Time for another annual roundup from the world of IP addresses. Let’s see what has changed in the past 12 months in addressing the Internet and look at how IP address allocation information can inform us of the changing nature of the network itself.

There is no doubt that the Internet continues to grow. While the sales volumes of the more traditional forms of personal computers has peaked at some 430 million units per year (according to Gartner’s annual roundups of the industry and sales volumes of end devices) and sales of handheld smart devices has also peaked at some 1.9 billion units per year, the world of the Internet of Things continues to spiral upward. The installed barusise of these ‘things’ is now at an astonishing 8.4 billion at the end of 2017.

Around 1992, the IETF gazed into the crystal ball and tried to understand how the Internet was going to evolve and what demands that would place on the addressing system as part of the “IP Next Generation” study. The staggeringly large numbers of connected devices that we see today were certainly within the range predicted by that exercise.

Looking further out, it is doubtless that these numbers will continue to grow. We continue to increase silicon production volumes and at the same time continue to refine the production process to decrease the unit costs of these chips. But, at that time, we also predicted that the only way we could make the Internet work across such a massive pool of connected devices was to deploy a new IP protocol that came with a massively larger address space. It was from that reasoning that IPv6 was designed. This world of abundant silicon was the issue that IPv6 was primarily intended to solve. The copious volumes of address space were intended to allow us to uniquely assign a public IPv6 address to every such device, no matter how small, or in what volume they might be deployed.

But while the Internet has grown at such amazing rates, the deployment of IPv6 continues at a far more leisurely pace. There is no common sense of urgency about the deployment of this protocol, and still, there is no hard evidence that the continued reliance on IPv4 is failing us.

Much of the reason for this apparent contradiction is that the Internet is now a client/server network. Clients can initiate network transactions with servers but are incapable of initiating transactions with other clients. Network Address Translators (NATs) are a natural fit to this client/server model, where pools of clients share a smaller pool of public addresses, and only required the use of an address while they have an active session with a remote server. NATs are the reason why in excess of 15 billion connected devices can be squeezed into some 2 billion active IPv4 addresses.

However, the pressures of this inexorable growth in the number of deployed devices mean that the even NATs cannot withstand these growth pressures forever. Inevitably, either we will see the fragmenting of an IPv4 Internet into a number of disconnected parts, so that the entire concept of a globally unique and coherent address pool will be foregone, or we will see these growth pressures motivate the further deployment of IPv6, and the emergence of IPv6-only elements of the Internet as it tries to maintain a cohesive and connected whole. There are commercial pressures pulling the network in both of these directions, so it’s entirely unclear what path the Internet will follow in the coming years.

Can address allocation data help us to shed some light on what is happening in the larger Internet? Let’s look at what happened in 2017.

IPv4 in 2017

It appears that the process of exhausting the remaining pools of unallocated IPv4 addresses is proving to be as protracted as the process of the transition to IPv6.

The allocation of 16 million addresses in 2017, on top of a base of 3,641 million addresses that are already allocated at the start of the year, represents a growth rate of 0.43% for the year for the total allocated IPv4 public address pool. This is less than one-tenth of the growth in 2010 (the last full year before the onset of IPv4 address exhaustion).

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Allocated Addresses (M) | 203.3 | 189.4 | 248.8 | 201.0 | 114.9 | 65.1 | 63.9 | 34.8 | 22.2 | 15.6 |

| Total Annual Volume (B) | 2.52 | 2.72 | 2.90 | 3.14 | 3.34 | 3.43 | 3.50 | 3.59 | 3.62 | 3.65 |

| Relative Growth | 7.9% | 6.6% | 8.3% | 6.4% | 2.9% | 1.9% | 1.8% | 1.0% | 0.6% | 0.6% |

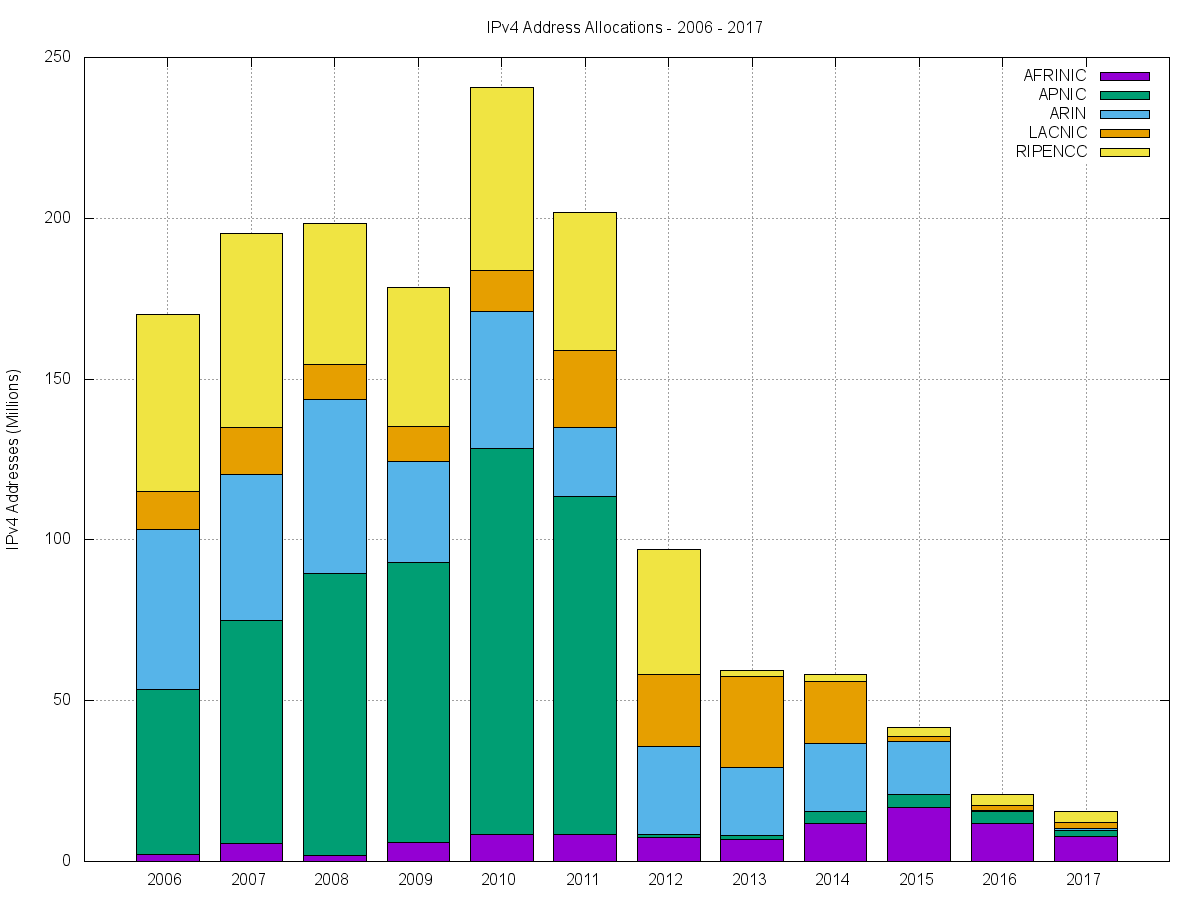

The record of address allocations per RIR over the past 10 years is shown in Table 2.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| APNIC | 87.8 | 86.9 | 120.2 | 105.2 | 1.0 | 1.3 | 3.7 | 4.1 | 3.8 | 1.8 |

| RIPE NCC | 44.0 | 43.4 | 56.0 | 43.1 | 40.0 | 2.0 | 2.5 | 3.3 | 3.4 | 3.6 |

| ARIN | 57.1 | 41.1 | 45.2 | 23.5 | 45.0 | 26.5 | 26.0 | 8.6 | 1.6 | 0.8 |

| LACNIC | 12.0 | 10.5 | 13.0 | 24.4 | 21.0 | 28.5 | 19.1 | 1.8 | 1.6 | 1.7 |

| AFRINIC | 1.6 | 5.9 | 8.5 | 9.2 | 7.9 | 6.8 | 12.5 | 16.9 | 11.8 | 7.8 |

In terms of the IPv4 Internet, there is a considerable diversity in the situation in each region. As of the end of 2017, AFRINIC was the last remaining Regional Internet Registry (RIR) with remaining IPv4 addresses available for general allocation, with some 12.8 million addresses left in its available address pool. APNIC and the RIPE NCC have both adopted “Last /8” policies, where each applicant can receive just a single allocation of up to 1,024 addresses from their respective last /8 address pools. APNIC has 5.6 million addresses left in this pool, and the RIPE NCC has some 9.9 million addresses. LACNIC has a pool of 277,000 remaining addresses, while ARIN has none at all.

