Time for another annual roundup from the world of IP addresses. Let’s see what has changed in the past 12 months in addressing the Internet and look at how IP address allocation information can inform us on the changing nature of the network itself.

Back around 1992, the IETF gazed into their crystal ball and tried to understand how the Internet was going to evolve and what demands that evolution would place on the addressing system as part of the ‘IP Next Generation’ study. The staggeringly large numbers of connected devices we see today were certainly within the range predicted by that exercise. We continue to increase silicon production volumes and, at the same, time continue to refine the production process so it’s doubtless that these device numbers will continue to grow.

We also predicted that the only way to make the Internet work across such a massive pool of connected devices was to deploy a new IP protocol with a massively larger address space. It was from that reasoning that IPv6 was designed — a world of abundant silicon was the issue that IPv6 was primarily intended to solve. Copious volumes of address space were intended to allow us to uniquely assign a public IPv6 address to every device, no matter how small, regardless of the volume that might be deployed.

But, while the Internet has grown at such amazing rates, the deployment of IPv6 continues at a more measured pace. There is still no commonly held sense of urgency about the deployment of this protocol, and there is still no common agreement that the continued reliance on IPv4 is failing us.

Much of the reason for this apparent contradiction between the designed population of the IPv4 Internet and the actual device count (which is, of course, many times larger) is that the Internet is now a client/server network. Clients can initiate network transactions with servers but are incapable of initiating transactions with other clients. Network Address Translators (NATs) are a natural fit to this client/server model, where pools of clients share a smaller pool of public addresses, and only require the use of an address while they have an active session with a remote server. NATs are the reason why more than 20 billion connected devices can be squeezed into 2 billion active IPv4 addresses. Applications that cannot work behind NATs are no longer useful and no longer used.

However, the pressures of this inexorable growth in the number of deployed devices in the Internet means that even NATs cannot absorb growth pressures forever. NATs can extend the effective addressable space by up to 32 ‘extra’ bits, and they enable the time-based sharing of addresses. Both of these are effective measures in stretching the address space to encompass a larger device pool, but they do not transform the address space into an infinitely elastic resource.

The inevitable outcome of this process is either we will see the fragmenting of the IPv4 Internet into a number of disconnected parts (probably based on the service ‘cones’ of the various points of presence of the content distribution servers, so that the entire concept of a globally unique and coherent address pool layered over a single coherent packet transmission realm will be foregone), or we will see these growth pressures motivate the further deployment of IPv6, and the emergence of IPv6-only elements of the Internet as it tries to maintain a cohesive and connected whole. There are commercial pressures pulling the network in both of these directions, so it’s entirely unclear what path the Internet will follow in the coming years, but my (admittedly cynical and perhaps jaded) personal opinion lies in a future of a highly fragmented network.

Can address allocation data help us to shed some light on what is happening in the larger Internet? Let’s look at what happened in 2021.

IPv4 in 2021

It appears the process of exhausting the remaining pools of unallocated IPv4 addresses is proving to be as protracted as the process of transition to IPv6. Although, by the end of 2021 the end of the old registry allocation model was in sight with the depletion of the residual pools of unallocated addresses in each of the Regional Internet Registries (RIRs).

It is increasingly difficult to talk about ‘allocations’ in today’s Internet. There is still a set of transactions where addresses are drawn from the residual pools of RIR-managed available address space and allocated or assigned to network operators. But at the same time, there is also a set of transactions where addresses are traded between networks in what is essentially a sale. These address transfers necessarily entail a change of registration details, so the registry records the outcome of a transfer, or sale, in a manner that is similar to an allocation or assignment.

To look at the larger picture of the amount of IPv4 address space that is used or usable by Internet network operators, perhaps the best metric to use is the total span of allocated and assigned addresses, and the consequent indication of annual change in the change in this total address span.

What is the difference between ‘allocated’ and assigned?

When a network operator or sub-registry has received an allocation, it can further delegate that IP address space to their customers along with using it for their own internal infrastructure. When a network operator has received an assignment, this can only be used for their own internal infrastructure.

I personally find the distinction between these two terms somewhat of an artifice these days, so from here on I’ll use the term ‘allocation’ to describe both allocations and assignments.

The total IPv4 allocated address pool expanded by 1.1 million addresses in 2021, on top of a base of 3.682 billion addresses that were already allocated at the start of the year. This represents a total allocated IPv4 public address pool growth rate of 0.1% for the year, and 0.1% is less than one tenth of the growth rate in 2010 (the last full year before the onset of IPv4 address pool depletion. (Table 1).

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

| Address Span (Billions) | 3.685 | 3.684 | 3.682 | 3.657 | 3.657 | 3.643 | 3.624 | 3.593 | 3.537 | 3.483 | 3.395 | 3.227 | 2.985 |

| Annual Change (Millions) | 1.1 | 2.2 | 24.9 | 0.6 | 13.2 | 19.4 | 30.6 | 55.9 | 53.9 | 88.4 | 168.0 | 241.7 | 189.4 |

| Relative Growth | 0.0% | 0.1% | 0.7% | 0.0% | 0.4% | 0.5% | 0.9% | 1.6% | 1.5% | 2.6% | 5.2% | 8.1% | 7.9% |

Table 1 — IPv4 allocated addresses by year.

Where is this supposedly ‘new’ address space coming from? The old model held unallocated addresses in a single pool by IANA, and blocks of addresses were passed to RIRs who then allocated them to various end entities, either for their own use or for further allocation. IANA exhausted the last of its available address pools some years ago, and these days it holds just three /24 address prefixes. As the option of dividing this pool into five equal chunks of 153.6 individual address is not viable, these addresses are likely to sit in the IANA Recovered Address registry for some time (until one or more of the RIRs return prefixes recovered from the old ‘legacy’ allocated addresses, giving IANA the ability to equally distribute them to the RIRs, which is unlikely to occur).

There are also addresses marked by IANA as reserved, including blocks of addresses reserved for multicast use, and the top end of the IPv4 address space, curiously marked as reserved for future use. This latter category is a relatively large pool of 268,435,456 addresses (former ‘Class E’ space), so if ever there was a ‘future’ for IPv4 then it is now. But exactly how to unlock this space and return it to the general use pool is a problem that has so far eluded a generally workable solution.

The topic of releasing the Class E space as globally routable unicast address space for use in the public Internet has been raised from time-to-time over the past 15 years or so. Some Internet drafts were published for the IETF’s consideration that either directly proposed releasing this space for use, or outlined impediments in various host and router implementations that were observed to exist in 2008 when these drafts were being developed.

The proposals lapsed, probably due to limited available time and resources to work on these issues, and the result of efforts spent in freeing this IPv4 space for general use was only going to obtain a small extension in the anticipated date of depletion of the remaining IPv4 address pools, while effort spent advancing IPv6 deployment was assumed to have a far larger beneficial outcome.

Occasionally, this topic reappears on various mailing lists, but the debates tend to circle around the same set of topics one more time, and then lapse.

As IANA is no longer a source of ‘new’ addresses, then we need to look at RIR practices to find these 2.2 million addresses. When IP address space is returned to the RIR or reclaimed by the RIR according to the RIR’s policies, it is normally marked as ‘reserved’ by the RIR. Marking returned or recovered addresses as ‘reserved’ allows various address prefix reputation and related services, including routing records, some time to record the cessation of the previous state of the prefix of the address, prior to any subsequent allocation. Following this period, which has been observed to be between some months and some years, reserved space is released for reuse. This is the address space we are seeing as expanding the allocated address pool in 2021.

The record of annual year-on-year change in allocated addresses per RIR over the same twelve-year period is shown in Table 2. There are some years when the per-RIR pool of allocated addresses shrank in size. This is generally caused by inter-RIR movement of addresses, due to administrative changes in some instances and inter-RIR address transfers in others.

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

| APNIC | 1.5 | 1.7 | 10.5 | 0.4 | 3.2 | 6.7 | 7.4 | 4.6 | 1.2 | 0.6 | 101.0 | 119.5 | 86.9 |

| RIPE NCC | 2.5 | 0.4 | 12.0 | 0.3 | 3.7 | 4.1 | 4.7 | 33.8 | 1.0 | 37.8 | 40.5 | 52.3 | 43.4 |

| ARIN | -1.7 | -0.9 | -10.1 | -0.3 | -2.3 | -4.8 | 2.3 | -14.1 | 19.0 | 24.3 | 53.8 | 27.2 | 41.1 |

| LACNIC | -0.2 | 1.2 | 2.4 | 0.1 | 1.4 | 1.5 | 1.2 | 18.7 | 26.3 | 17.3 | 13.6 | 17.1 | 10.5 |

| AFRINIC | -0.9 | -0.2 | 10.1 | 0.2 | 7.1 | 11.9 | 15.0 | 12.8 | 6.3 | 8.5 | 9.4 | 8.8 | 5.9 |

| TOTAL | 1.2 | 2.2 | 24.9 | 0.7 | 13.1 | 19.4 | 30.6 | 55.8 | 53.8 | 88.5 | 218.3 | 224.9 | 187.8 |

Table 2 — Annual change in IPv4 allocated addresses (millions), distribution by RIRs.

Each of the RIRs are running through their final pools of IPv4 addresses. Some of the RIRs have undertaken address reclamation efforts during 2021, particularly in redesignating previously reserved addresses as available for allocation, notably in APNIC and LACNIC.

