For the first time in Italy, a major event — the Serie A football championship — is being broadcast, exclusively (for most matches) via the Internet. We are not talking about the distribution of on-demand content, drawing on a ready-made archive, but about live streaming, the transmission of live content. The broadcaster is a global sports entertainment platform, DAZN.

In-depth analysis

A major transition is taking place — a change of era. From satellite-based live content distribution, we are moving to Internet-based distribution. We are facing the beginning of a major digital transformation that will have a significant impact on the Internet ecosystem and lead to changes on the network that will necessarily accelerate the progress and technological advancement that has just begun.

On the content side, the difference between DAZN and other entertainment platforms is huge. Netflix, Disney+, and Amazon Prime provide an on-demand service, for which even high-demand content is prepared before broadcasting, pre-distributed in their network, and not necessarily requested at the same time. For DAZN’s Serie A, these elements represent a big challenge — the preparation of the content takes place on the spot and the distribution ‘on air’ at the same time to thousands of people (in a short instant of time).

For users, the Italian telecommunications operators, both large and small, are suffering from the so-called ‘elephant effect’. They need to adapt their network infrastructure to cope with the impact that an event of this magnitude has while providing their customers with quality service. It’s no small feat.

Today we have DAZN and the distribution of the Serie A matches, as well as Amazon Prime for those of the Champions League, but tomorrow what other live services will appear on the network? DAZN represents a good training ground and was certainly a good first attempt. From my point of view, it was a successful test of how the network would react to such a large load.

Were there problems? Yes, but it was inevitable. From DAZN’s acquisition of the rights to broadcast the Serie A at the end of March 2021, to the whistle for the start of the championship at the end of August, the time available to understand the impact of the phenomenon (and to adapt) was not much. But much was successful, and the infrastructural adjustments were important, from the large national operator to the small local one.

In addition, it should be emphasized which (and how many!) actors are involved in the phenomenon. Apart from the broadcaster DAZN, we have the Content Delivery Networks (CDNs) as well as the Internet Exchange Points (IXPs). Then there are the access networks of Internet Service Providers (ISPs), and the local networks in users’ homes. The supply chain is complex. This plurality of actors highlights a need for greater collaboration and coordination, and the sharing of information and feedback becomes essential for the proper functioning of the whole chain.

But what do Italian operators think about how well the event functioned? An initial answer can be found in the feedback requested from 70 operators throughout the economy. Thanking them for their cooperation and transparency, I would like to present the results of this survey below.

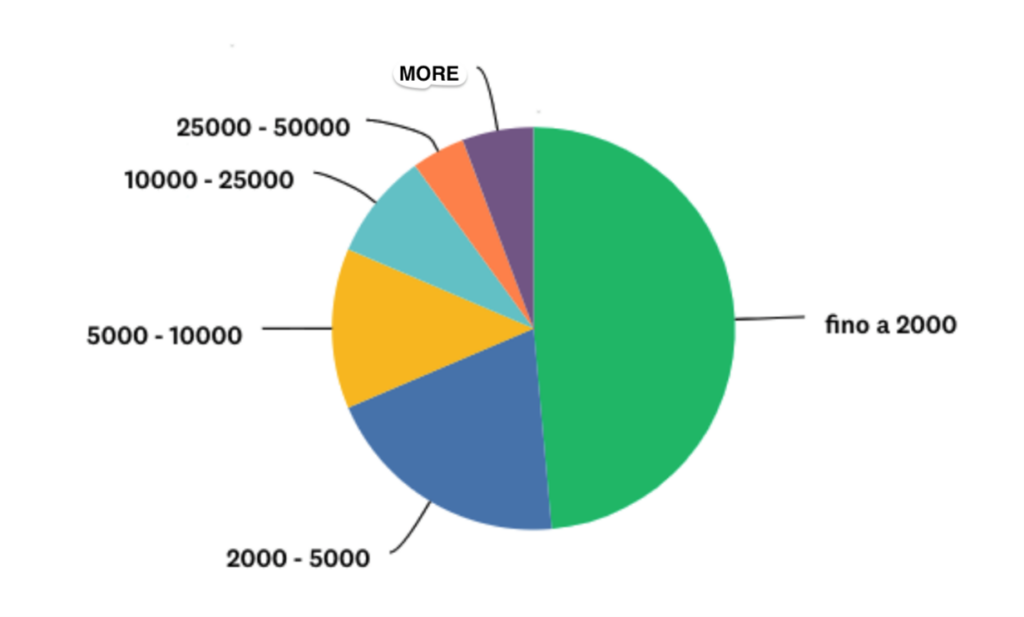

Firstly, it is important to emphasize the size of operators who took part in the survey. A majority (almost 50% of the respondents) were represented by small local operators (up to 2,000 customers) and less than 10% by large ones (over 50,000). The remaining 40% of the respondents are small to medium-sized operators (between 2,000 and 50,000 customers).