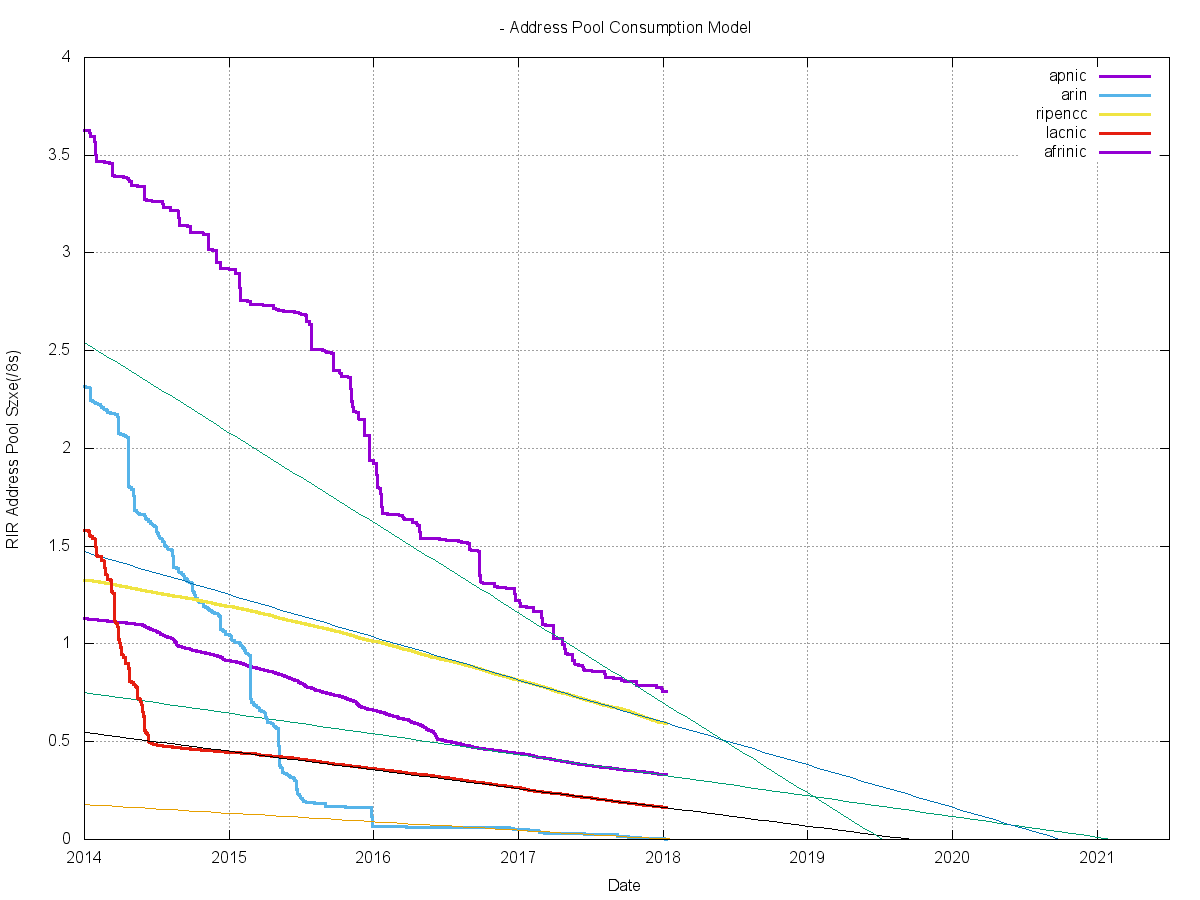

We can use the address allocation data from 2017 and perform a forward extrapolation on this to predict when the available address pools of each RIR will be exhausted. This is shown in Figure 1.Figure 1 – IPv4 RIR pool runout scenarios

The address consumption rate for APNIC reduced slightly in 2017 as compared to previous years, and at this stage, the pool will last for a further three years at this allocation rate.

The RIPE NCC uses a similar address management policy for its remaining pool of addresses, but the consumption rate is slightly higher than that of APNIC, and it increased in 2017 as compared to previous years, so this pool will last for a further 2½ years at its current rate of consumption. LACNIC’s remaining address pool will last for a further 1½ years, and ARIN has completely exhausted its available pool.

The picture with AFRINIC is not as clear. There have been a small number of relatively large single allocations in recent years. The first half of 2017 also saw a high level of activity, while the allocation rate in the second half of the year was considerably lower. The 2017 average allocation rate of ½ of a /8 per year will see the AFRINIC address pool last for a further 1½ years. This is shown in Table 3.

| RIR | estimated IPv4 address exhaustion |

| ARIN | already exhausted |

| AFRINIC | mid-2019 |

| LACNIC | mid-2019 |

| RIPE NCC | mid-2020 |

| APNIC | early-2021 |

This analysis of the remaining address pools is not quite the complete picture, as each of the RIRs also have reserved some addresses, in accordance with their local policies. There are a variety of reasons for this reservation, including non-contactability of the original address holder, or addresses undergoing a period of ‘quarantine’ following a forced recovery, or a reservation as prescribed by a local policy. ARIN has 6 million reserved IPv4 addresses, APNIC has 4.2 million, AFRINIC two million, the RIPE NCC has 1.1 million, and LACNIC one million. The total pool of reserved IPv4 addresses is some 14.4 million addresses in size.

Finally, the IANA is holding 18,688 addresses in its recovered address pool in 64 discrete address blocks. The forthcoming relatively small allocations to each RIR from this address pool will have little in the way of impact on the overall IPv4 picture.

The RIR IPv4 address allocation volumes by year are shown in Figure 2.

Figure 2 – IPv4 allocations by RIR by year

IPv4 address transfers

In recent years, several RIRs (RIPE NCC, ARIN, and APNIC) have included the registration of IPv4 transfers between address holders, as a means of allowing secondary re-distribution of addresses as an alternative to returning unused addresses to the registry.

This has been in response to the issues raised by IPv4 address exhaustion, where the underlying motivation as to encourage the reuse of otherwise idle or inefficiently used address blocks through the incentives provided by a market for addresses, and to ensure that such address movement is publically recorded in the registry system.

