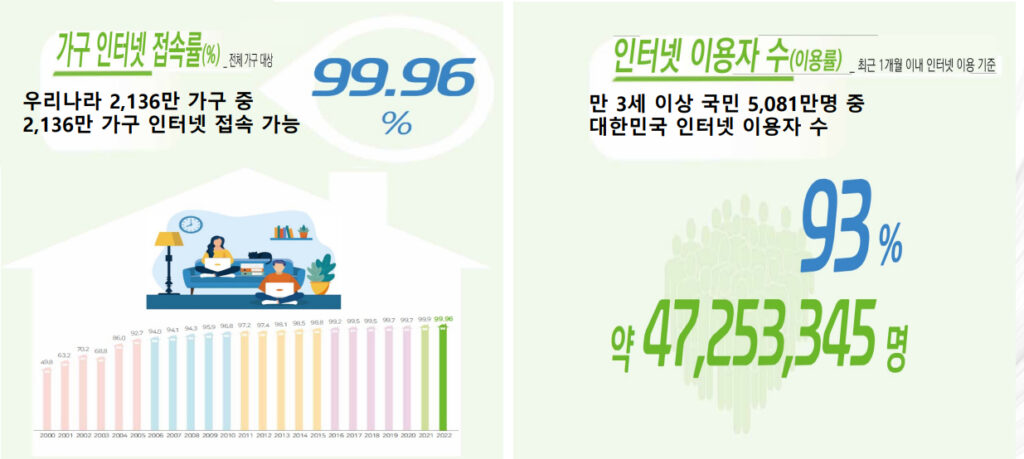

In South Korea, the rate of Internet accessibility is truly remarkable. With a staggering 100% household Internet access rate, all 21.36 million households across the economy are connected. This means that every household in South Korea can access resources and opportunities available on the Internet.

When we consider the total population of 50.81 million people, it’s astounding to note that 47 million individuals are actively using the Internet. This translates to 93% of the population being regular Internet users. The widespread availability and use of the Internet underscores South Korea’s commitment to technological advancement and digital inclusion.

With such high levels of connectivity, it’s clear that the Internet plays a pivotal role in the lives of South Koreans, enabling access to information, communication, and countless other opportunities. South Korea’s approach to Internet accessibility serves as a model for other economies striving to bridge the digital divide and empower their citizens through connectivity.

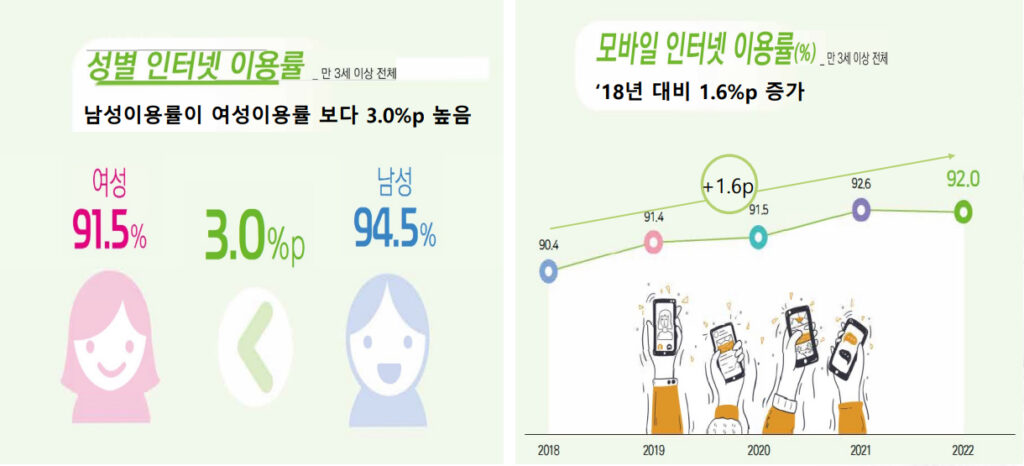

In today’s digital age, Internet usage has become an integral part of our daily lives. One interesting aspect of Internet usage is the difference between genders. Recent studies have shown that the male Internet usage rate is 3.0% higher than the female usage rate. This indicates a significant gap in how men and women use the Internet for various activities such as communication, information gathering, and entertainment.