Across the RIR system at the end of 2021 there are 5.2 million addresses in the available pool, held mainly in APNIC (3.5 million) and AFRINIC (1.6 million). 12 million addresses are marked as reserved, with 5.5 million held by ARIN, 4 million addresses held by AFRINIC, and 1.8 million addresses held by APNIC. It is evident from this table that there has been a major effort at address reclamation from the ‘quarantine’ pools marked as reserved during 2021. As seen in Table 3, there has been some reduction in the reserved pool in APNIC (700K), ARIN (300K) and RIPE NCC (200K) while the reserved pool in AFRINIC has risen by 1.2 million addresses throughout 2021.

| Available | Reserved | |||||

| RIR | 2019 | 2020 | 2021 | 2019 | 2020 | 2021 |

| APNIC | 2,937,088 | 4,003,072 | 3,533,056 | 4,398,848 | 2,483,968 | 1,787,904 |

| RIPE NCC | 1,536 | 328,448 | - | 1,072,608 | 965,728 | 762,104 |

| ARIN | 4,096 | 4,352 | 4,608 | 6,137,600 | 5,509,888 | 5,244,160 |

| LACNIC | 50,688 | - | 7,168 | 1,416,448 | 266,240 | 224,768 |

| AFRINIC | 2,638,848 | 1,925,888 | 1,652,480 | 1,920,256 | 2,853,888 | 4,065,024 |

| TOTAL | 5,632,256 | 6,261,760 | 5,197,312 | 14,945,760 | 12,079,712 | 12,083,960 |

Table 3 — IPv4 available and reserved pools, December 2021.

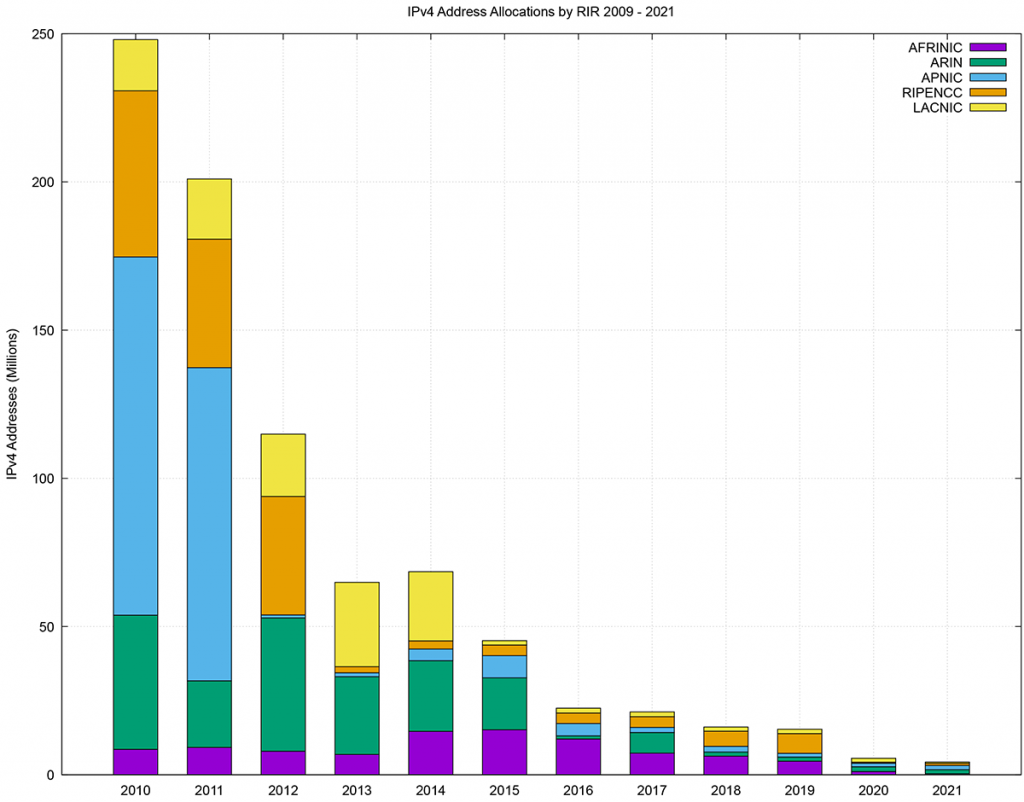

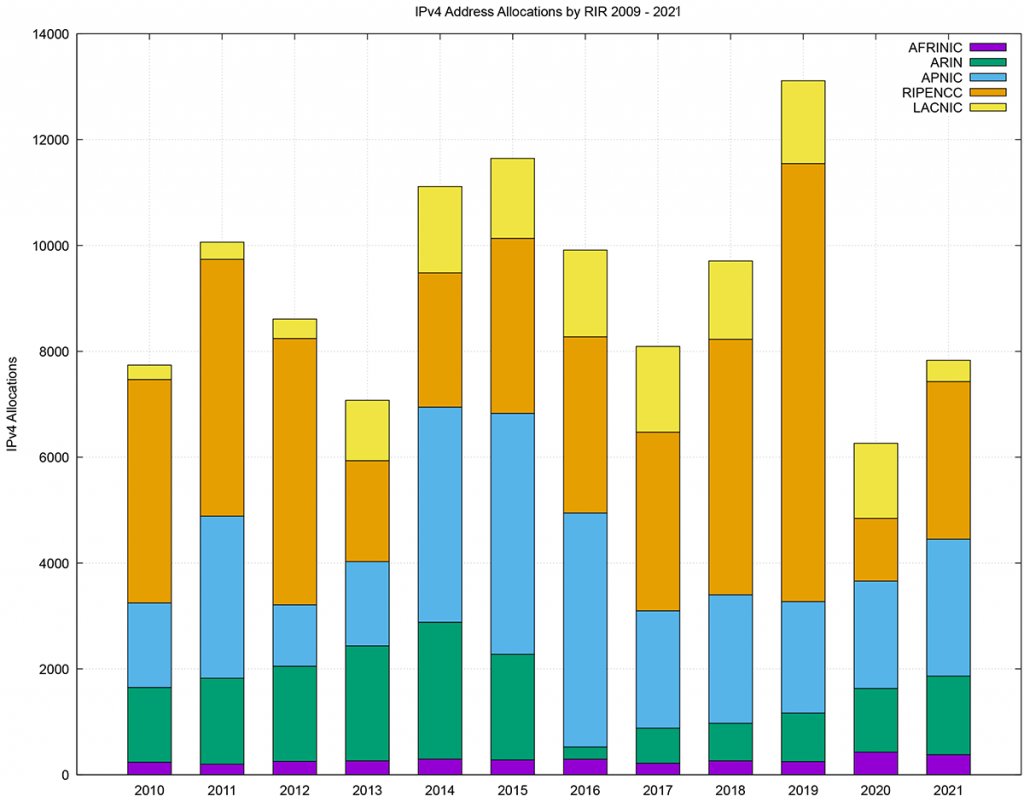

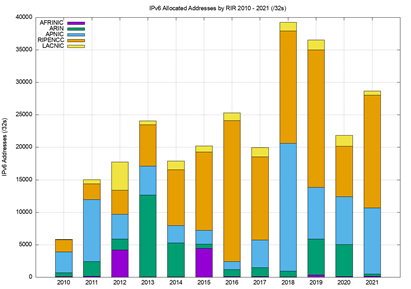

The RIR IPv4 address allocation volumes by year are shown in Figure 1, but it is challenging to understand what is meant by an ‘allocation’ across the entire RIR system as there are some subtle but important differences between RIRs, particularly as they relate to the handling of transfers of IPv4 addresses.

In ARIN’s case, a transfer between two ARIN-serviced entities is conceptually treated as two distinct transactions: A return of the addresses to the ARIN registry and a new allocation from ARIN. The date of the transfer is recorded as the new ‘allocation date’ in records published by the RIR. Other RIRs treat an address transfer in a manner analogous to a change of the nominated holder of the already-allocated addresses, and when processing a transfer, the RIR’s records preserve the original allocation date for the transferred addresses. When we look at the individual transaction records in the published RIR data, and collect them by year, then in the case of ARIN the collected data includes the volume of transferred addresses that were processed in that year, while the other RIRs only include the allocations performed in that year.

To provide a view across the entire system it’s necessary to use an analysis approach that can compensate for these differences in the ways RIRs record address transactions. In this study, an ‘allocation’ is defined here as a state transition in the registry records from reserved or available to an allocated state. This is intended to separate out the various actions associated with processing address transfers, which generally involve no visible state, as the transferred address block remains allocated across the transfer. This is how the data used to generate Figure 1 has been generated from the RIR published data.

The number of RIR IPv4 allocations by year, generated using the same data analysis technique as Figure 1, are shown in Figure 2.

It is clear from these two figures that the average size of an IPv4 address allocation shrank considerably in recent years, corresponding to the various IPv4 address exhaustion policies in each of the RIRs.

IPv4 address transfers

In recent years, the RIRs have permitted the registration of IPv4 transfers between address holders, to allow secondary redistribution of addresses as an alternative to returning unused addresses to the registry. This was a response to the issues raised by IPv4 address exhaustion. The motivation was to encourage the reuse of idle or inefficiently used address blocks through the incentives provided by a market for addresses, and to ensure that such address movement is publicly recorded in the registry system.

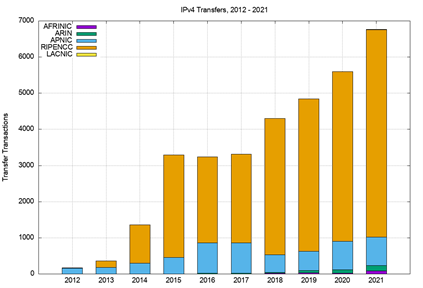

The numbers of registered transfers in the past nine years are shown in Table 4, including both inter-RIR and intra-RIR transfers. It also includes both the merger and acquisition-based transfers and the other grounds for address transfers. Each transfer is treated as a single transaction, and in the case of inter-RIR transfers, this is accounted for in the receiving RIR’s totals.

| Recieving RIR | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| APNIC | 786 | 781 | 528 | 487 | 834 | 841 | 451 | 302 | 185 | 159 |

| RIPE NCC | 5,743 | 4,696 | 4,221 | 3,774 | 2,451 | 2,373 | 2,836 | 1,054 | 171 | 10 |

| ARIN | 150 | 94 | 68 | 26 | 26 | 22 | 3 | |||

| LACNIC | 9 | 3 | 2 | |||||||

| AFRINIC | 80 | 26 | 27 | 17 | ||||||

| Total | 6,768 | 5,600 | 4,844 | 4,306 | 3,311 | 3,236 | 3,290 | 1,356 | 356 | 169 |

Table 4 — IPv4 address transfers per year.