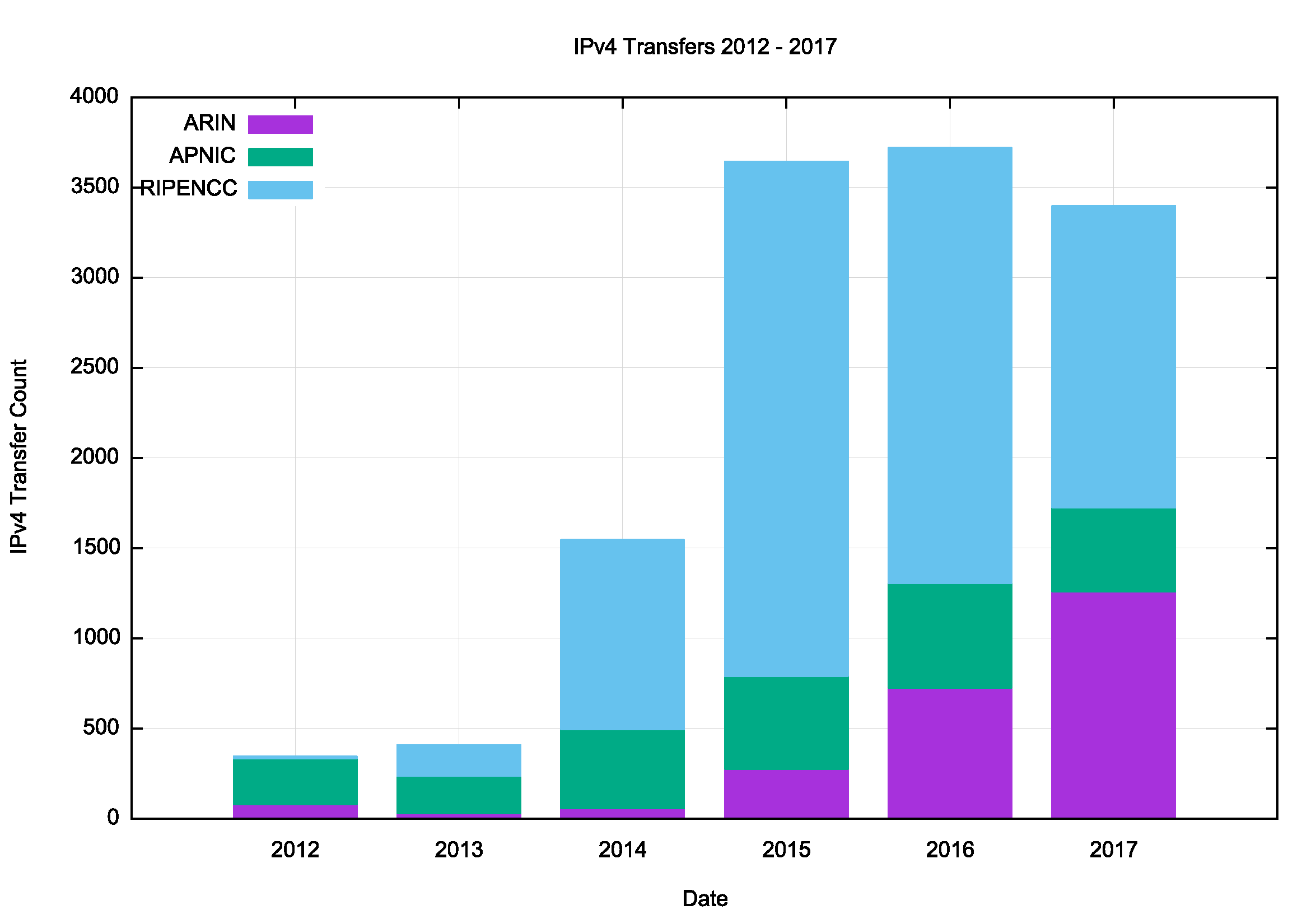

The numbers of registered transfers in the past four years are shown in Table 4.

| Receiving RIR | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| ARIN | 79 | 31 | 58 | 277 | 727 | 1,260 |

| APNIC | 255 | 206 | 437 | 514 | 581 | 466 |

| RIPE NCC | 10 | 171 | 1,050 | 2,852 | 2,411 | 1,671 |

| Total | 344 | 408 | 1,545 | 3,643 | 3,719 | 3,397 |

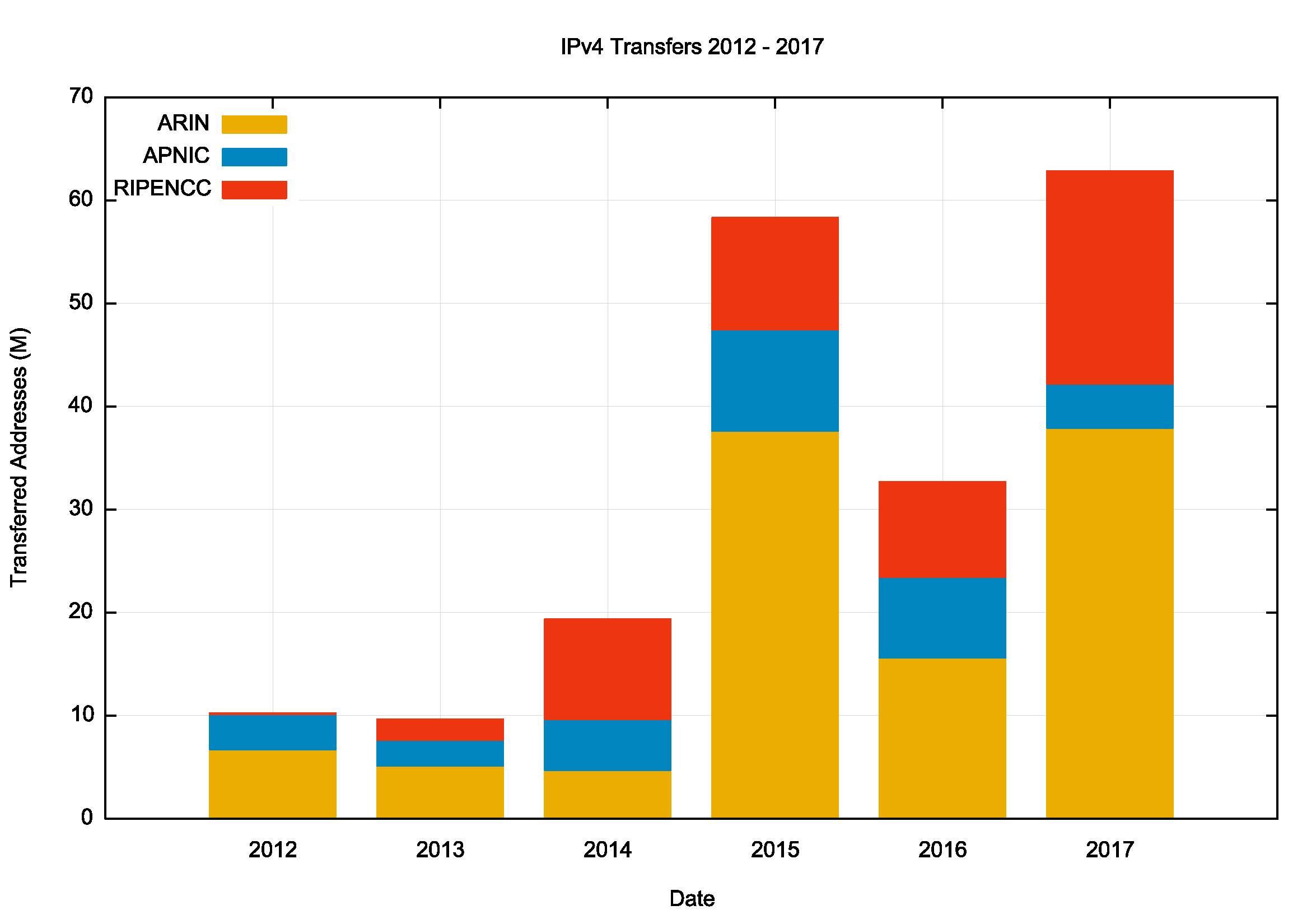

A slightly different view is that of the volume of addresses transferred per year (Table 5).

| Receiving RIR | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| ARIN | 6,728,448 | 5,136,640 | 4,737,280 | 37,637,888 | 15,613,952 | 37,942,528 |

| APNIC | 3,434,496 | 2,504,960 | 4,953,088 | 9,836,288 | 7,842,816 | 4,283,136 |

| RIPE NCC | 65,536,1,977,344 | 9,635,328 | 10,835,712 | 9,220,864 | 20,61\5 | 168 |

| Total | 10,228,480 | 9,618,944 | 19,325,696 | 58,309,888 | 32,677,632 | 62,840,832 |

A plot of these numbers is shown in Figures 3 and 4.

The total volume of addresses transferred in this way is four times the volume of allocated addresses across 2017. The aggregate total of addresses in the transfer logs is some 193 million addresses or the equivalent of 11.5 /8s.

This data raises some questions about the nature of transfers.

How effective have address transfers been advertising allocated IPv4 addresses?

The first question is whether address transfers have managed to be effective in dredging the pool of allocated but unadvertised public IPv4 addresses. It was thought that by being able to monetize these addresses, holders of such addresses may have been motivated to convert their networks to use private addresses and resell their holding of public addresses. The numbers appear to show that this has happened, although progress has been slow.

