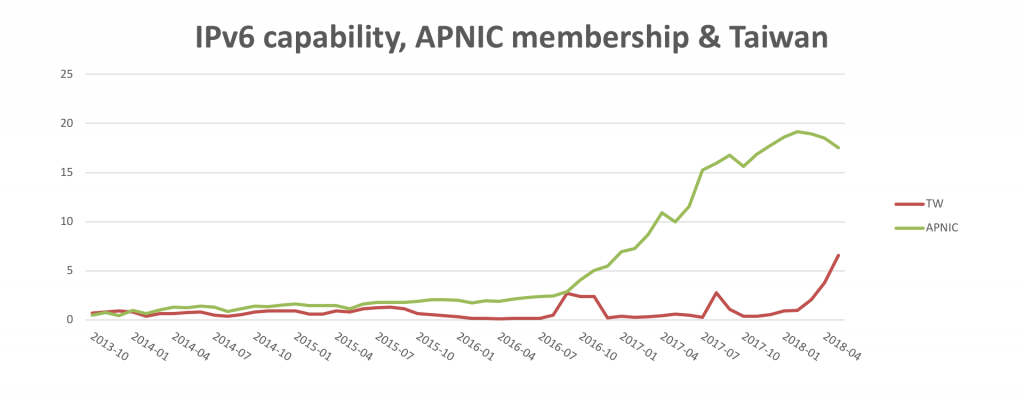

If you’ve been watching the APNIC Labs stats pages for IPv6 capability you may have noticed that over the last few weeks Taiwan has shot up in the rankings. The economy is showing on our normal chart at around 10% IPv6 capability.

This is a deployment of significance for the APNIC community, and worth celebrating. Let’s explore what’s happening inside Taiwan.

Figure 1 – IPv6 capability: APNIC membership overall and Taiwan.

(For background: when we say an end-user is capable of using IPv6, we mean that we’ve actively tested them using APNIC Labs’ advert-based measurement with an IPv6-only URL, and they fetched it).

What’s actually going on in Taiwan?

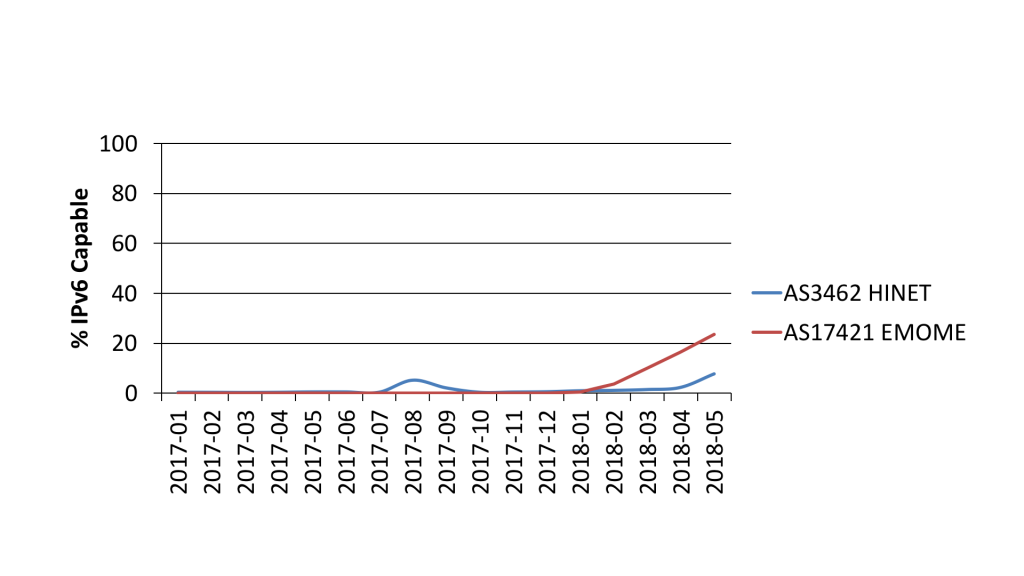

Two ASNs appear as the major reason for this surge in IPv6. That’s AS3462, which is HINET and AS17421, which is EMOME. HINET’s IPv6 capability is around 15% and EMOME’s is a very respectable 33%.

Figure 2 – IPv6 capability of HINET and EMOME.

Figure 2 – IPv6 capability of HINET and EMOME.

A prior deployment of note is TANET, AS1659, but in our measurement they have a lower sample count and, we think, are limited to the Taiwan academic community. Having said that, we believe from discussions with TWNIC that TANET includes some IPv6-enabled schools, and so in raw numbers may well be a large deployment. School-based networks are heavily filtered, and it is likely our measurement method, which relies on advertisements, can’t see them.

Are we seeing competition in IPv6?

It might look like there is some active competition emerging in IPv6, however, if you look at the registration details for these ASNs, what emerges quickly is that it’s actually one deployment. Both HINET and EMOME are sub-services for Chunghwa Telecom — its landline (cable, xDSL) and mobile divisions.