The differences between RIR reported numbers are interesting. The policies relating to address transfers do not appear to have been adopted to any significant extent by address holders in AFRINIC and LACNIC serviced regions, while uptake in the RIPE NCC service region appears to be very enthusiastic!

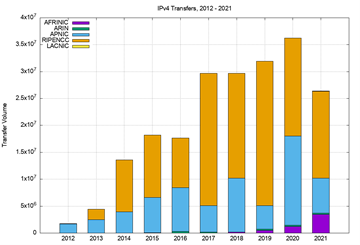

A slightly different view is that of the volume of addresses transferred per year (Table 5).

| Recieving RIR | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| APNIC | 6.5 | 16.6 | 4.3 | 10.0 | 4.9 | 8.2 | 6.6 | 3.9 | 2.5 | 1.7 |

| RIPE NCC | 16.2 | 18.2 | 26.9 | 19.5 | 24.6 | 9.2 | 11.6 | 9.6 | 2.0 | 0.1 |

| ARIN | 0.2 | 0.2 | 0.3 | 0.2 | 0.3 | 0.1 | ||||

| LACNIC | ||||||||||

| AFRINIC | 3.4 | 1.2 | 0.5 | 0.2 | ||||||

| Total | 26.4 | 36.2 | 31.9 | 29.7 | 29.7 | 17.6 | 18.2 | 13.6 | 4.5 | 1.7 |

Table 5 — Volume of transferred IPv4 addresses per year (millions of addresses).

A plot of these numbers is shown in Figures 3 and 4.

The aggregate total of addresses listed in these transfer logs since 2012 is 210 million addresses, or the equivalent of 12.5 /8s, which is 5.7% of the total delegated IPv4 address space of 3.7 billion addresses.

Are transfers performing unused address recovery?

This data raises questions about the nature of transfers. The first question is whether address transfers have managed to be effective in dredging the pool of allocated but unadvertised public IPv4 addresses and recycling these addresses back into active use.

It was thought that by being able to monetize these addresses, holders of such addresses may have been motivated to convert their networks to use private addresses and resell their holding of public addresses. In other words, the opening of a market in addresses would provide incentive for otherwise unproductive address assets to be placed on the market. Providers with a need for addresses would compete with other providers with a similar need by bidding to purchase these addresses. In conventional market theory, the ‘most efficient’ (the ability to use addresses to generate the greatest revenue) users of addresses would be able to set the market price. Otherwise, unused addresses would be put to productive use, and if demand outstrips supply the most efficient use of addresses is promoted by the actions of the market. In theory.

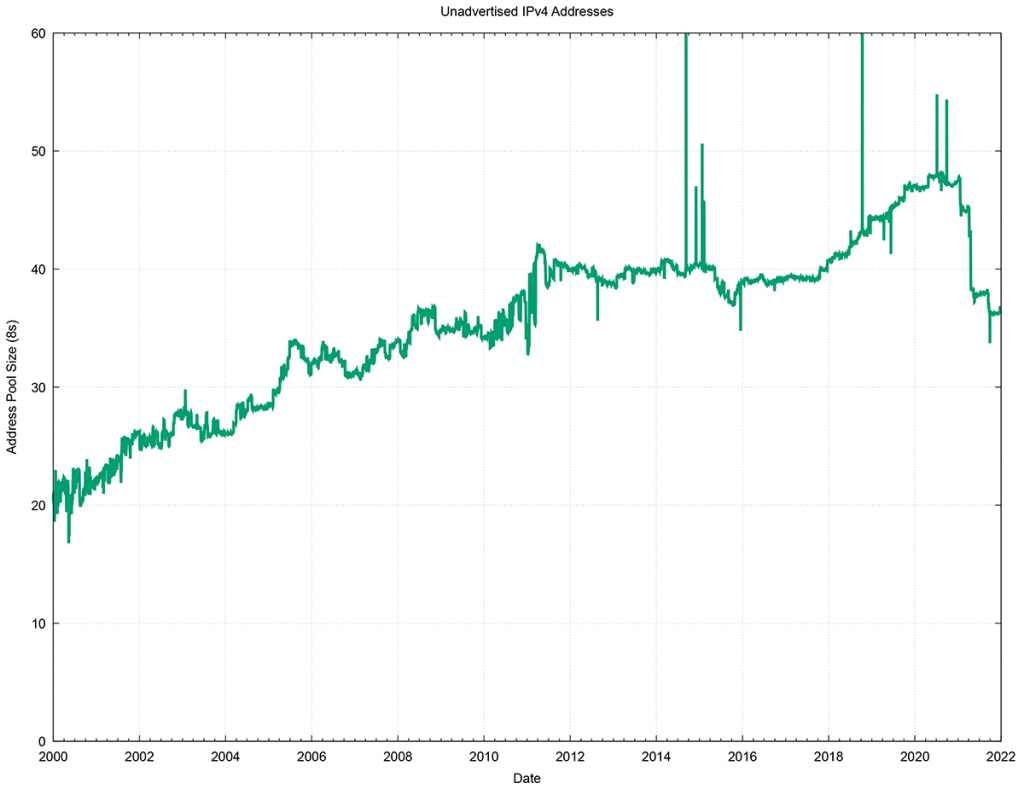

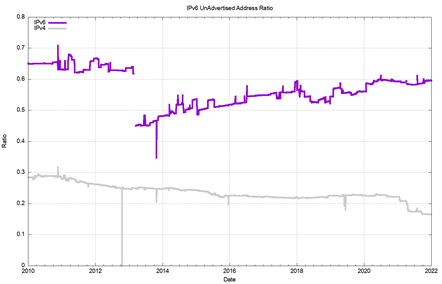

However, the practical experience with transfers is not so clear. The data relating to address recycling is inconclusive. Between 2011 and late 2017, the pool of unadvertised addresses sat between 38 and 40 /8s. This pool of unadvertised addresses rose from the start of 2018 and by early 2020 there were just under 50 /8s unadvertised in the public Internet. This two-year period of increase in the unadvertised address pool appeared to be when IPv4 addresses were being hoarded, though such a conclusion from just this high-level aggregate data is highly speculative.

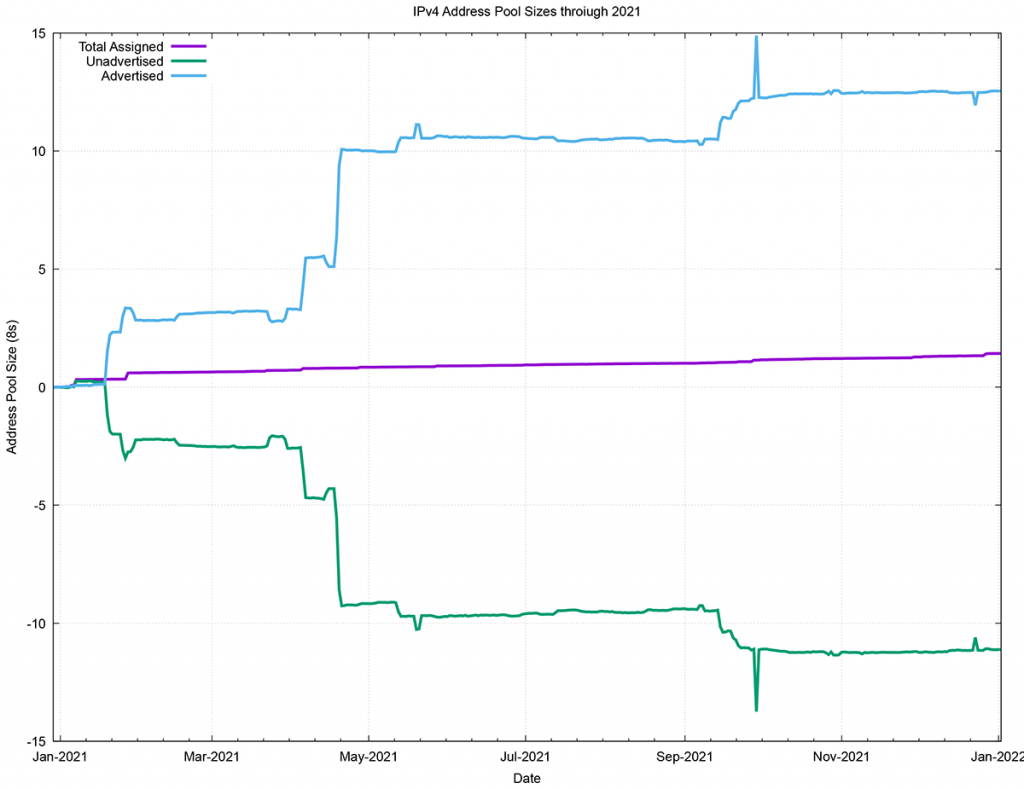

There has been a substantial size reduction in this unadvertised address pool across 2021, and an expansion of the data across 2021 is shown in Figure 6. The major change in 2021 was the announcement of seven /8s from the address space originally allocated to the US Department of Defence (US DoD) in the early days of the then ARPANET. On 20 January 2021, AS 8003, registered to Global Resource Systems (a contractor to the US DoD), advertised 11.0.0.0/8 and 22.0.0.0/8. On 7 April, another block, 33.0.0.0/8 was advertised, again by AS 8003. On 19 and 20 April a further 4 /8 address blocks, 21.0.0.0/8, 26.0.0.0/8, 28.0.0.0/8 and 30.0.0.0/8, were advertised by AS 8003. On 7 September 2021, these addresses were shifted over to AS 749, a network registered to the US Defence Data Network.

In April 2021, this set of address advertisements was picked up in the media, and several motives were ascribed to this action. The likely explanation is far more prosaic, and probably sits in the category of defensive measures, as the advertisement by a legitimate source makes efforts to co-opt those addresses as part of an attack a little more obvious. At the end of 2021, AS 749 originates more IPv4 addresses than any other network — 211,581,184 addresses, or the equivalent of a /4.34 in prefix length notation, or 5% of the total IPv4 address pool.