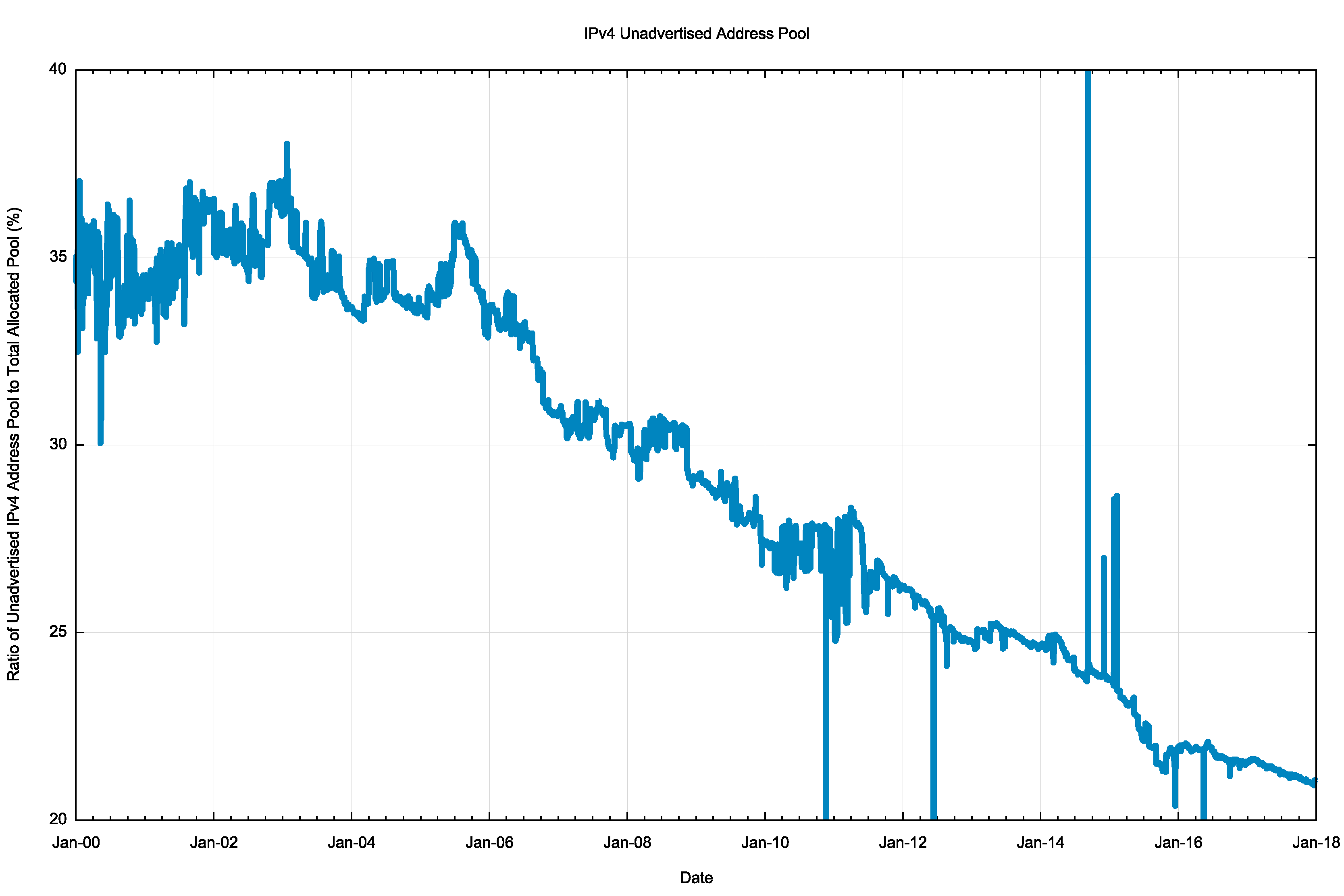

At the onset of IPv4 address exhaustion in early 2011, the unadvertised pool was at the equivalent of 54 /8s and it was down to 45 /8s at the end of 2017 (Figure 5). Some 150 million IPv4 addresses have been recirculated back into the advertised address space over this seven-year period. In relative terms, the pool dropped from 27% of the total allocated address pool to 21% in the same period (Figure 6).

This data appears to support the observation that address scarcity has managed to increase the efficiency of the IPv4 address pool, by bringing into the routed space addresses that were either previously idle or were used in private contexts.

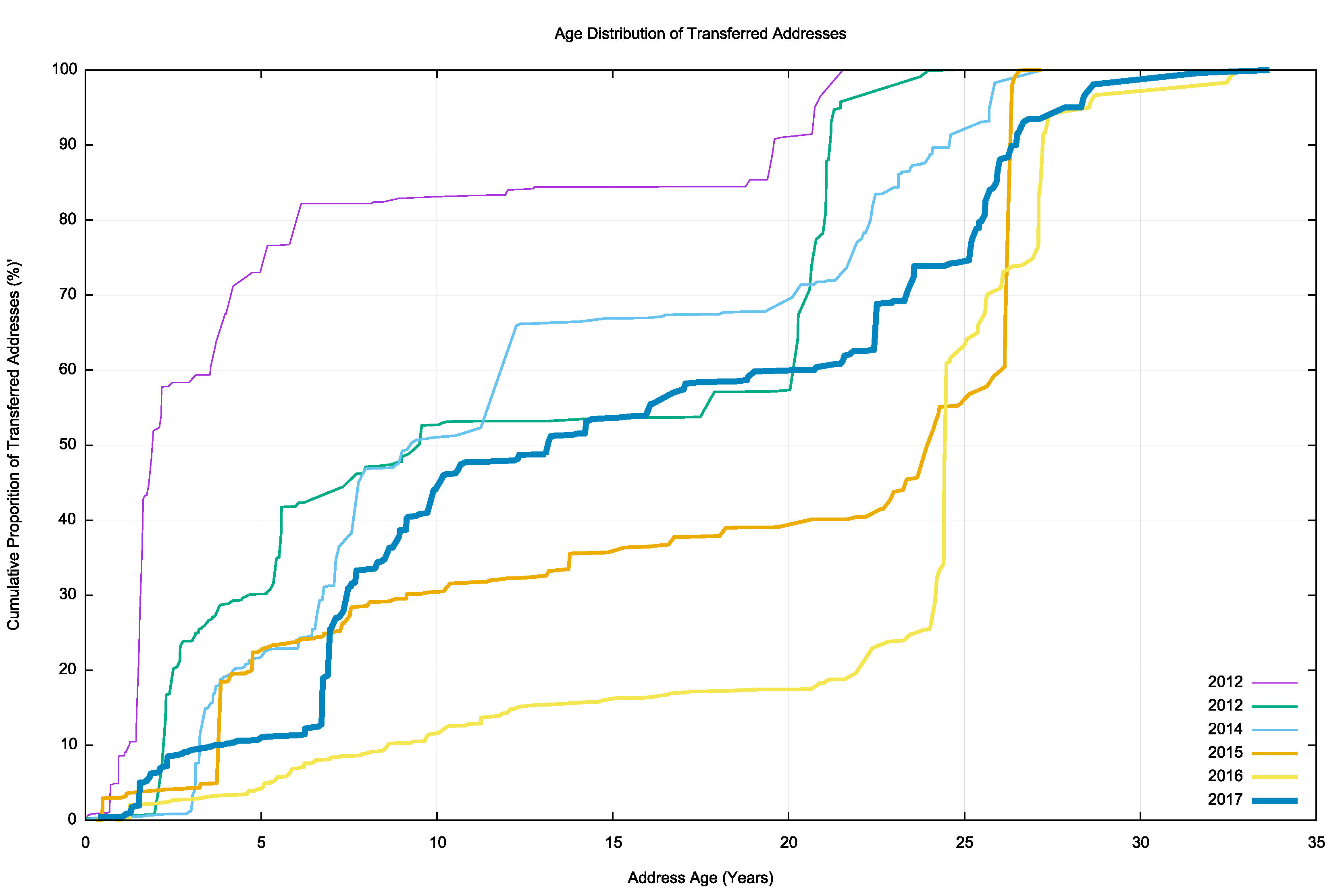

There is a slightly different aspect to this question, concerning whether the transferred addresses are predominately recently allocated addresses, where there may be the potential for arbitrage between the costs of receiving an address allocation from an RIR and the potential returns from selling these address holdings on the transfer market, and longer held addresses where the holder is wanting to realize otherwise unused assets. The basic question concerns the ‘age’ distribution of transferred addresses where the ‘age’ of an address reflects the period since it was first allocated or assigned by the RIR system.

The cumulative age distribution of transferred addresses is shown on a year-by-year basis in Figure 7.

In 2012, more than 80% of the transferred address blocks were originally assigned or allocated by an RIR within the previous 10 years. In 2016, this has dropped to around to 10% of transferred addresses, but in 2017, the trend reversed, and some 45% of all transferred addresses were less than 10 years old.

The high volumes of transfer activity associated with legacy addresses appear to have peaked in 2016, and the transfer activity has a slightly more even distribution across the age range.