Furthermore, when it comes to mobile Internet usage, there has been a noticeable increase. In comparison to 2018, today’s mobile Internet usage rate has risen by 1.6%. This suggests a growing trend towards mobile devices as the primary means of accessing the Internet. With the convenience and accessibility offered by smartphones and tablets, it is no surprise that more people are turning to mobile Internet for their online needs. As technology continues to advance, it will be interesting to see how these trends evolve and whether the gender gap in Internet usage narrows in the future. Stay tuned for more updates on the latest Internet usage trends and developments.

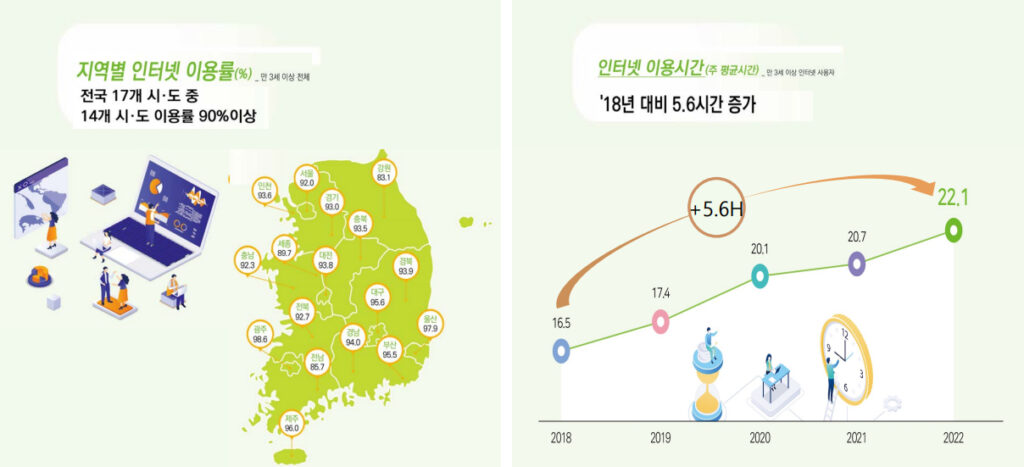

The regional Internet usage rate has been on the rise, with 14 out of 17 cities and provinces across Korea reporting a usage rate of over 90%. This reflects a growing trend in Internet adoption and access to online resources. Additionally, the average weekly Internet usage time has increased by 5.6 hours compared to 2018, indicating a significant shift towards digital connectivity and reliance on online platforms for various activities.

This surge in Internet usage signifies the increasing importance of the digital landscape in our daily lives. From remote work and online learning to e-commerce and entertainment, the Internet has become an integral part of modern society. As more people embrace the digital world, it is crucial to ensure equitable access and reliable infrastructure to support this growing demand.

Broadband uptake

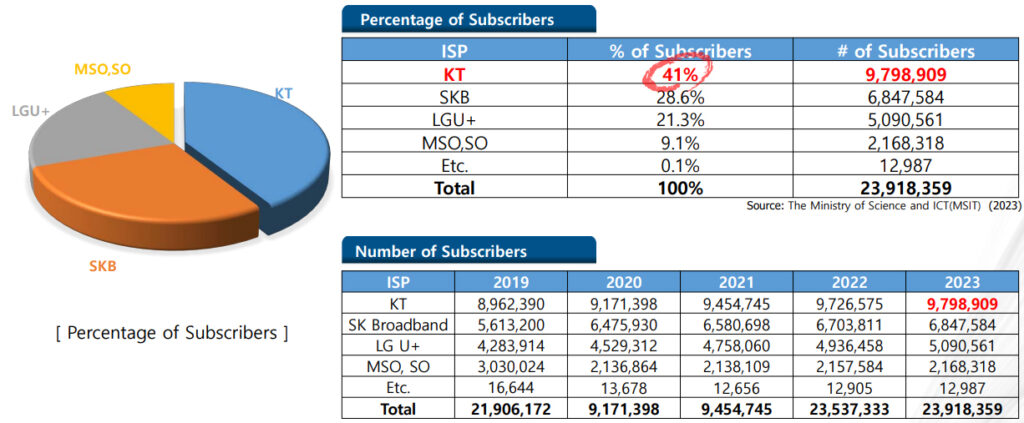

The latest statistics for the broadband market in South Korea have been released, and the results are quite interesting. KT (formerly Korea Telecom) has emerged as the leader in the market with a 41% share, followed closely by SK Broadband (SKB) with 29% and LG Uplus (LGU+) with 21%. This indicates that KT has a strong hold on the broadband market, but SKB and LGU+ are not far behind.