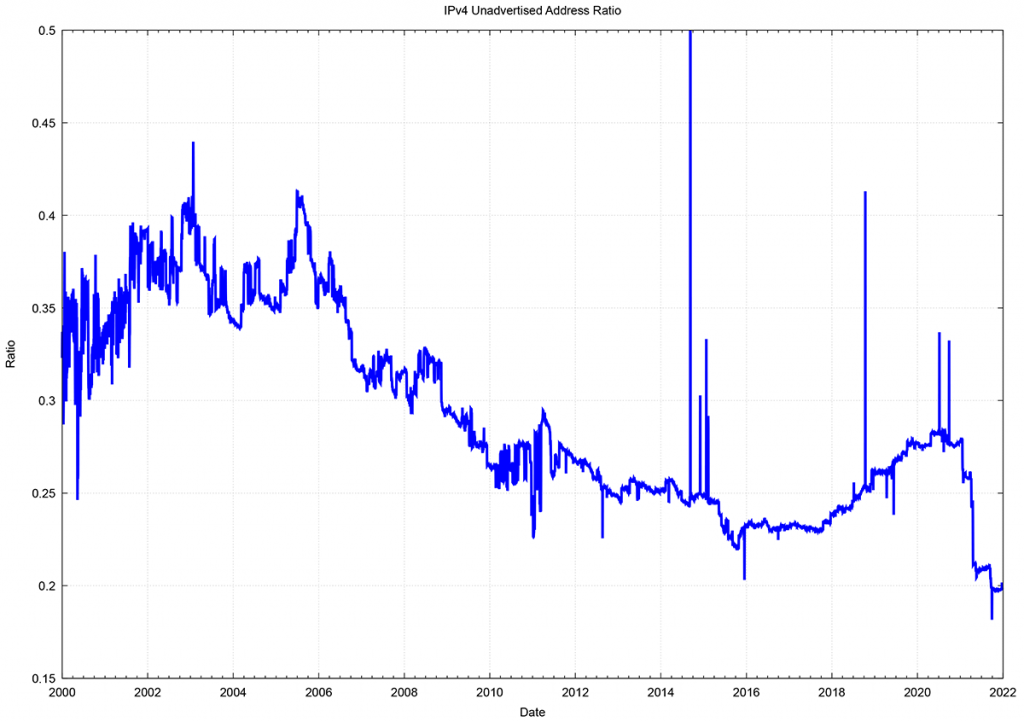

In relative terms, expressed as a proportion of the total pool of allocated IP addresses, the unadvertised address pool dropped from 28% in 2011 to a low of 24% at the start of 2016, and subsequently rose to 29% by the end of 2020. During 2021, this figure has dropped to 20%, largely due to the advertisement of the legacy US DoD address space, rather than the activation of previously unadvertised address space. This suggests that address transfer activity has not made a substantial change in the overall picture of address utilization efficiency in the past 12 months (Figure 7).

This data appears to point to a somewhat sluggish transfer market. The number of transfer transactions is rising, but the total volume of transferred addresses is falling. The address market has not been very effective in flushing out otherwise idle addresses and redeploying them into the routed network.

However, as with all other commodity markets, the market price of the commodity reflects the balancing of supply and demand and the future expectations of supply and demand. What can be seen in the price of traded IPv4 addresses over the past eight years?

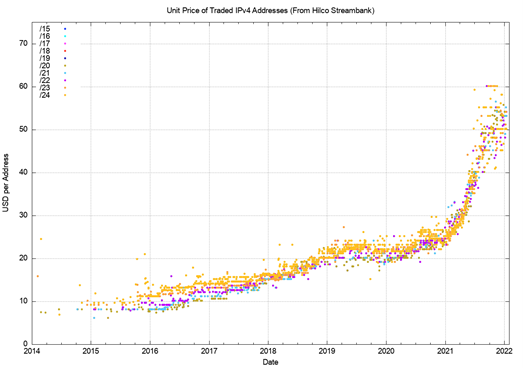

One address broker, Hilco Streambank, publishes the historical price information of transactions (if only all the address brokers did the same, as a market with open price information for transactions can operate more efficiently and fairly than markets where price information is occluded). Figure 8 uses the Hilco Streambank transaction data to produce a time series of address price.

There are several distinct behaviour modes in this data. The initial data prior to 2016 reflected a relatively low volume of transactions with stable pricing, just below USD 10 per address. The price doubled by the start of 2019, with small blocks (/24s and /23s) attracting a price premium. The price stabilized for the next 18 months at between USD 20 to USD 25 per address, with large and small blocks trading at a similar unit price. The most recent 18 months has seen a new dynamic, reflecting an exponential rise in prices that lifted to between USD 45 and USD 60 per address by the end of 2021. There is a greater price variance at present, particularly compared to the start of 2021.

If prices are reflective of supply and demand, it appears that demand has increased at a far greater level than supply, and the higher price reflects some form of scarcity premium being applied to addresses in recent times (Figure 8).

Is the supply of tradable IPv4 addresses declining? One way to provide some insight into answering this question is to look at the registration age of transferred addresses. Are such addresses predominantly recently allocated addresses, or are they longer-held addresses where the holder is wanting to realize the inherent value in otherwise unused assets? The basic question concerns the age distribution of transferred addresses where the age of an address reflects the period since it was first allocated or assigned by the RIR system.

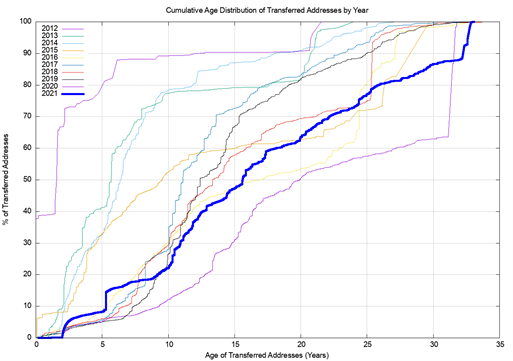

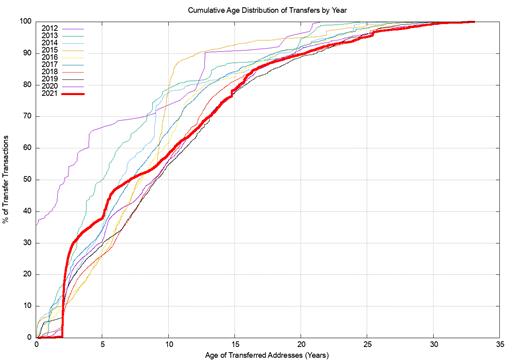

The cumulative age distribution of transferred addresses by transaction is shown on a year-by-year basis in Figures 9 and 10. 10% of all transferred addresses in 2021 were drawn from legacy address holders, as shown in Figure 9. It appears that the effort to recycle the legacy address pool has all but run its course and the volume of transferred legacy addresses has declined sharply.

Address holders appear to hold recently allocated addresses for minimum policy-mandated holding periods (two years in some RIR regions), but then a visible proportion of these holders market these addresses. 8% of addresses that were transferred in 2021 were allocated in 2019, and 15% of transferred addresses were allocated since 2016. As shown in Figure 10, these transactions accounted for 40% of the transfer transactions in 2021, which is somewhat larger than previous years. It’s also useful to consider the situation described in Figure 10 by considering the data in Table 4. In 2021, some 84% of all transfers recorded in the registry system are transfers in the RIPE region, so this behaviour of receiving an allocated IP address, holding it for the policy-mandated minimum holding time, and then trading the block on the address market is predominantly seen in the RIPE region.

In 2012, 90% of transferred address blocks were originally assigned or allocated by an RIR within the previous 10 years. In 2021, 20% of these transferred addresses relate to addresses that were originally allocated by an RIR in the previous 10 years. Given that the onset of IPv4 address exhaustion occurred 10 years ago, and the address allocations performed since then were performed under the constraints of exhaustion allocation policies, then 20% of transferred addresses, and 60% of all transfers transactions in 2021 involve addresses originally allocated under address exhaustion policy frameworks.

The comparison of Figures 9 and 10 also suggests that the transfers of older address blocks have far larger address spans, corresponding to the very early IPv4 address allocations of /8 and /16 prefixes.

Are transfers effectively recovering and recycling address blocks that have fallen into disuse, and passing them back into active use? The available data indicates that this is not a strong theme of address transfers. The more prevalent current behaviour is where organizations obtain allocations from the RIPE NCC registry, hold the space for the policy-mandated minimum time, and then monetize the addresses by trading them on the transfer market.

Do transfers fragment the address space?

The next question is whether the transfer process is further fragmenting the address space by splitting up larger address blocks into successively smaller address blocks. There are 33,193 transactions described in RIR transfer registries from the start of 2012 until the start of 2022. Of these, 11,245 entries list transferred address blocks that are smaller than the original allocated block. So, 34% of transfers implicitly perform fragmentation of the original allocation.

These 11,245 transfer entries that have fragmented the original allocation are drawn from 4,229 such original allocations. On average, the original allocation is split into 2.6 smaller address blocks. This data implies that address blocks are being fragmented as a result of address transfers, but in absolute terms this is not a major issue. There were 229,019 distinct address allocations from the RIRs to end entities by the end of 2021, and the fragmentation reflected in the addition of 7,016 more specific entries of these original address blocks is around 3% of the total pool of allocated address prefixes.