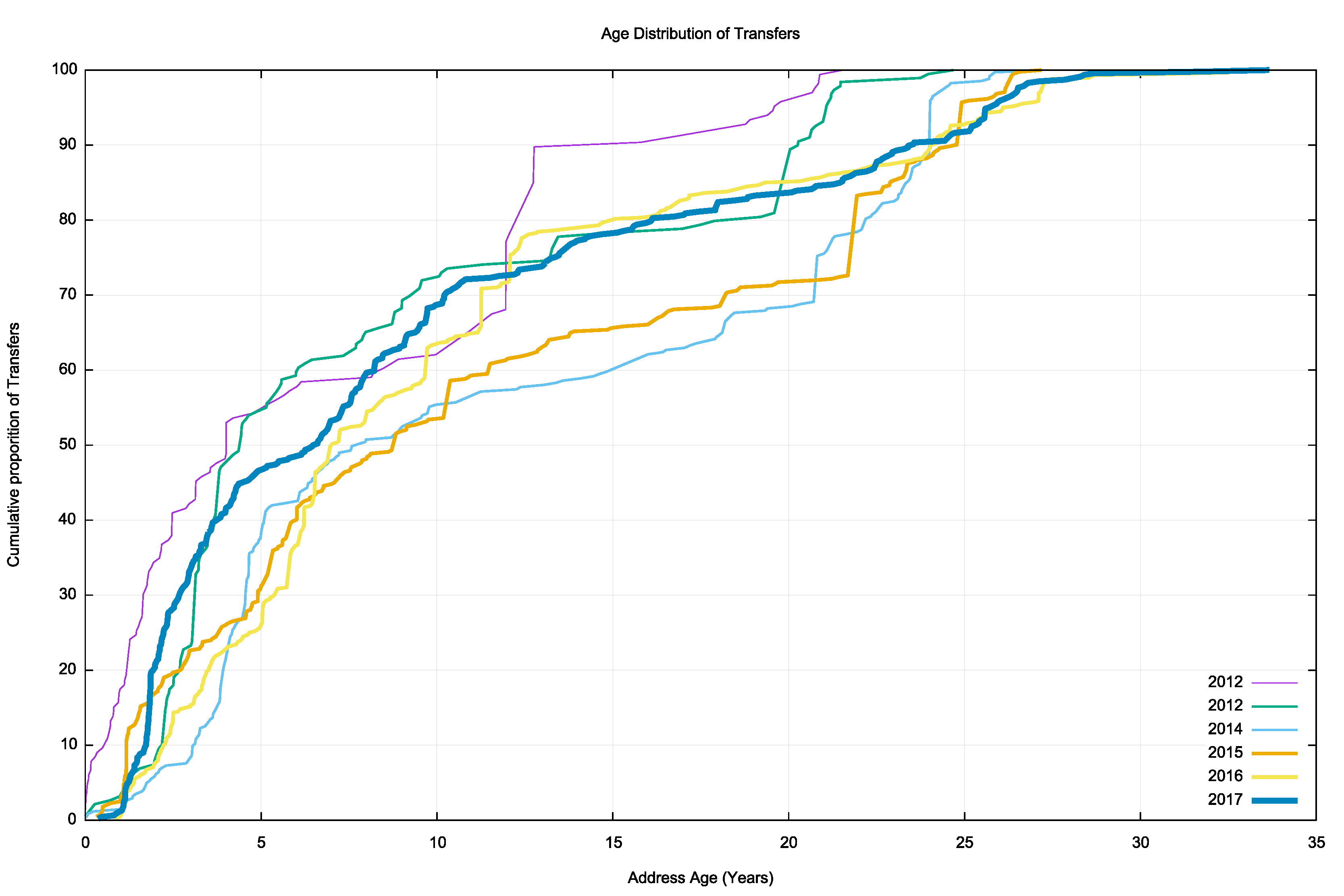

If we look at transfer transactions, irrespective of the size of each transfer, we get a slightly different picture (Figure 8). One-half of all transfer transactions deal with addresses that are no older than seven years, and this has been the case in each of the past six years. This data indicates that a large number of transaction activity deals with small address blocks that have been allocated relatively recently, while the legacy address blocks tend to be transferred as larger address blocks.

Is the transfer process further fragmenting the address space by splitting up larger address blocks into successively smaller address blocks?

The second question is whether the transfer process is further fragmenting the address space by splitting up larger address blocks into successively smaller address blocks.

There are 11,607 address blocks described in the transfer registries up to the end of 2017, and of these 4,558 entries list transferred address blocks that are the same size as the original allocated block. The remaining 7,049 entries are fragments of the originally allocated address blocks.

One-third of all original address blocks that are transferred (1,921 out of 6,278) are split into smaller fragments with multiple holders, and, on average, this results in approximately slightly less than four different holders of transferred address fragments.

This data implies that the answer to the second question is that address blocks are being fragmented as a result of address transfers, but in absolute terms, this is not a major issue. There are some 182,026 distinct address allocations from the RIRs to end entities, and the fragmentation of 1,921 of these address blocks is around 1% of the total pool of allocated address prefixes.

Where are addresses transferring from and to?

The third question concerns the inter-economy flow of transferred addresses. Let’s look at the top 10:

- economies that sourced the greatest volume of transferred addresses, irrespective of their destination (including ‘domestic’ transfers within the same economy) (Table 6)

- largest recipients of transfers (Table 7),

- largest economy-to-economy address transfers (Table 8).

In this case, we will use the published transfer data in all years up to the end of 2017.

| Rank | CC | Addresses | Economy Name |

| 1 | US | 110,978,304 | USA |

| 2 | CA | 19,074,048 | Canada |

| 3 | FR | 12,230,912 | France |

| 4 | RO | 7,321,856 | Romania |

| 5 | GB | 7,081,728 | UK |

| 6 | RU | 4,895,232 | Russia |

| 7 | JP | 3,455,744 | Japan |

| 8 | DE | 3,221,504 | Germany |

| 9 | CN | 3,122,432 | China |

| 10 | HK | 2,089,984 | Hong Kong |

| Rank | CC | Addresses | Economy Name |

| 1 | US | 113,937,408 | USA |

| 2 | FR | 13,216,000 | France |

| 3 | CN | 10,270,208 | China |

| 4 | IN | 6,789,632 | India |

| 5 | GB | 6,669,824 | UK |

| 6 | JP | 5,580,800 | Japan |

| 7 | IR | 4,161,792 | Iran |

| 8 | RU | 3,353,600 | Russia |

| 9 | SA | 2,930,176 | Saudi Arabia |

| 10 | DE | 2,899,896 | Germany |

| Rank | From-CC | To-CC | Addresses | From | To |

| 1 | US | US | 98,388,224 | USA | USA |

| 2 | CA | US | 14,513,408 | Canada | USA |

| 3 | FR | FR | 12,069,120 | France | France |

| 4 | GB | GB | 5,093,376 | UK | UK |

| 5 | US | IN | 4,158,976 | USA | India |

| 6 | JP | JP | 3,324,416 | Japan | Japan |

| 7 | RU | RU | 3,068,160 | Russia | Russia |

| 8 | CN | CN | 2,605,824 | China | China |

| 9 | CA | CN | 2,359,296 | Canada | China |

| 10 | US | CN | 2,245,632 | USA | China |

The transfer logs contain 7,436 domestic address transfers, with a total of 139,465,472 addresses, while 4,808 transfers appear to result in a movement of addresses between economies, involving a total of 54,947,072 addresses.

The total volume of addresses reassigned in this manner, some 194 million IPv4 addresses over eight years, is far less than the underlying pre-exhaustion address demand levels that peaked at some 250 million addresses in a single year.

It appears that the address supply hiatus has motivated most Internet service providers to use address sharing technologies, and, in particular, Carrier Grade NAT (CGN), on the access side and server pooling on the content side as a means of increasing the level of sharing of addresses. This has been accompanied by a universal shift of the architecture of the Internet to a client/server model, where clients are dynamically assigned IP addresses in order to communicate with servers (via NATs) and many servers use common IP addresses via name-sharing constructs. The result is that the pressure of the IP address space has been relieved to a considerable extent, and the sense of urgency to migrate to an all-IPv6 network has been largely, but not completely, mitigated in recent years.

Have transfers been recorded in the registry system?

The outstanding question about this transfer data is whether all address transfers that have occurred have been duly recorded in the registry system. This question is raised because registered transfers require conformance to various registry policies, and it may be the case that only a subset of transfers are being recorded in the registry as a result. This can be somewhat challenging to detect, particularly if such a transfer is expressed as a lease or other form of temporary arrangement, and if the parties agree to keep the details of the transfer confidential.