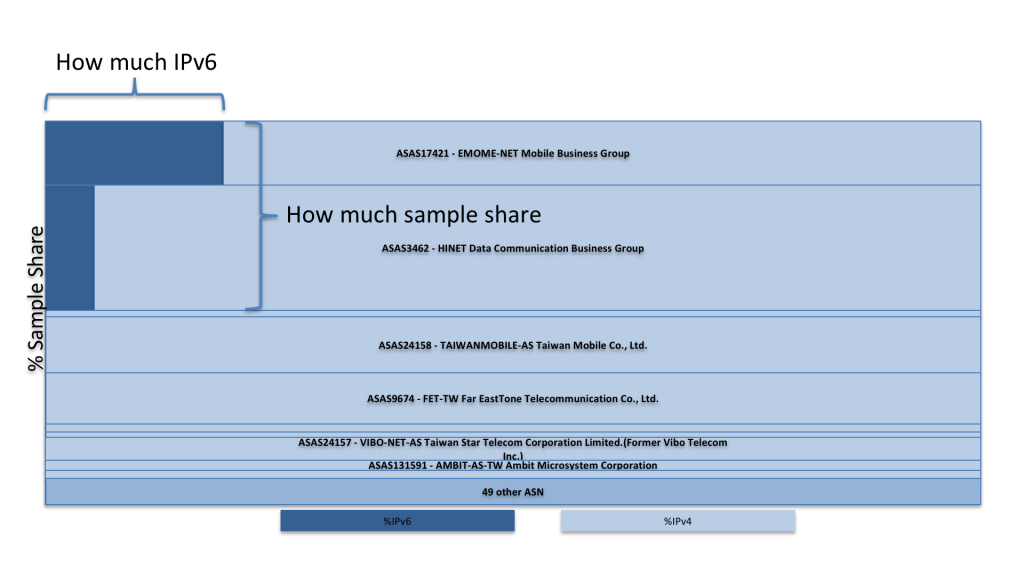

It is worth bearing in mind that the Labs measurement’s random distribution of samples over a given economy are quite interesting as an indication of relative size. Let’s look at the distribution of samples into the top 10 ASNs seen by sample count in Taiwan:

Figure 3 – Distribution of samples among Taiwan’s top 10 ASNs.

Figure 3 – Distribution of samples among Taiwan’s top 10 ASNs.

This shows that HINET plus EMOME is almost 50% of the samples we see in Taiwan. So, this deployment, which is only three months old, is quite significant. We expect to see this move upward, and we do expect to see a market response from other Internet providers in the economy.

Is this going to ‘lift’ the APNIC region figures?

To understand the impact this deployment is going to have at scale, we need to understand what the overall size of IPv6 by economy looks like.

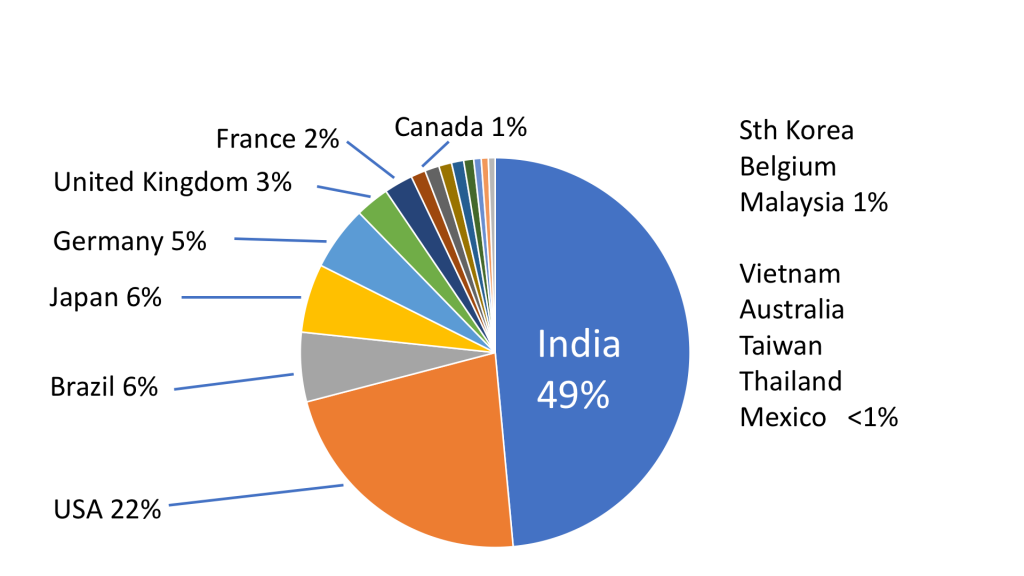

Figure 4 – Economies’ contributions to globally visible IPv6 usage.

Figure 4 – Economies’ contributions to globally visible IPv6 usage.

Australia is an economy of similar scale to Taiwan. Its overall contribution to world IPv6 in the last two months, also from the largest ISP in the economy (Telstra), has been slightly below 1% (noting it has a longer term deployment planned). So at best, Taiwan will represent this class of impact on a wider scale.

Ideally, we like to see continuing momentum behind the APNIC region figures, which currently sit at around 18%. It is clear however, from the scale of the major world contribution to IPv6 in this region (India, population 1.3b), that while this is a highly important and economically interesting deployment, it won’t alter the trajectory of uptake in the APNIC region very quickly.

For movement at scale, we need to see other large economies in our region deploy. This means China and Indonesia. We watch intently.

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.