Imports and exports of addresses

The next question concerns the international flow of transferred addresses. Let’s look at the ten economies that sourced the greatest volume of transferred addresses, irrespective of their destination (including ‘domestic’ transfers within the same economy) (Table 6), the ten largest recipients of transfers (Table 7), and the ten largest international address transfers (Table 8). We will use the RIR-published transfer data for 2021 as the basis for these tables.

| Rank | CC | Addresses | Economy |

| 1 | GB | 3,697,152 | United Kingdom |

| 2 | ZA | 3,143,936 | South Africa |

| 3 | AU | 2,387,968 | Australia |

| 4 | US | 2,044,000 | USA |

| 5 | RU | 1,409,536 | Russia |

| 6 | CN | 1,332,224 | China |

| 7 | DE | 1,081,920 | Germany |

| 8 | CH | 1,029,632 | Switzerland |

| 9 | TH | 1,017,856 | Thailand |

| 10 | HU | 785,664 | Hungary |

Table 6 — Top 10 economies sourcing transferred IPv4 addresses in 2021.

| Rank | CC | Addresses | Destination Economy |

| 1 | US | 3,625,312 | USA |

| 2 | GB | 3,367,168 | United Kingdom |

| 3 | ZA | 3,339,520 | South Africa |

| 4 | RU | 1,301,248 | Russian Federation |

| 5 | DE | 1,242,944 | Germany |

| 6 | TH | 1,082,624 | Thailand |

| 7 | CH | 1,080,320 | Switzerland |

| 8 | CN | 890,880 | China |

| 9 | HU | 781,056 | Hungary |

| 10 | BR | 742,912 | Brazil |

Table 7 — Top 10 economies receiving transferred IPv4 addresses in 2021.

There are many caveats in this data collection, particularly relating to the source and meaning of this economy-based geolocation. Even if we use only the country code (CC) entry in the RIR’s registry records, then we get a variety of meanings. Some RIRs use the principle that the recorded CC entry corresponds to the physical location of the headquarters of the nominated entity that is the holder of the addresses, irrespective of the locale where the addresses are used on the Internet. Other RIRs allow the holder to update this geolocation entry to match the holder’s intended locale where the addresses will be used. It is generally not possible to confirm the holder’s assertion of location, so whether these self-managed records reflect the actual location of the addresses or reflect a location of convenience is not always possible to determine.

When we look at the various geolocation services, for which Maxmind is a commonly used service, there are similar challenges of location. These services generally intend to associate an address with a location that relates to where the address is physically located. At times, this is not easy to establish, such as with tunnels used in VPNs. Is the correct location the location of the tunnel ingress or tunnel egress? Many of the fine-grained differences in geolocation services reflect the challenges in dealing with VPNs and the various ways these location services have responded.

There is also the issue of cloud-based services. Where the cloud service uses anycast the address is in many locations at once. Where the cloud uses conventional unicast, the addresses used may be fluid across the cloud service’s points of presence based on distributing addresses to meet the demands for the service. These location listings are a ‘fuzzy’ approximation rather than a precise indication of location.

With that in mind, let’s now look at imports and exports of addresses of 2021 transfers where the source and destination of the transfers are in different economies.

| Rank | From | To | Addresses (M) | Source | Destination |

| 1 | AU | US | 2,089,984 | Australia | USA |

| 2 | CN | BR | 524,288 | China | Brazil |

| 3 | US | GB | 303,360 | USA | United Kingdom |

| 4 | US | FR | 268,288 | USA | France |

| 5 | GB | US | 238,592 | United Kingdom | USA |

| 6 | DE | US | 231,680 | Germany | USA |

| 7 | US | DE | 149,248 | USA | Germany |

| 8 | AU | JP | 133,376 | Australia | Japan |

| 9 | GB | DE | 132,608 | United Kingdom | Germany |

| 10 | US | FI | 132,096 | USA | Finland |

| 11 | SG | CN | 131,072 | Singapore | China |

| 12 | US | ES | 128,000 | USA | Spain |

| 13 | NL | US | 120,576 | Netherlands | USA |

| 14 | NL | DE | 89,600 | Netherlands | Germany |

| 15 | CN | SG | 87,040 | China | Singapore |

| 16 | LV | US | 80,896 | Latvia | USA |

| 17 | GB | ES | 77,824 | United Kingdom | Spain |

| 18 | GB | IT | 75,776 | United Kingdom | Italy |

| 19 | US | HK | 73,472 | USA | Hong Kong |

| 20 | US | PH | 66,816 | USA | Philippines |

Table 8 — Top 20 economy to economy IPv4 address transfers in 2021.

The 2021 transfer logs contain 4,033 domestic address transfers, with a total of 17,723,296 addresses, with the largest activity by address volume in domestic transfers in South Africa, the United Kingdom, and Russia. 2,735 transfers appear to result in a movement of addresses between economies, involving a total of 8,663,040 addresses.

It appears that the IPv4 address supply hiatus has motivated most Internet Service Providers to use address sharing technologies. In particular, Carrier Grade NAT (CGN) on the access side and name-based server pooling on the content side to increase the level of address sharing. This has been accompanied by a universal shift of the architecture of the Internet to a client/server model. The result is that the pressure on the IPv4 address space has been relieved to a considerable extent, and the sense of urgency to migrate to an all-IPv6 network has been largely, but not completely, mitigated over this period.

The outstanding question about this transfer data is whether all address transfers have been duly recorded in the registry system. This question is raised because registered transfers require conformance to various registry policies, and it may be that only a subset of transfers are being recorded in the registry as a result. This can be somewhat challenging to detect, particularly if such a transfer is expressed as a lease or other form of temporary arrangement, and if the parties agree to keep the details of the transfer confidential.

It might be possible to place an upper bound on the volume of address movements occurring in any period. One way to shed some further light on what this upper bound on transfers might be is through a simple examination of the routing system, looking at addresses that were announced in 2021 by comparing the routing stable states at the start and end of the year (Table 9).

| Jan-21 | Jan-22 | Delta | Unchanged | Rehomed | Removed | Added | |

| Announcements | 855,767 | 906,456 | 50,689 | 697,928 | 29,226 | 82,098 | 132,787 |

| Address Span (/8s) | 236.44 | 249.61 | 13.17 | 208.18 | 5.35 | 11.45 | 24.62 |

| Root Prefixes: | 399,812 | 423,948 | 24,136 | 336,842 | 15,080 | 27,593 | 49,000 |

| Address Span (/8s) | 170.75 | 183.29 | 12.54 | 160.20 | 3.20 | 6.19 | 17.89 |

| More Specifics: | 455,955 | 482,508 | 26,553 | 361,086 | 14,146 | 54,505 | 83,787 |

| Address Span (/8s) | 50.54 | 50.62 | 0.08 | 58.28 | 2.15 | 5.26 | 6.73 |

Table 9 — IPv4 BGP changes over 2021.

While the routing table grew by 50,689 entries over the year, the nature of the change is slightly more involved. 92,098 prefixes that were announced at the start of the year were removed from the routing system at some time throughout the year, and 132,787 prefixes were announced by the end of the year that were not announced at the start of the year. More transient prefixes may have appeared and been withdrawn throughout the year of course, but we are comparing two snapshots rather than looking at every update message. A further 24,226 prefixes had changed their originating ASN, indicating some form of change in the prefix’s network location in some manner.

Looking at the entirety of all updates throughout 2021 shows a larger collection of transient address prefixes. A total of 1,128,986 distinct prefixes were observed in the total of all BGP updates throughout 2021 — or 273,219 additional prefixes from the initial set at the start of the year.

We can compare the prefixes that changed in 2021 against the transfer logs for the two-year period of 2020 and 2021. Table 10 shows the comparison of these routing numbers against the set of transfers that were logged in these two years.

| Type | Listed | Unlisted | Ratio |

| Rehomed | |||

| All | 2,382 | 26,844 | 8.2% |

| Root Prefixes | 1,991 | 12,773 | 13.5% |

| Removed | |||

| All | 3,966 | 78,132 | 4.8% |

| Root Prefixes | 2,748 | 24,845 | 10.0% |

| Added | |||

| All | 7,026 | 125,761 | 5.3% |

| Root Prefixes | 5,070 | 43,930 | 10.3% |

Table 10 — Routing changes across 2021 compared to the transfer log entries for 2020 – 2021.

These figures show that 5% to 10% of changes in advertised addresses from the beginning to the end of the year are reflected as changes as recorded in RIR transfer logs. This shouldn’t imply that the remaining changes in advertised prefixes reflect unrecorded address transfers. There are many reasons for changes in the advertisement of an address prefix, and a change in the administrative controller of the address is only one potential cause. However, it does establish some notional upper ceiling on the number of movements of addresses in 2021, some of which relate to transfer of operational control of an address block, that have not been captured in the transfer logs.

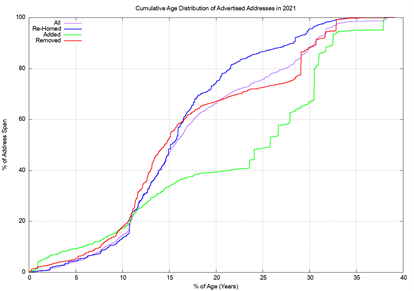

Finally, we can perform an age profile of the addresses that were added, removed, and rehomed during 2021, then compare it to the overall age profile of IPv4 addresses in the routing table. This is shown in Figure 11. In terms of addresses that were added in 2021, they differ from the average profile due to a skew in favour of ‘older’ addresses, and 20% of all announced addresses were allocated or assigned more than 30 years ago. This is due to the advertisement of the legacy US DoD /8 allocations, as already noted. Addresses that rehome appear to be disproportionately represented in the age bracket between 15 to 30 years old.

However, as IPv4 moves into its final stages we are perhaps now able to take stock of the overall distribution of IPv4 addresses and look at where the addresses ended up. Table 11 shows the ten economies that have the largest pools of allocated IPv4 addresses. However, I have to note that the assignment of a CC in an address registration reflects where the address holder is located (the corporate location), and not necessarily the economy where the addresses will be deployed.

| Rank | CC | IPv4 Pool | % Total | Per-Capita | Economy |

| 1 | US | 1,619,530,848 | 43.9% | 4.89 | United States of America |

| 2 | CN | 343,938,048 | 9.3% | 0.24 | China |

| 3 | JP | 190,204,416 | 5.2% | 1.50 | Japan |

| 4 | DE | 123,997,312 | 3.4% | 1.48 | Germany |

| 5 | KR | 112,486,912 | 3.1% | 2.19 | South Korea |

| 6 | GB | 112,046,184 | 3.0% | 1.65 | United Kingdom |

| 7 | BR | 87,127,552 | 2.4% | 0.41 | Brazil |

| 8 | FR | 82,836,112 | 2.2% | 1.27 | France |

| 9 | CA | 69,632,000 | 1.9% | 1.84 | Canada |

| 10 | IT | 55,131,712 | 1.5% | 0.91 | Italy |

Table 11 — IPv4 allocated address pools per economy.