It might be possible to place an upper bound on the volume of address movements that have occurred in any period is to look at the Internet’s routing system. One way to shed some further light on what this upper bound on transfers might be is through a simple examination of the routing system, looking at addresses that were announced in 2017 by comparing the routing stable state at the start of the year with the table state at the end of the year (Table 9).

| Jan-17 | Jan-18 | Delta | Unchanged | Re-Homed | Removed | Added | ||

| Announcements | 646,059 | 698,680 | 52,621 | 557,812 | 17,366 | 70,881 | 123,502 | |

| Root Prefixes | 309,093 | 332,487 | 23,394 | 275,278 | 11,041 | 23,166 | 46,168 | |

| Address span (/8s) | 158.34 | 160.86 | 2.42 | 149.06 | 2.64 | 6.70 | 9.91 | |

| More Specifics | 336,966 | 366,193 | 29,227 | 282,534 | 6,325 | 47,716 | 77,334 | |

| Address Count (/8s) | 56.04 | 57.37 | 1.33 | 49.72 | 0.75 | 6.32 | 6.90 |

While the routing table grew by 52,621 entries over the year, the nature of the change is slightly more involved. Some 70,881 prefixes that were announced at the start of the year were removed from the routing system through the year, and 123,502 prefixes were announced by the end of the year that were not announced at the start of the year. (Without the scope of this study I have not tracked the progress of announcements through the year, and it is likely that more prefixes were announced and removed on a transient basis through the course of the year.) A further 17,366 prefixes had changed their originating Autonomous System number, indicating some form of change in the prefix’s network location in some manner (Table 9).

We can compare these changed prefixes against the transfer logs for the two-year period 2016 and 2017. Table 10 shows the comparison of these routing numbers against the set of transfers that were logged in these two years.

| Type | Registered Transfer | Unlisted | Ratio |

| Re-Homed | |||

| All | 1,123 | 16,243 | 6.9% |

| Root Prefixes | 891 | 9,745 | 9.1% |

| Removed | |||

| All | 2,746 | 68,135 | 4.0% |

| Root Prefixes | 1,655 | 21,510 | 8.5% |

| Added | |||

| All | 6,602 | 116,900 | 5.6% |

| Root Prefixes | 4,021 | 42,147 | 9.5% |

These figures show that some 4-10% of changes in advertised addresses are reflected as changes as recorded in the RIRs’ transfer logs. This should not imply that the remaining 90-96% of changes in advertised prefixes reflect unrecorded address transfers.

There are many reasons for changes in the advertisement of an address prefix and a change in the administrative controller of the address is only one potential cause. However, it does establish some notional upper ceiling on the number of movements of addresses in 2017, some of which relate to transfer of operational control of an address block, that have not been captured in the transfer logs.

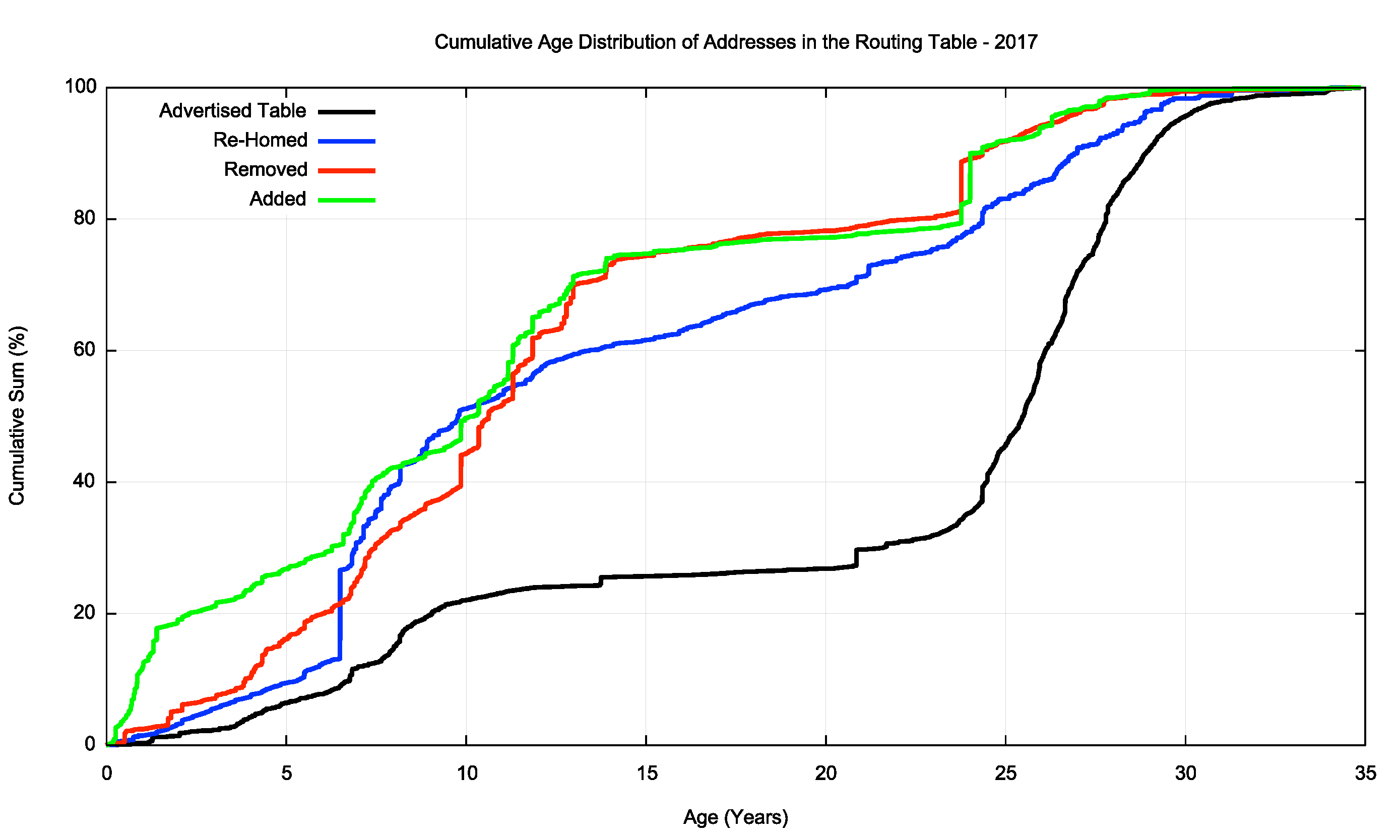

Finally, we can perform an age profile of the addresses that were Added, Removed and Re-Homed during 2017, and compare it to the overall age profile of IPv4 addresses in the routing table (Figure 9). In terms of addresses that were added in 2017, they differ from the average profile due to a skew in favour of ‘recent’ addresses, and 20% of all announced addresses were allocated or assigned in the past 18 months. In terms of addresses that were removed from the routing system, there is a disproportionate volume of removed addresses that are between 2 and 10 years old. 20% of removed addresses are more than 20 years old, where almost 70% of all advertised addresses are more than 20 years old. Addresses that Re-Home appear to be disproportionally represented in the age bracket of between 7 and 15 years old.

Figure 9 – Change in the size of the BGP routing table across 2017

However, as IPv4 moves into its final stages we are perhaps now in a position to take stock of the overall distribution of IPv4 addresses and look at where the addresses landed up. Table 11 shows the ten economies that have the largest pools of allocated IPv4 addresses.

| Rank | CC | IPv4 Pool | % of Total | Per-Capita | CC Name |

| 1 | US | 9,613,129,216 | 37.56% | 4.972 | USA |

| 2 | CN | 339,378,176 | 7.9% | 0.241 | China |

| 3 | JP | 203,720,192 | 4.74% | 1.598 | Japan |

| 4 | GB | 123,396,376 | 2.87% | 1.865 | UK |

| 5 | DE | 121,341,312 | 2.83% | 1.478 | Germany |

| 6 | KR | 112,435,456 | 2.62% | 2.205 | Korea |

| 7 | BR | 84,118,528 | 1.96% | 0.402 | Brazil |

| 8 | FR | 81,492,528 | 1.90% | 1.254 | France |

| 9 | CA | 70,089,216 | 1.63% | 1.914 | Canada |

| 10 | IT | 54,182,464 | 1.26% | 0.913 | Italy |

Slightly more than one-third of all IPv4 addresses are allocated to entities that are registered as US entities. If we divide this address pool by the current population of each national entity, then we can derive an address per capita index.