What’s even more impressive is the overall growth in the number of broadband users. In 2023, there has been a 9% increase in the number of users compared to 2019. This demonstrates the growing demand for broadband services in South Korea, and it’s clear that the market is expanding.

The competition between the major players will likely intensify as they strive to capture a larger share of the market. It will be interesting to see how these companies adapt to the changing landscape and continue to meet the increasing demand for broadband services. Overall, the future looks promising for the broadband market in South Korea, and consumers can expect to see even more options and advancements in the coming years.

Mobile uptake

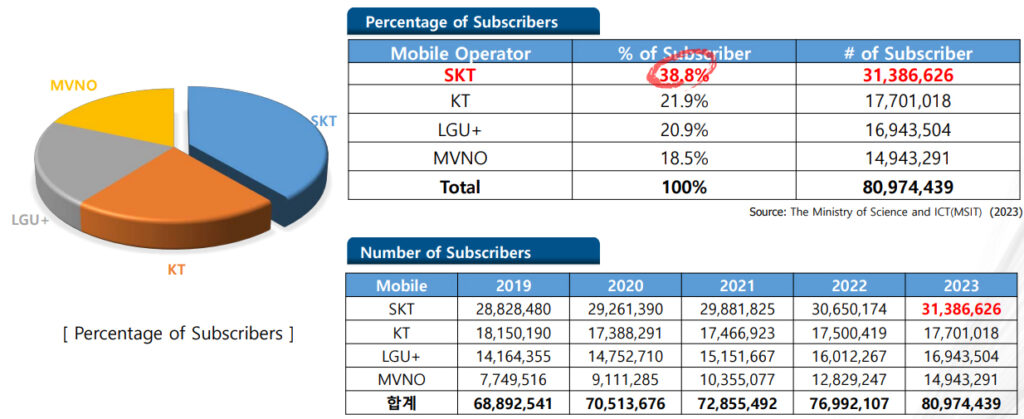

In the dynamic world of mobile network carriers, SKT has long been a dominant player in the South Korean market. However, recent data indicates a shift in the competitive landscape. According to the latest figures (Figure 5), SKT now holds a 38% market share, marking the first time it has fallen below the 40% threshold during the era of three major carriers. This development is significant as it reflects a changing tide in consumer preferences and demands. Following closely behind, KT commands a 22% market share, while LGU+ holds 21%

These numbers suggest a narrowing gap between the top players, indicating increased competition and choice for consumers. As the industry continues to evolve, it will be interesting to see how these key players adapt to meet the evolving needs of their customer base. Stay tuned for further updates on this evolving landscape.

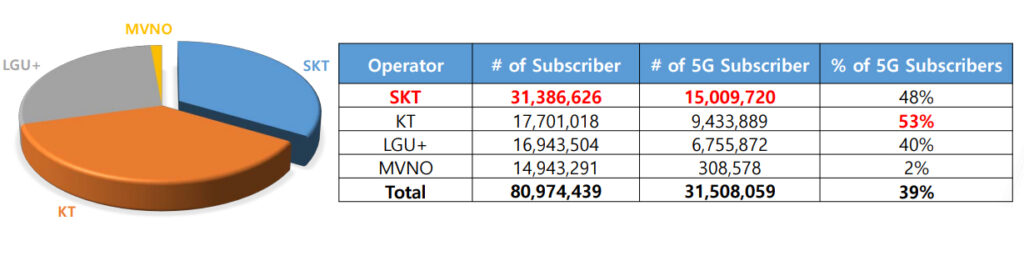

South Korea made history on 3 April 2019, by becoming the first economy in the world to commercialize 5G services. Now, leading the pack is SKT, boasting over 15M subscribers for its 5G service, followed closely by KT and LGU+.