If we divide this address pool by the current population of each economy, we can derive an address per capita index. The global total of 3.70 billion allocated addresses with an estimated global population of 7.8 billion people gives an overall value of 0.47 IPv4 addresses per capita.

| Rank | CC | IPv4 Pool | % Total | Per-Capita | Economy |

| 1 | SC | 7,244,288 | 0.2% | 73.66 | Seychelles |

| 2 | VA | 10,752 | 0.0% | 13.42 | Holy See |

| 3 | GI | 254,464 | 0.0% | 7.55 | Gibraltar |

| 4 | US | 1,619,530,848 | 43.9% | 4.89 | United States of America |

| 5 | SG | 24,064,512 | 0.7% | 4.11 | Singapore |

| 6 | MU | 4,777,472 | 0.1% | 3.76 | Mauritius |

| 7 | LI | 116,256 | 0.0% | 3.05 | Liechtenstein |

| 8 | SE | 29,993,576 | 0.8% | 2.97 | Sweden |

| 9 | NL | 50,198,304 | 1.4% | 2.93 | Netherlands |

| 10 | NO | 15,680,528 | 0.4% | 2.89 | Norway |

| - | 3,684,980,232 | 100.0% | 0.47 | World |

Table 12 — IPv4 allocated address pools ranked by per-capita holdings.

The full table of IPv4 allocations per national economy can be found here.

IPv4 address leasing

It is worth noting that the address market includes leasing as well as sales. Should an entity who requires IPv4 addresses perform an outright purchase of the addresses from an existing address holder, or should they execute a timed lease to have the use of these addresses for a specified period and presumably return these addresses at the end of the lease? This lease versus buy question is a very conventional question in market economics and there are various well-rehearsed answers to the question. They tend to relate to the factoring of market information and scenario planning.

If a buyer believes that the situation that led to the formation of a market will endure for a long time, and the goods being traded on the market are in finite supply while the level of demand for these goods is increasing, then the market will add an escalating scarcity premium to the price of the goods being traded. The balancing of demand and supply becomes a function of this scarcity premium imposed on the good. Goods in short supply tend to become more expensive to buy over time. A holder of these goods will see an increase in the value of the goods that they hold. A lessee will not.

If a buyer believes that the market only has a short lifespan, and that demand for the good will rapidly dissipate at the end of this lifespan, then leasing the good makes sense, so that the lessee is not left with a valueless asset when the market collapses.

Scarcity also has several additional consequences, one of which is the pricing of substitute goods. At some point, the price of the original good rises to the point that substitution looks economically attractive, even if the substitute good has a higher cost of production or use. In fact, this substitution price effectively sets a price ceiling for the original scarce good.

Some commentators have advanced the view that an escalating price for IPv4 increases the economic incentive for IPv6 adoption. This may indeed be the case, but there are other potential substitutes that have been used, most notably NATs. While NATs do not eliminate the demand pressure for IPv4, they can go a long way to increase the address utilization efficiency of IPv4 addresses. NATs allow the same address to be used by multiple customers at different times. The larger the pool of customers that share a common pool of NAT addresses, the greater the achievable multiplexing capability.

The estimate as to how long the market in IPv4 addresses will persist is effectively a judgement as to how long IPv4 and NATs can last and how long it will take IPv6 to be sufficiently deployed to be viable as an IPv6-only service. When that happens, there is likely to be a tipping point where the pressure for all hosts and networks to support access to services over IPv4 collapses. At that point, the early IPv6-only adopters can dump all their remaining IPv4 resources onto the market as they have no further need for them, which would presumably trigger a level of market panic to emerge as existing holders are faced with the prospect of holding a worthless asset and are therefore under pressure to sell off their IPv4 assets while there are still buyers in the market.

While a significant population of IPv4-only hosts and networks can stall this transition and increase scarcity pressure, if the scarcity pressure becomes too great the impetus of IPv6-only adoption increases to the level that the IPv6-connected base achieves market dominance. When this condition is achieved, the IPv4 address market will quickly collapse.

IPv6 in 2021

Obviously, IPv4 address allocation is only half of the story, and to complete the picture it’s necessary to look at how IPv6 has fared over 2021.

IPv6 uses a somewhat different address allocation methodology than IPv4, and it is a matter of choice for a service provider as to how large an IPv6 address prefix is assigned to each customer. The original recommendations published by the IAB and IESG in 2001, documented in RFC 3177, envisaged the general use of a /48 prefix as an end site prefix. Subsequent consideration of long-term address conservation saw a more flexible approach being taken with the choice of the end site prefix size being left to the service provider.

Today’s IPv6 environment has some providers using a /60 end site allocation unit, many using a /56, and many others using a /48. This variation makes a comparison of the count of allocated IPv6 addresses somewhat misleading, as an ISP using /48’s for end sites will require 256 times more address space to accommodate a similarly sized same customer base as a provider who uses a /56 end site prefix, and 4,096 times more address space than an ISP using a /60 end site allocation!

For IPv6, let’s use both the number of discrete IPv6 allocations and the total amount of space that was allocated to see how IPv6 fared in 2021.

Comparing 2020 to 2021, the number of individual allocations of IPv6 address space has remained stable while the number of IPv4 allocations has increased somewhat (Table 13).

| Allocations | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| IPv6 | 5,471 | 5,455 | 6,922 | 6,311 | 5,765 | 5,593 | 4,736 | 4,537 | 4,020 | 3,302 | 3,588 | 2,461 | 1,279 |

| IPv4 | 7,829 | 6,263 | 13,112 | 9,707 | 8,091 | 9,911 | 11,644 | 11,114 | 7,073 | 8,608 | 10,062 | 7,739 | 6,698 |

Table 13 — Number of individual address allocations, 2009 – 2021.

The amount of IPv6 address space distributed in 2021 is 30% more than the amount that was allocated in 2020 (Table 14).

| Addresses | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| IPv6 (/32s) | 28,690 | 21,835 | 36,507 | 39,278 | 19,986 | 25,300 | 20,234 | 17,917 | 24,103 | 17,740 | 15,018 | 5,844 | 1,091 |

| IPv4 (/32s)(M) | 4.3 | 5.6 | 15.4 | 16.1 | 21.2 | 22.5 | 45.3 | 68.5 | 64.9 | 114.9 | 201.0 | 248.0 | 190.1 |

Table 14 — Volume of address allocations, 2009 – 2021.

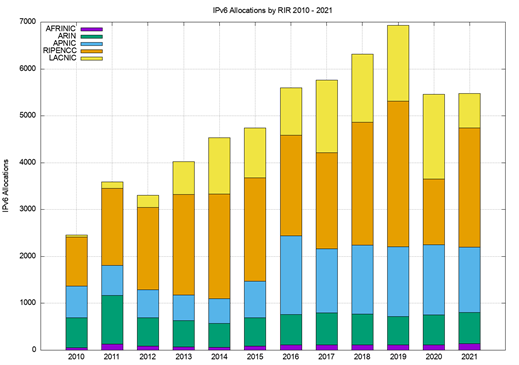

Regionally, each RIR saw IPv6 allocation activity in 2021 that was on a par with those seen in the previous year, except RIPE NCC, which saw a 50% decrease in allocations (Table 15).

| Allocations | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| ARIN | 671 | 644 | 605 | 659 | 684 | 646 | 604 | 512 | 560 | 611 | 1,039 | 638 | 394 |

| APNIC | 1,392 | 1,498 | 1,484 | 1,474 | 1,369 | 1,681 | 778 | 528 | 540 | 599 | 641 | 670 | 194 |

| RIPENCC | 2,542 | 1,403 | 3,104 | 2,620 | 2,051 | 2,141 | 2,207 | 2,227 | 2,151 | 1,756 | 1,647 | 1,048 | 642 |

| LACNIC | 730 | 1,801 | 1,614 | 1,448 | 1,549 | 1,009 | 1,061 | 1,208 | 696 | 253 | 132 | 50 | 35 |

| AFRINIC | 136 | 109 | 115 | 110 | 112 | 116 | 86 | 62 | 73 | 83 | 129 | 55 | 14 |

| 5,471 | 5,455 | 6,922 | 6,311 | 5,765 | 5,593 | 4,736 | 4,537 | 4,020 | 3,302 | 3,588 | 2,461 | 1,279 |

Table 15 — IPv6 allocations by RIR.

The address assignment data tells a slightly different story. Table 16 shows the number of allocated IPv6 /32s per year. There were two /20 allocations in the year, one to CERNET in China (an earlier allocation of an IPv6 /20 was also made to CERNET in 2019), and a second to the National Knowledge Network in India. A third large allocation of /22 was made to China’s State Oil and Gas Pipeline Group.

| Addresses (/32s) | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

| ARIN | 374 | 4,975 | 5,522 | 845 | 1,372 | 1,088 | 642 | 5,232 | 12,581 | 1,676 | 2,280 | 584 | 257 |

| APNIC | 10,185 | 7,365 | 7,945 | 19,690 | 4,228 | 1,236 | 2,109 | 2,663 | 4,462 | 3,807 | 9,506 | 3,241 | 175 |

| RIPENCC | 17,329 | 7,737 | 21,180 | 17,335 | 12,844 | 21,717 | 12,039 | 8,608 | 6,385 | 3,729 | 2,425 | 1,869 | 617 |

| LACNIC | 660 | 1,669 | 1,496 | 1,336 | 1,429 | 1,181 | 973 | 1,363 | 608 | 4,325 | 652 | 46 | 32 |

| AFRINIC | 142 | 89 | 364 | 72 | 113 | 78 | 4,471 | 51 | 67 | 4,203 | 155 | 104 | 9 |

| 28,690 | 21,835 | 36,507 | 39,278 | 19,986 | 25,300 | 20,234 | 17,917 | 24,103 | 17,740 | 15,018 | 5,844 | 1,091 |

Table 16 — IPv6 address allocation volumes by RIR.