For the curious, the value of just under five addresses per capita for the United States is not quite the highest value, as the numbers for the Seychelles and the Holy See are far higher! But they are so high by virtue of their relatively small population rather than vast address holdings.

The global total of 3.7 billion allocated addresses with an estimated global population of 7.5 billion people gives an overall value of 0.49 IPv4 addresses per capita. It appears that early adopter communities tend to have high than average per capita values, while later adopters tend to fall below the global average. The full table of IPv4 allocations per national economy can be found at here.

IPv6 in 2017

Obviously, IPv4 address allocations only form half of the story, and to complete the picture it’s necessary to look at how IPv6 has fared over 2017.

IPv6 uses a somewhat different address allocation methodology than IPv4, and it is a matter of choice for a service provider as to how large an IPv6 address prefix is assigned to each customer. The original recommendations published by the IAB and IESG in 2001, documented in RFC3177, envisaged the general use of a /48 as an end site prefix. Subsequent consideration of long-term address conservation saw a more flexible approach being taken with the choice of the end site prefix size being left to the service provider.

Today’s IPv6 environment has some providers using a /60 end site allocation unit, many use a /56, and other providers use a /48. This variation makes a comparison of the count of allocated IPv6 addresses somewhat misleading, as an ISP using /48’s for end sites will require 256 times more address space to accommodate a similarly sized same customer base as a provider who uses a /56 end site prefix, and 4,096 times more address space than an ISP using a /60 end site allocation!

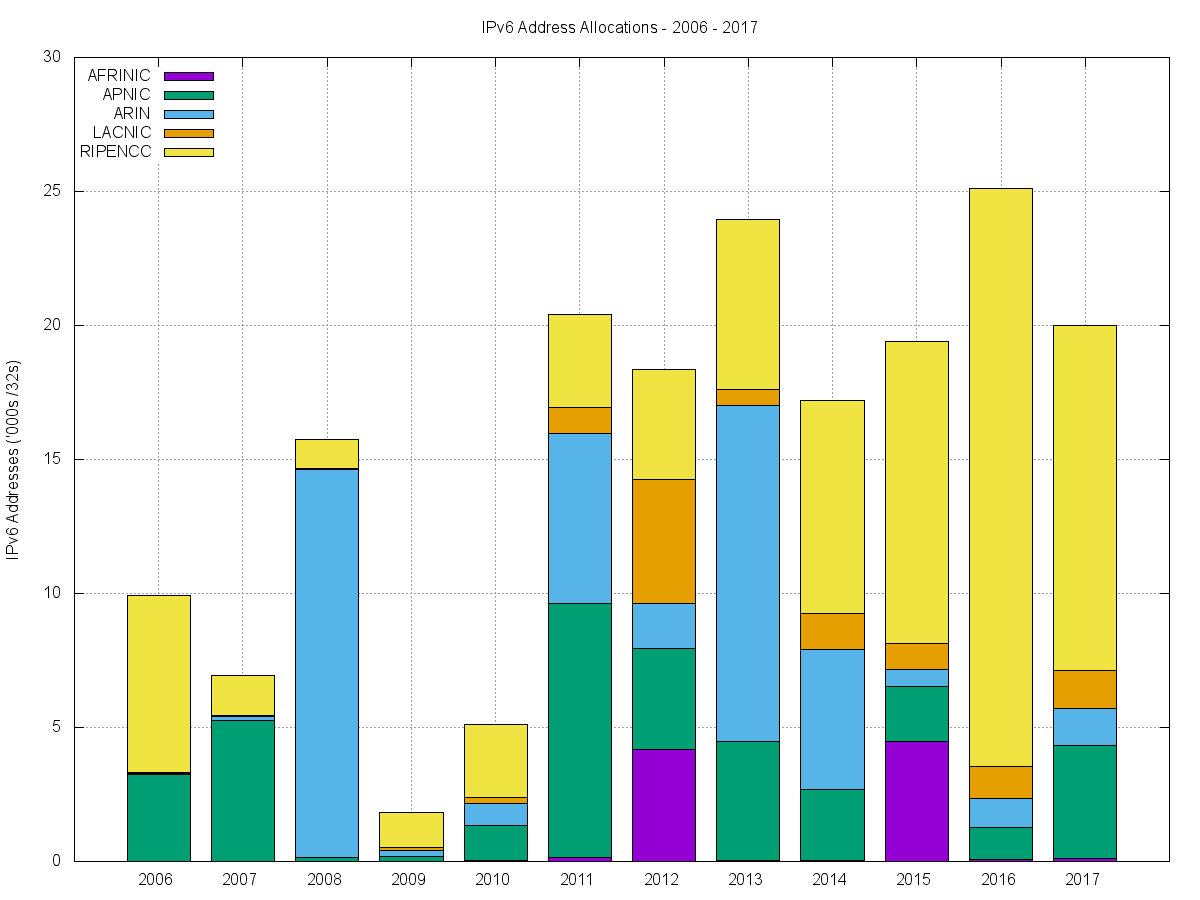

For IPv6, let’s use both the number of discrete IPv6 allocations and the total amount of space that was allocated to see how IPv6 fared in 2017.

Comparing 2016 to 2017, the number of individual allocations of IPv6 address space has held steady, as is also the case with IPv4 (Table 12).

| Allocations | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| IPv6 | 473 | 841 | 1,243 | 2,477 | 3,700 | 3,403 | 3,840 | 4,407 | 4,733 | 5,594 | 5,765 |

| IPv4 | 6,312 | 6,969 | 6,701 | 7,758 | 10,061 | 8,619 | 7,110 | 10,853 | 11,732 | 9,787 | 9,440 |

The amount of IPv6 address space distributed in 2016 rose by around 25% compared to 2015, but in 2017 the total volume of allocated addresses fell by the same amount, back to the same total volume of addresses as in 2015. The number of allocations increased, however, indicating that in 2017 there were no anomalous extremely large allocations of IPv6 address space (Table 13).

| Addresses | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| IPv6 (/32s) | 6,916 | 15,634 | 1,555 | 4,754 | 20,009 | 18,136 | 23,935 | 17,513 | 20,225 | 25,301 | 19,986 |

| IPv4 (/32s)(M) | 203.9 | 203.3 | 189.4 | 248.8 | 201.0 | 114.9 | 65.1 | 63.9 | 34.8 | 22.2 | 51.9 |