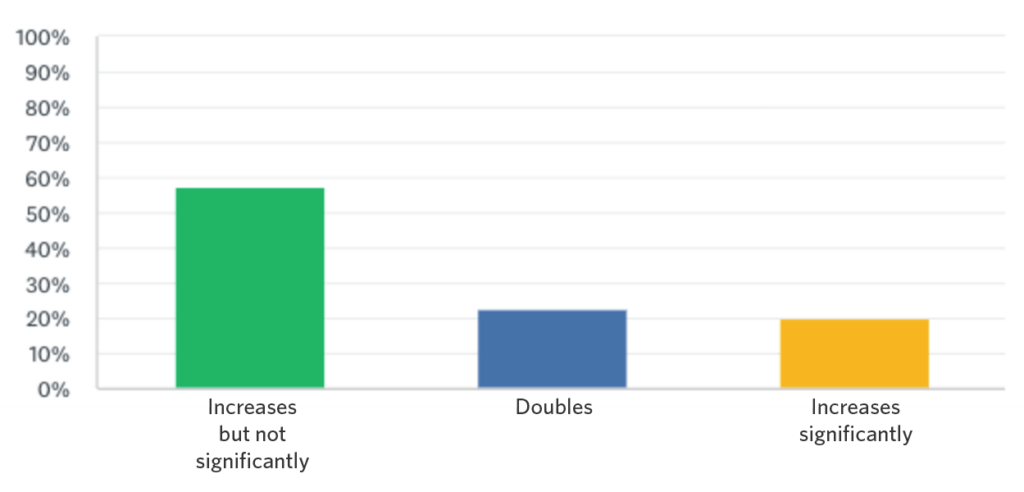

The first question asked was: “During Serie A matches, does the total traffic increase?”

As can be seen in Figure 2, almost 60% of respondents stated that traffic increased, although not significantly. For 40%, however, it doubles and increased significantly. From the operators’ point of view, the problems encountered in the first half of the season were mostly due to capacity saturation episodes, with an identifiable impact on all routes (transit as well as IXP infrastructure), from streamed matches.

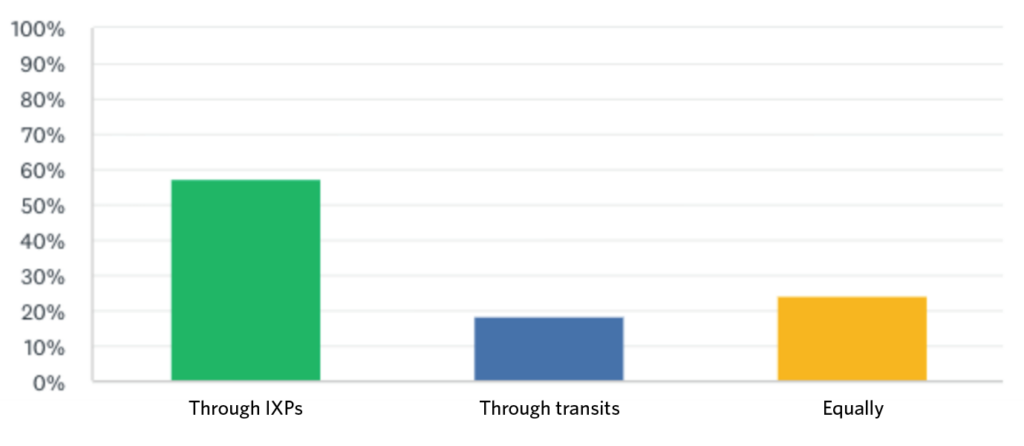

So, an increase in traffic is visible on the network, as was expected. Where is this increase most visible?

Most of the additional load can be seen through the IXPs, where CDNs are mostly present. It’s important to remember that IXPs distribute DAZN content mainly to small and medium-sized ISPs.

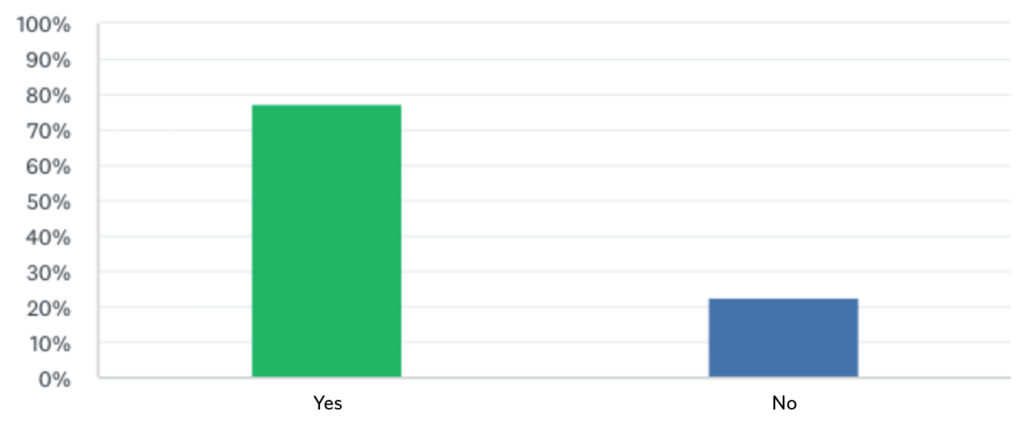

So, do IXPs represent an advantage for the operator’s network?