Dividing addresses by allocations gives the average IPv6 allocation size in each region (Table 16). Overall, the average IPv6 allocation size remains around /30, with RIPE NCC and APNIC averaging larger individual IPv6 allocations than the other RIRs.

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |

| ARIN | /32.8 | /29.1 | /28.8 | /31.6 | /31.0 | /31.2 | /31.9 | /28.6 | /27.5 | /30.5 | /30.9 | /32.1 | /32.6 |

| APNIC | /29.1 | /29.7 | /29.6 | /28.3 | /30.4 | /32.4 | /30.6 | /29.7 | /29.0 | /29.3 | /28.1 | /29.7 | /32.1 |

| RIPENCC | /29.2 | /29.5 | /29.2 | /29.3 | /29.4 | /28.7 | /29.6 | /30.0 | /30.4 | /30.9 | /31.4 | /31.2 | /32.1 |

| LACNIC | /32.1 | /32.1 | /32.1 | /32.1 | /32.1 | /31.8 | /32.1 | /31.8 | /32.2 | /27.9 | /29.7 | /32.1 | /32.1 |

| AFRINIC | /31.9 | /32.3 | /30.3 | /32.6 | /32.0 | /32.6 | /26.3 | /32.3 | /32.1 | /26.3 | /31.7 | /31.1 | /32.6 |

| /29.6 | /30.0 | /29.6 | /29.4 | /30.2 | /29.8 | /29.9 | /30.0 | /29.4 | /29.6 | /29.9 | /30.8 | /32.2 |

Table 17 — Average IPv6 address allocation size by RIR.

The number and volume of IPv6 allocations per RIR per year is shown in Figures 12 and 13.

It might be tempting to ascribe the decline of IPv6 allocations in 2020 from RIPE NCC to the year where many European economies were hit hard by COVID-19 measures. Arguing against that is the observation that economies all over the world have been similarly affected, yet the decline in IPv6 allocation activity in 2020 is only seen in the data from RIPE NCC. However, it’s interesting to question why the IPv6 address allocation activity has slumped in European economies, but not in China, the US, and Brazil (Table 19).

| Rank | 2021 | 2020 | 2019 | 2018 | 2017 | |||||

| 1 | USA | 619 | Brazil | 1,394 | Brazil | 1,112 | Brazil | 1,049 | Brazil | 1,114 |

| 2 | Russia | 576 | USA | 588 | USA | 538 | Russia | 638 | USA | 634 |

| 3 | Brazil | 508 | Indonesia | 389 | Russia | 502 | USA | 595 | Germany | 270 |

| 4 | Netherlands | 448 | India | 226 | Germany | 407 | Germany | 308 | Russia | 220 |

| 5 | India | 390 | Netherlands | 199 | Indonesia | 366 | China | 253 | Australia | 211 |

| 6 | UK | 304 | Germany | 192 | Netherlands | 342 | Indonesia | 213 | China | 208 |

| 7 | Bangladesh | 213 | Bangladesh | 182 | UK | 223 | UK | 184 | Netherlands | 194 |

| 8 | Germany | 196 | Russia | 128 | Bangladesh | 202 | Bangladesh | 183 | UK | 190 |

| 9 | Indonesia | 110 | Australia | 118 | France | 179 | India | 168 | Indonesia | 187 |

| 10 | Hong Kong | 108 | China | 115 | China | 165 | Netherlands | 162 | Argentina | 178 |

Table 18 — IPv6 allocations by year, by economy.

Table 18 shows the economies who received the largest number of individual IPv6 allocations, while Table 19 shows the amount of IPv6 address space assigned on a per economy basis for the past five years (using units of /32s).

| Rank | 2021 | 2020 | 2019 | 2018 | 2017 | |||||

| 1 | China | 5,424 | China | 6,765 | China | 6,787 | China | 17,647 | China | 2,245 |

| 2 | Russia | 4,409 | USA | 5,051 | USA | 5,510 | Russia | 4,675 | USA | 1,497 |

| 3 | India | 4,281 | Brazil | 1,358 | Russia | 3,716 | Germany | 1,932 | Germany | 1,364 |

| 4 | Netherlands | 3,390 | Netherlands | 1,331 | Germany | 2,522 | UK | 1,209 | Russia | 1,358 |

| 5 | UK | 2,249 | Germany | 716 | Netherlands | 2,516 | Singapore | 1,055 | Netherlands | 1,296 |

| 6 | Germany | 896 | Russia | 715 | UK | 1,355 | Netherlands | 1,025 | Spain | 1,170 |

| 7 | Ukraine | 651 | UK | 552 | France | 1,182 | Brazil | 1,007 | India | 1,087 |

| 8 | Lithuania | 633 | Italy | 391 | Italy | 1,052 | USA | 874 | UK | 1,072 |

| 9 | Brazil | 502 | France | 390 | Brazil | 1,049 | Spain | 851 | Brazil | 1,049 |

| 10 | USA | 491 | Turkey | 290 | Spain | 854 | France | 722 | France | 714 |

Table 19 — IPv6 address allocation volumes by year, by economy (/32s).

We can also look at the allocated address pools for the 25 economies with the largest allocated address pools in IPv6, and the current picture is shown in Table 20.

While the US also tops this list in terms of the total pool of allocated IPv6 addresses, with 20% of the total span of allocated IPv6 addresses, the per capita number is lower than many others in this list. Sweden has a surprisingly high number. The large address pools are likely due to early IPv6 allocations, made under a somewhat different allocation policy regime than used today.

Twenty years ago, it was common practice to point out the inequities in the state of IPv4 address deployment. Some US universities had more IPv4 addresses at their disposal than some highly populated developing economies, and the disparity was a part of the criticism of the address management practices of the time.

The RIR system was intended to address this issue of predisposition to a biased outcome. The concept behind the system was that within the regional community, each community had the ability to develop their own address distribution policies and could determine for themselves what they meant by such terms as ‘fairness’ and ‘equity’ and then direct their regional address registry to implement these policies.

IPv4 had a very evident early adopter reward — address allocations in the IPv4 class-based address plan could be quite extravagant. With IPv6, the idea was that address allocations were developed from the outset through local bottom-up policy determinate frameworks, and inequities in the outcome would be avoided.

It was also envisaged that with such a vast address plan provided by 128 bits of address space, the entire concept of scarcity and inequity would be largely irrelevant. 2128 is a vast number and the entire concept of comparison between two vast pools of addresses is somewhat irrelevant. So, when we look at the metric of a /48 per head of population don’t forget that /48 is 80 bits of address space, which is massively larger than the entire IPv4 address space. Even India’s average of 0.1 /48s per capita is still a truly massive number of IPv6 addresses!

However, before we go too far down this path it is also useful to bear in mind that the 128 bits of address space in IPv6 has become largely a myth. We sliced off 64 bits in the address span for no particularly good reason, as it turns out. We then sliced off a further 48 bits for, again, no particularly good reason. So, the vastness of the address space represented by 128 bits in IPv6 is in fact, not so vast.

The usable address prefix space in IPv4 roughly equates a /32 end address in IPv4 with around a /48 prefix in IPv6. So perhaps this comparison of /48s per capita is not entirely fanciful, and there is some substance to the observation that there are inequities in the address distribution in IPv6 so far. However, unlike IPv4, the exhaustion of the IPv6 address space is still quite some time off, and we still believe that there are sufficient IPv6 addresses to support a uniform address utilization model across the entire world of silicon over time.

| Rank | CC | Allocated (/48s) | % Total | /48s p.c. | Advertised (/48s) | Deployed | Name |

| 1 | CN | 3,936,092,249 | 17.4% | 2.7 | 1,655,222,454 | 17.8% | China |

| 2 | US | 3,807,856,200 | 16.8% | 11.5 | 1,022,265,534 | 11.0% | USA |

| 3 | DE | 1,490,944,680 | 6.6% | 17.8 | 1,031,211,619 | 11.1% | Germany |

| 4 | GB | 1,458,438,378 | 6.4% | 21.5 | 404,885,857 | 4.3% | UK |

| 5 | RU | 1,073,414,454 | 4.7% | 7.4 | 177,953,050 | 1.9% | Russia |

| 6 | FR | 949,227,921 | 4.2% | 14.5 | 160,147,671 | 1.7% | France |

| 7 | NL | 802,750,772 | 3.5% | 46.8 | 373,539,852 | 4.0% | Netherlands |

| 8 | JP | 663,101,642 | 2.9% | 5.2 | 508,415,880 | 5.5% | Japan |

| 9 | IT | 648,744,989 | 2.9% | 10.7 | 408,634,242 | 4.4% | Italy |

| 10 | AU | 618,398,908 | 2.7% | 24.3 | 307,830,331 | 3.3% | Australia |

| 11 | BR | 536,371,604 | 2.4% | 2.5 | 353,980,127 | 3.8% | Brazil |

| 12 | SE | 434,635,090 | 1.9% | 43.0 | 354,176,919 | 3.8% | Sweden |

| 13 | IN | 425,591,614 | 1.9% | 0.3 | 87,989,109 | 0.9% | India |

| 14 | PL | 386,859,241 | 1.7% | 10.2 | 206,078,405 | 2.2% | Poland |

| 15 | ES | 381,812,772 | 1.7% | 8.2 | 94,643,292 | 1.0% | Spain |

| 16 | AR | 349,046,886 | 1.5% | 7.7 | 283,176,806 | 3.0% | Argentina |

| 17 | KR | 344,915,979 | 1.5% | 6.7 | 4,321,983 | 0.0% | Korea |

| 18 | ZA | 317,986,504 | 1.4% | 5.4 | 289,465,297 | 3.1% | South Africa |

| 19 | EG | 270,139,394 | 1.2% | 2.6 | 269,942,784 | 2.9% | Egypt |

| 20 | CH | 236,388,527 | 1.0% | 27.3 | 113,156,004 | 1.2% | Switzerland |

| 21 | TR | 216,006,682 | 1.0% | 2.6 | 45,105,048 | 0.5% | Turkey |

| 22 | CZ | 188,022,895 | 0.8% | 17.6 | 109,987,216 | 1.2% | Czech Republic |

| 23 | UA | 179,044,525 | 0.8% | 4.1 | 69,595,577 | 0.7% | Ukraine |

| 24 | IR | 176,357,383 | 0.8% | 2.1 | 28,537,229 | 0.3% | Iran |

| 25 | TW | 168,165,391 | 0.7% | 7.1 | 154,817,108 | 1.7% | Taiwan |

Table 20 — IPv6 allocated address pools per national economy, December 2021.