The adoption of 5G has been rapid, with a significant 19.3% increase in usage rate compared to the previous year. This rapid growth in 5G usage reflects South Korea’s strong commitment to staying at the forefront of technological innovation. South Korea’s success in rolling out 5G demonstrates its position as a global leader in telecommunications and sets a high bar for other economies looking to follow suit. With such impressive numbers and a clear trajectory of growth, it’s evident that 5G has firmly taken root in South Korea and is poised to shape the future of connectivity for years to come.

In a significant move towards bridging the digital gap, the Ministry of Science and ICT, along with major mobile carriers SK Telecom, KT, and LG U+, have come together to share networks. This collaboration aims to make 5G services accessible in rural areas, marking a pivotal moment in the advancement of telecommunications in South Korea.

In 2021, the three Mobile Network Operators (MNOs) and the government reached an agreement to implement National Roaming among 5G networks. This step is poised to revolutionize connectivity by rapidly expanding coverage and ensuring that even remote areas can access high-speed Internet.

This development is a commitment towards overcoming the digital divide and ensuring that the benefits of technological advancements are extended to all corners of the economy. With this collaborative effort, South Korea is set to witness a significant leap towards a more connected and inclusive society. Stay tuned for more updates as we witness the transformation of telecommunications in South Korea.

Internet Exchange Points

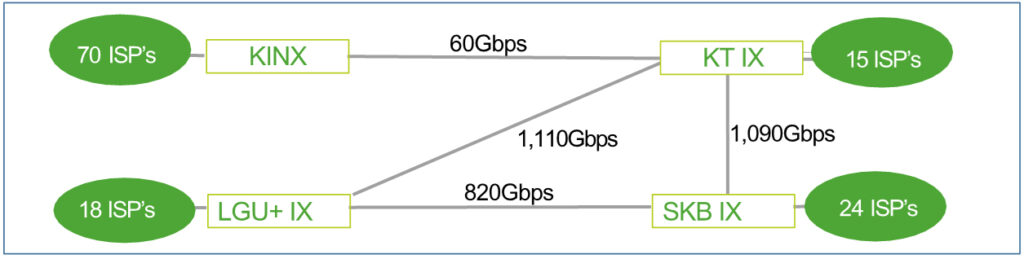

In South Korea, there are currently five Internet Exchange Points (IXPs) in operation, each playing a crucial role across the economy’s Internet infrastructure. Three of these IXPs are operated by major ISPs, including KT, SKB, and LGU+, while the remaining two are operated by KINX and Sejong Telecom.

Although the capacity information provided is from 2020, it is important to note that the actual capacity has likely increased significantly since then. Unfortunately, the latest information has not been shared by the Korea Internet & Security Agency, making it challenging to provide the most up-to-date statistics.

The presence of multiple IXPs in South Korea underscores the economy’s commitment to fostering a robust and resilient Internet ecosystem. As the demand for digital connectivity continues to surge, these IXPs are poised to play an even more pivotal role in ensuring seamless and efficient Internet traffic exchange within the region. Despite the lack of current capacity data, it is evident that South Korea’s IXPs are positioned for continued growth and innovation, further solidifying the economy’s lead in advanced telecommunications infrastructure.

| IXP | Operating institution | Number of ISPs connected | Total connection capacity (Gbps) |