Turning to infrastructural adjustments, 60% of respondents said they had to prepare and upgrade their network. It should be emphasized that a large proportion of respondents considered these adjustments to be sustainable, given the nature of the service and the mode of distribution. For others, however (around 40%), there is no economic sustainability in the upgrades made.

From this 60%, we have diverse answers as to what exactly the areas of intervention were. Below is the distribution of responses.

| Area of infrastructure upgrades | Network operator responses |

| Capacity upgrades to IXP/transit | 22.06% |

| Increased network hardware resources | 11.76% |

| Overall increase in access capacities | 17.65% |

| Improving geographical distribution | 10.29% |

Projecting instead into the not-too-distant future, services such as DAZN will be increasingly present. We, therefore, asked whether there are plans to invest in infrastructure upgrades. 80% think so, and here is the distribution of the areas where efforts will be directed most.

| Area of infrastructure upgrades | Network operator responses |

| Capacity upgrades to IXP/transit | 26.47% |

| Increased network hardware resources | 13.24% |

| Overall increase in access capacities | 26.47% |

| Improving geographical distribution | 16.18% |

Summing up

Does the live streaming distribution of sports represent a problem or an opportunity?

Trying to summarize the thoughts of the operators who responded to the questionnaire, it seems most agree that the phenomenon represents a great opportunity from a technological point of view as the infrastructural adjustments made in a very short time have accelerated the process of updating the network.

IXPs were also spectators and players in the race to expand capacity at the beginning of 2020, due to the pandemic — we clearly felt an increase in the number of networks interconnected to our infrastructure (an increase mostly aimed at a better geographical distribution by smaller operators).

From the point of view of investment, for some, this phenomenon represents a problem rather than an opportunity due to the increased load on the network. While infrastructures are being adapted, the number of customers is not increasing, or at least not in proportion to the load itself. This is an imbalance that can only be smoothed out over time with the migration of further live services onto the Internet. Perhaps at that point operators will have a network that is more than ready, returning the investment that would appear to be not very sustainable today.

But what do the big national operators think?

In the case of large national networks, we are faced with a different infrastructural approach in the distribution of Serie A matches. While small and medium-sized operators IXPs represent a fundamental link in the chain (due to the presence of global CDNs), large national ISPs distribute live DAZN through ‘DAZN Edge’ (a proprietary broadcaster cache based on their relative market share) operating directly within their networks. However, for the large ISPs, IXPs represent an important element for resilience — should there be any problems on DAZN Edge, or should the maximum supported capacity be reached, global CDNs present in IXPs act as an additional backup point and geographic redundancy in the distribution of content.

In trying to summarize the experience of the large national ISPs, it is important to emphasize three different aspects: The load on the network in relation to the presence of streaming traffic, the sustainability of the investments made, and future projections.

During major events, traffic increases significantly — about 30% compared to normal traffic. The main challenges are encountered when a major match is played at the weekend when streaming traffic is added to regular traffic.

On the other hand, concern for unsustainable investments is primarily about capacity adjustments on the backbone and access but also increases in network hardware resources. However, infrastructure upgrades had already begun in 2020 to cope with the increased traffic from distance learning, remote working, and so on.

Future projections are concerned with two fundamental aspects — the technological and the economic. From the point of view of the network, multicast or technologies and distribution methods aimed at reducing the load on the network will certainly drive the presence of more and more live streaming services. Similarly, a greater distribution of CDNs over the economic territory will be driven by the need to minimize transport costs.

From a strictly economic point of view, the major Italian ISPs have emphasized the need for co-investment by Over-The-Top (OTT) media services or a revenue sharing model, given that revenues per customer have been steadily decreasing for years, both on the fixed and mobile networks, while traffic is constantly increasing.

Trying to summarize by points, we can therefore draw the following conclusions:

- The advent of DAZN has put a strain on the Italian Internet network, requiring operators to invest in greater capacity and more resilient networks.

- IXPs have been confirmed as an important element of the infrastructure, fundamental for medium and small local operators as well as a backup solution for large Other Licensed Operators (OLOs).

- The need to prepare networks for large amounts of traffic in a short period of time has made multicast a viable solution for the near future.

DAZN has opened its doors to live streaming on the Internet, a widely growing phenomenon that represents a huge change in approach to the distribution of live content.

The first important sign of this change is the marked growth of Internet traffic, in Italy and around the world. This has led to a heated debate in Brussels on the relationship between telcos and OTTs, with the former accusing some large American platforms (in particular Netflix, Alphabet, Meta, Amazon and Apple) of ‘taking advantage’ of European telecommunications networks to extract huge profits. Regardless of the merits and outcome of this debate, there is no doubt that the increasing transmission of content via the Internet represents not just an additional cost for telco operators but also drives investment in ultra-broadband networks.

Flavio Luciani is Chief Technology Officer at Namex (Roma IXP) and co-author of the book “BGP: from theory to practice“.

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.