To what extent are allocated IPv6 addresses visible as advertised prefixes in the Internet’s routing table?

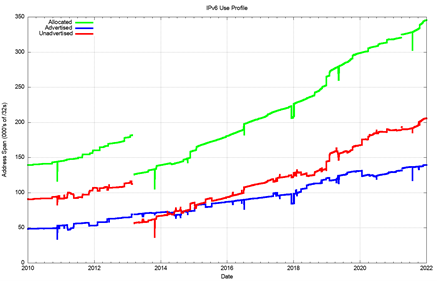

Figure 12 shows the overall counts of advertised, unadvertised, and total allocated address volume for IPv6 since 2010, while Figure 13 shows the advertised address span as a percentage of the total span of allocated and assigned IPv6 addresses.

The drop in the allocated address span in 2013 is the result of a change in LACNIC, where a single large allocation into Brazil was replaced by the recording of direct allocation and assignments to ISPs and similar end entities.

From a history of careful conservation of IPv4 addresses, where 77% of allocated or assigned IPv4 addresses are advertised in the BGP routing table, a comparable IPv6 figure of 40% does not look all that impressive. But that’s not the point. We chose the 128-bit address size in IPv6 to allow addresses to be used without overriding concerns about conservation. We are allowed to be inefficient in address utilization.

At the start of 2022, we have advertised an IPv6 address span equivalent to 150,000 /32s, or 9 billion end-site /48 prefixes. That is just 0.003% of the total number of /48 prefixes in IPv6.

The outlook for the Internet

Once more, the set of uncertainties that surround the immediate future of the Internet are considerably greater than the set of predictions that we can be reasonably certain about.

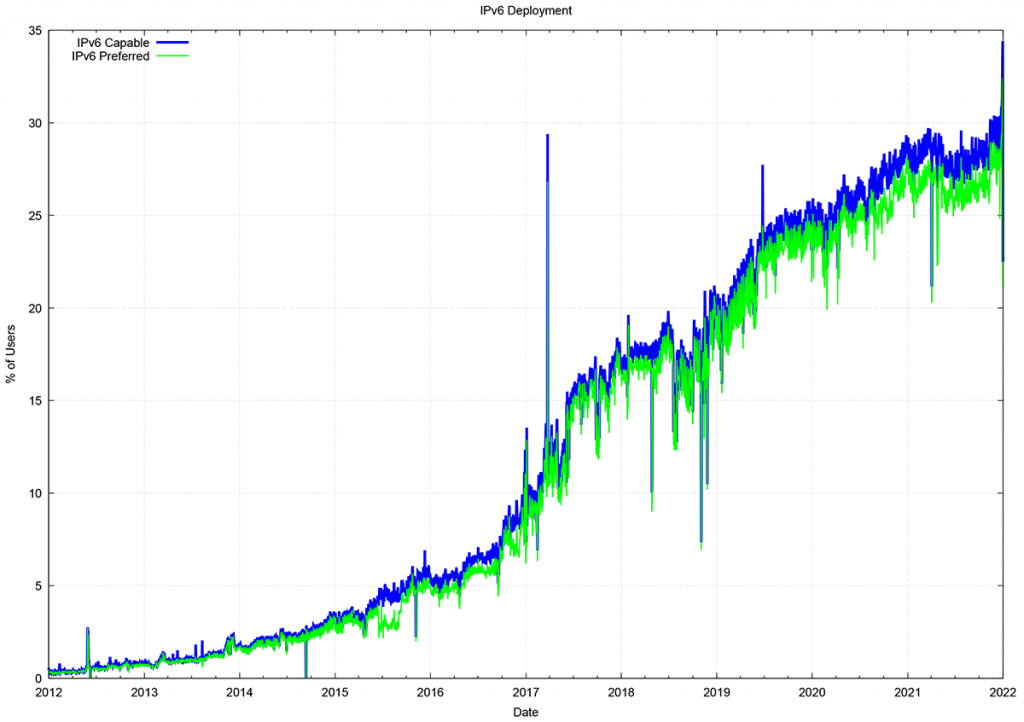

2017 saw a sharp rise in IPv6 deployment, influenced to a major extent by the deployment of IPv6 services in India, notably by the Jio service. 2018 was a quieter year, although the rise in the second half of the year is due to the initial efforts of mass scale IPv6 deployment in the major Chinese service providers. This movement accelerated in 2019 and the overall move of 5% in IPv6 deployment levels had a lot to do with the very rapid rise of the deployment of IPv6 in China.

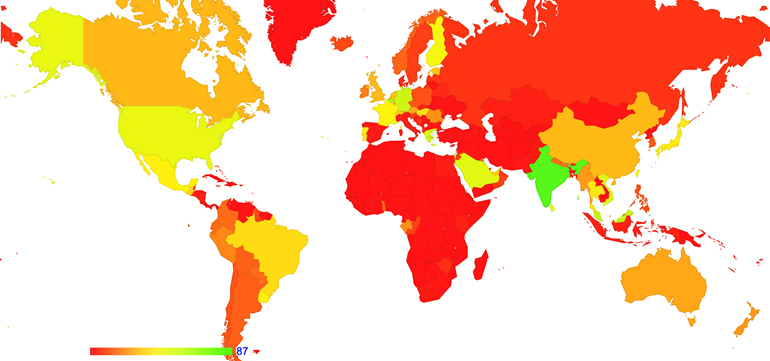

In 2021, the growth patterns for IPv6 were more diffuse around the world with a 3% overall growth rate, although there has been steady growth in IPv6 deployment in Brazil, Colombia, Ecuador, and Argentina. The regions where IPv6 deployment is low compared to this 30% Internet-wide average includes Africa, Southern and Eastern Europe, the Middle East and Central Asia (Figure 17).

While several service operators have reached the decision point that anticipated future costs of NAT deployment are unsustainable for their service platform, there remains a considerable school of thought that says that NATs will cost effectively absorb further Internet device population growth. At least, that’s the only rationale I can ascribe to a very large number of service providers who are making no visible moves to push out dual-stack services now. Given that the ultimate objective of this transition is not to turn on dual-stack everywhere but to turn off IPv4, there is still some time to go and the uncertainty lies in trying to quantify what that time might be.

The past decade has been dominated by the mass marketing of mobile Internet services, and the Internet’s growth rates for 2014 to 2016 were perhaps the highest recorded so far. This would’ve been visible in the IP address deployment data were it not for the exhaustion of the IPv4 address pool. In address terms, this growth in the IPv4 Internet is being almost completely masked by the use of CGNs in the mobile service provider environment, so the resultant demands for public addresses in IPv4 are quite low and the real underlying growth rates in the network are occluded by these NATs. In IPv6 the extremely large size of the address space masks out much of this volume. A single IPv6 /20 allocation to an ISP allows for 268 million /48 allocations, or 68 billion /56 allocations, so much of the growth in IPv6 networks is simply hidden behind the massive address plan of IPv6.

It has also been assumed that we should see IPv6 address demands for deployments of large-scale sensor networks and other forms of deployments encompassed under the broad umbrella of the Internet of Things (IoT). This does not necessarily imply that the deployment is merely a product of an over-hyped industry, although that is always a possibility. It is more likely to assume that, so far, such deployments are taking place using private IPv4 addresses, and they rely on NATs and application-level gateways to interface with the public network. Time and time again we are lectured that NATs are not a good security device but in practice, NATs offer a reasonable front-line defence against network scanning malware, so there may be a larger story behind the use of NATs and device-based networks than just a simple conservative preference to continue to use an IPv4 protocol stack.

More generally, we are witnessing an industry that is no longer using technical innovation, openness, and diversification as its primary means of propulsion. The widespread use of NATs in IPv4 limits the technical substrate of the Internet to a very restricted model of simple client/server interactions using TCP and UDP. The use of NATs forces the interactions into client-initiated transactions, and the model of an open network with considerable communication flexibility is no longer being sustained in today’s network. Incumbents are entrenching their position, and innovation and entrepreneurialism are taking a back seat while we sit out this protracted IPv4/IPv6 transition.

Today’s Internet carriage service is provided by a smaller number of very large players, each of whom appear to be assuming a very strong position within their respective markets. The drivers for such larger players tend towards risk aversion, conservatism, and increased levels of control across their scope of operation. The same trends of market aggregation are now appearing in content provision, where a small number of content providers are exerting a completely dominant position across the entire Internet.

The evolving makeup of the Internet industry has quite profound implications in terms of network neutrality, separation of carriage and service provision function, investment profiles, expectations of risk and return on infrastructure investments, and on the openness of the Internet itself.

Given the economies of volume in this industry, it was always going to be challenging to sustain an efficient, fully open, and competitive industry, but the degree of challenge in this agenda is multiplied many-fold when the underlying platform has run out of the basic currency of IP addresses.

The pressures on the larger players within these markets to leverage their incumbency into overarching control gains traction when the stream of new entrants with competitive offerings dries up, and solutions in such scenarios typically involve some form of public sector intervention directed to restore effective competition and revive the impetus for more efficient and effective offerings in the market.

As the Internet continues to evolve, it is no longer the technically innovative challenger pitted against venerable incumbents in the form of traditional industries of telephony, print newspapers, television entertainment, and social interaction. The Internet is now the established norm. The days when the Internet was touted as a poster child of disruption in a deregulated space are long since over. These days, we appear to be increasingly looking further afield for a regulatory and governance framework that can challenge the increasing complacency of the newly established incumbents.

It is unclear how successful we will be in this search. We can but wait and see.

Grants to support IPv6 Deployment are available through ISIF Asia.

Discuss on Hacker NewsThe views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.