| KTIX | KT | 15 | 625 |

| DIX | LG U+ | 18 | 2,443 |

| SKBIX | SK Broadband | 24 | 2,566 |

| KINX | KINX | 70 | 2,823 |

Submarine cable connectivity

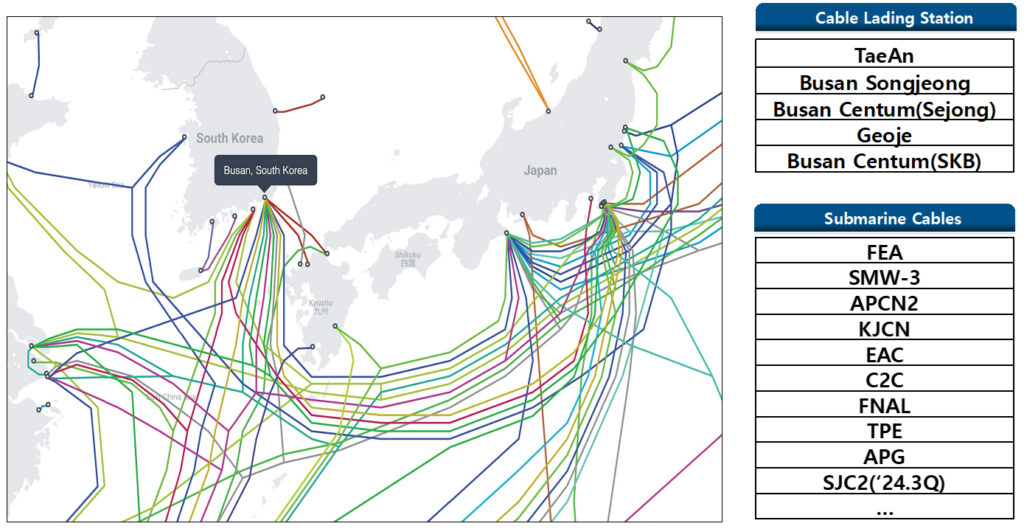

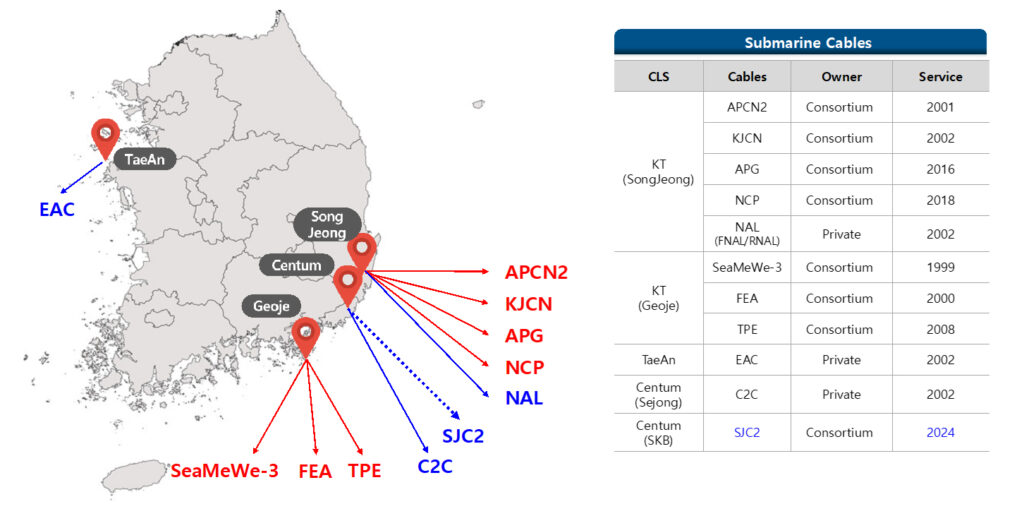

South Korea’s connectivity is set to receive a significant boost with the upcoming completion of a new submarine cable in the fourth quarter of 2024. This addition will strengthen the economy’s position as a hub for telecommunications in the region. Currently, South Korea has four submarine cable landing stations and operates nine submarine cables, facilitating robust international connectivity.

The strategic location of these landing stations has been instrumental in positioning South Korea as a key player in the global telecommunications network. With the continuous expansion of its submarine cable infrastructure, South Korea is poised to meet the growing demands for high-speed and reliable Internet connectivity, supporting both domestic needs and international data exchange. Stay tuned for more updates on this exciting development.

I recently completed mapping submarine cable landing stations and submarine cables, and the results are quite fascinating. Among the landing stations, KT Songjeong Cable Landing Station (CLS) stands out with connections to five submarine cables, while KT Geoje accommodates three submarine cables. Additionally, Taean and Centum Sejong’s CLSs each house one submarine cable. Exciting news is on the horizon as a new subsea cable is scheduled to be accommodated in the Centum SKB landing station in the fourth quarter of 2024.

This intricate network of submarine cables plays a crucial role in global communication and connectivity, and understanding its physical infrastructure is vital for ensuring reliable and efficient data transmission across continents.

Data centres

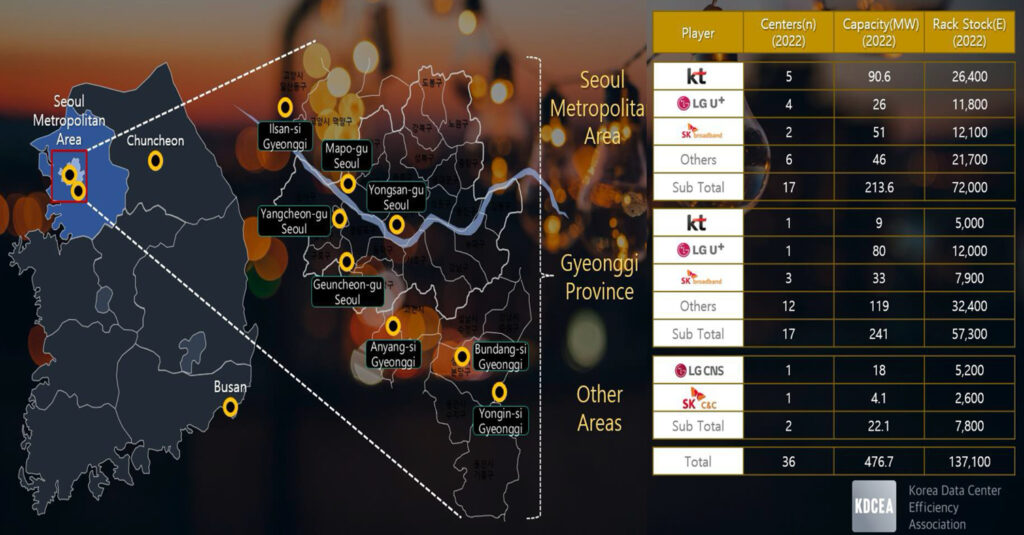

As the demand for digital infrastructure continues to rise, South Korea has seen a significant increase in the number of commercial data centres. Currently, there are a total of 36 data centres in operation throughout the economy, with 17 located in Seoul and another 17 in the Gyeonggi Province. With 94% of the commercial data centres concentrated in these two regions, Seoul and the Gyeonggi Province are major hubs for digital infrastructure In South Korea.

The remaining 6% of data centres are distributed across other regions, indicating a more scattered presence outside of the capital and its surrounding province. This distribution reflects the growing need for data centres to be strategically located to support various industries and businesses across the economy. With the demand for data processing and storage facilities expected to continue growing, it will be interesting to see how this distribution evolves in the coming years.

The domestic data centre industry is poised for significant growth in the coming years, with an estimated 34 new commercial data centre construction projects expected to be initiated by 2027. These projects are projected to attract a substantial investment of over KRW 14 trillion, underscoring the robust expansion of the sector.

This anticipated surge in data centre construction reflects the escalating demand for digital infrastructure to support the burgeoning digital economy. As businesses increasingly rely on data storage, processing, and cloud services, the need for state-of-the-art data centres continues to soar.

This trend not only presents lucrative opportunities for investors and construction firms but also underscores the critical role of data centres in enabling technological innovation and digital transformation. With substantial investments and advancements on the horizon, the data centre market is set to play a pivotal role in shaping the future of digital infrastructure.

KRNOG

The Korea Network Operator’s Group (KRNOG) was formed in 2021 to help shape and advance the field of network technology within South Korea and the region. Established as a platform for professionals and enthusiasts in the networking industry, KRNOG serves as a hub for knowledge exchange, collaboration, and skill development.

KRNOG currently meets annually to actively explore ways to improve the overall quality of Internet infrastructure, fostering an environment where professionals collaboratively contribute to advancements in these crucial aspects of network development.

KRNOG 1.0 met in Seoul, South Korea on 13 April 2023 and during APRICOT 2024, tentative plans were made to hold KRNOG 2.0 in October 2024. KRNOG is actively seeking volunteers and patrons. Join the KRNOG Group on Facebook or LinkedIn, or join the mailing list to get involved.

Mike Hwang is the Operations Manager of SK Broadband’s Core Infra Engineering Unit (IP Core and IX Network Design). He is also the KRNOG Chair.

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.