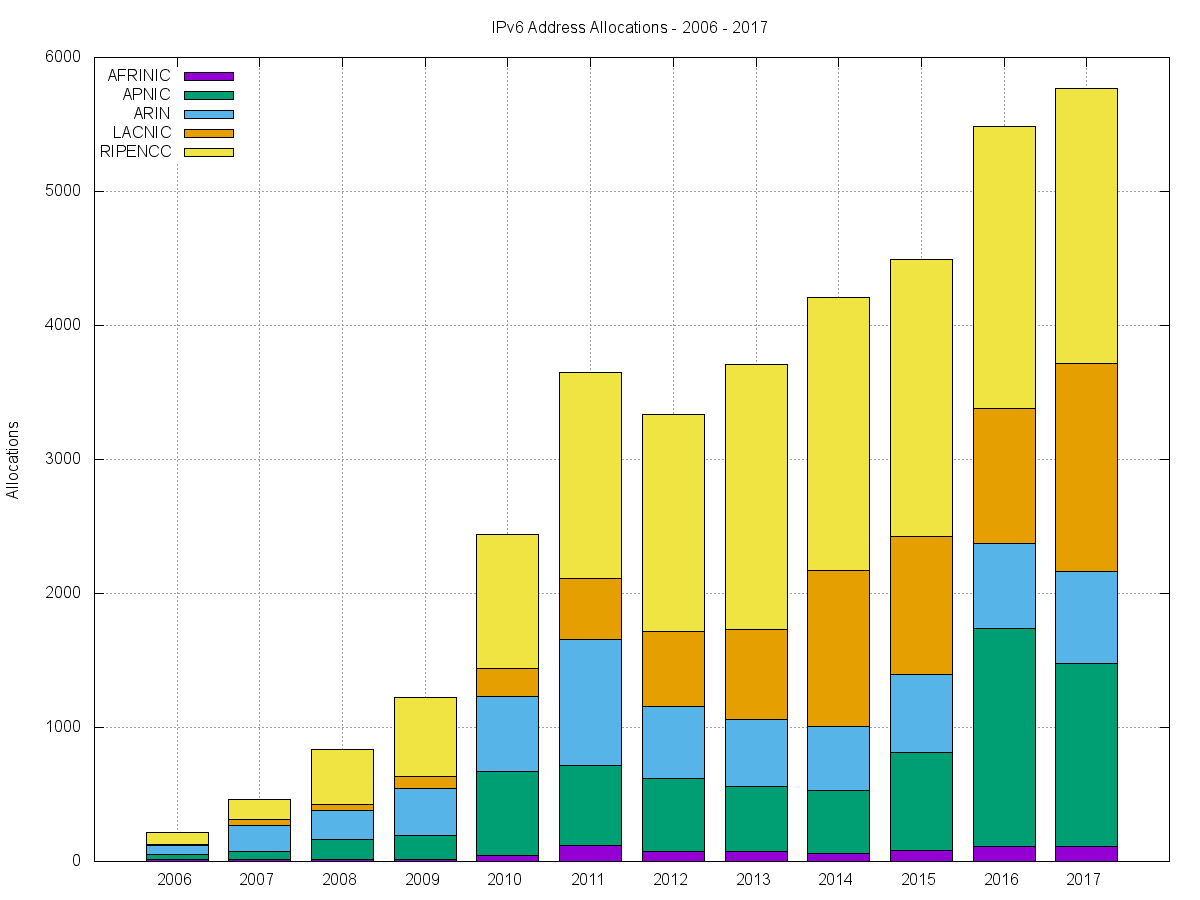

Regionally, each of the RIRs saw IPv6 allocation activity in 2017 that was on a par with those seen in the previous year, with the exception of LACNIC, which saw a 50% increase in allocations and APNIC, which saw a 20% decline in allocations (Table 14).

| Allocations | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| RIPE NCC | 150 | 413 | 595 | 1,012 | 1,565 | 1,661 | 2,057 | 2,143 | 2,206 | 2,141 | 2,051 |

| ARIN | 196 | 213 | 357 | 567 | 959 | 545 | 523 | 505 | 602 | 646 | 684 |

| APNIC | 61 | 158 | 185 | 637 | 610 | 561 | 505 | 503 | 778 | 1,681 | 1,369 |

| LACNIC | 38 | 43 | 93 | 212 | 447 | 560 | 683 | 1,196 | 1,061 | 1,010 | 1,549 |

| AFRINIC | 18 | 14 | 13 | 49 | 119 | 76 | 72 | 60 | 86 | 116 | 112 |

| Total | 473 | 841 | 1,243 | 2,477 | 3,700 | 3,403 | 3,840 | 4,407 | 4,733 | 5,594 | 5,765 |

The address assignment data tells a slightly different story. Table 15 shows the number of allocated IPv6 /32’s per year. It appears that 2016 was an anomalous year for the RIPE NCC, in that the allocation totals for 2015 and 2017 are roughly the same. APNIC allocated a larger total in 2017, thanks to three large allocations: a /24 into Japan, a /22 into India and a /21 into China.

| IPv6 Addresses (/32s) | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| RIPE NCC | 1,468 | 964 | 1,052 | 2,406 | 3,174 | 3,892 | 6,286 | 8,217 | 12,031 | 21,707 | 12,844 |

| ARIN | 148 | 14,486 | 236 | 780 | 6,344 | 1,660 | 12,558 | 5,241 | 641 | 1,088 | 1,372 |

| APNIC | 5,236 | 139 | 170 | 1,335 | 9,486 | 3,783 | 4,442 | 2,644 | 2,109 | 1,236 | 4,228 |

| LACNIC | 51 | 35 | 87 | 197 | 948 | 4,605 | 597 | 1,359 | 974 | 1,182 | 1,429 |

| AFRINIC | 13 | 10 | 9 | 36 | 147 | 4,196 | 51 | 51 | 4,471 | 78 | 113 |

| Total | 6,916 | 5,634 | 1,555 | 4,754 | 20,099 | 8,136 | 23,935 | 17,513 | 20,225 | 25,301 | 19,986 |

Dividing addresses by allocations gives the average IPv6 allocation size in each region (Table 16). APNIC average allocations increase in size due to the large allocations already noted. Overall, the average IPv6 allocation size remains a /30.

| Avg IPv6 Allocation | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| RIPE NCC | /28.7 | /30.8 | /31.2 | /30.8 | /31.0 | /30.8 | /30.4 | /30.1 | /29.6 | /28.7 | /29.4 |

| ARIN | /32.4 | /25.9 | /32.6 | /31.5 | /29.3 | /30.4 | /27.4 | /28.6 | /31.9 | /31.2 | /31.0 |

| APNIC | /25.6 | /32.2 | /32.1 | /30.9 | /28.0 | /29.2 | /28.9 | /29.6 | /30.6 | /32.4 | /30.4 |

| LACNIC | /31.6 | /32.3 | /32.1 | /32.1 | /30.9 | /29.0 | /32.2 | /31.8 | /32.1 | /31.8 | /32.1 |

| AFRINIC | /32.5 | /32.5 | /32.5 | /32.4 | /31.7 | /26.2 | /32.5 | /32.2 | /26.3 | /32.6 | /32.0 |

| All | /28.1 | /27.8 | /31.7 | /31.1 | /29.6 | /29.6 | /29.4 | /30.0 | /29.9 | /29.8 | /30.2 |

The number and volume of IPv6 allocations per RIR per year are shown in Figures 10 and 11.

Table 17 shows the economies who received the largest number of IPv6 allocations, while Table 18 shows the amount of IPv6 address space assigned on a per economy basis for the past five years (using units of /32s).

| Rank | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||||||

| 1 | USA | 549 | USA | 485 | Brazil | 946 | Brazil | 815 | Brazil | 744 | Brazil | 1,114 |

| 2 | UK | 199 | Brazil | 473 | USA | 457 | USA | 540 | USA | 603 | USA | 634 |

| 3 | Germany | 187 | UK | 248 | UK | 239 | China | 267 | China | 509 | Germany | 270 |

| 4 | Russia | 186 | Russia | 246 | Germany | 215 | Germany | 249 | Germany | 266 | Russia | 220 |

| 5 | Netherlands | 124 | Germany | 195 | Russia | 201 | UK | 216 | Australia | 219 | Australia | 211 |

| 6 | Australia | 113 | Netherlands | 134 | Netherlands | 181 | Russia | 183 | UK | 211 | China | 208 |

| 7 | France | 111 | France | 132 | France | 122 | Netherlands | 170 | Netherlands | 198 | Netherlands | 194 |

| 8 | Sweden | 90 | Sweden | 112 | Switzerland | 103 | Australia | 123 | Russia | 173 | UK | 190 |

| 9 | Argentina | 78 | Australia | 102 | Italy | 103 | Spain | 119 | India | 161 | Indonesia | 187 |

| 10 | Poland | 77 | Italy | 98 | Australia | 101 | France | 116 | Indonesia | 159 | Argentina | 178 |

| Rank | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||||||

| 1 | Argentina | 4,177 | USA | 12,537 | USA | 4,930 | South Africa | 4,440 | UK | 9,571 | China | 2,245 |

| 2 | Egypt | 4,098 | China | 4,135 | China | 2,127 | China | 1,797 | Germany | 1,525 | USA | 1,498 |

| 3 | China | 3,136 | UK | 782 | UK | 1,090 | UK | 1,297 | Netherlands | 1,312 | Germany | 1,364 |

| 4 | USA | 1,337 | Germany | 651 | Brazil | 863 | Germany | 1,269 | USA | 1,137 | Russia | 1,358 |

| 5 | Italy | 635 | Russia | 523 | Germany | 749 | Netherlands | 1,010 | Russia | 1,005 | Netherlands | 1,296 |

| 6 | Russia | 403 | Netherlands | 463 | Netherlands | 719 | Russia | 864 | France | 926 | Spain | 1,170 |

| 7 | Germany | 399 | Brazil | 450 | Russia | 716 | Brazil | 755 | Brazil | 727 | India | 1,087 |

| 8 | UK | 356 | France | 435 | France | 436 | Spain | 708 | Spain | 702 | UK | 1,072 |

| 9 | Canada | 323 | Italy | 339 | Italy | 410 | Italy | 707 | Italy | 679 | Brazil | 1,049 |

| 10 | Brazil | 294 | Switzerland | 265 | Switzerland | 369 | USA | 662 | China | 596 | France | 714 |

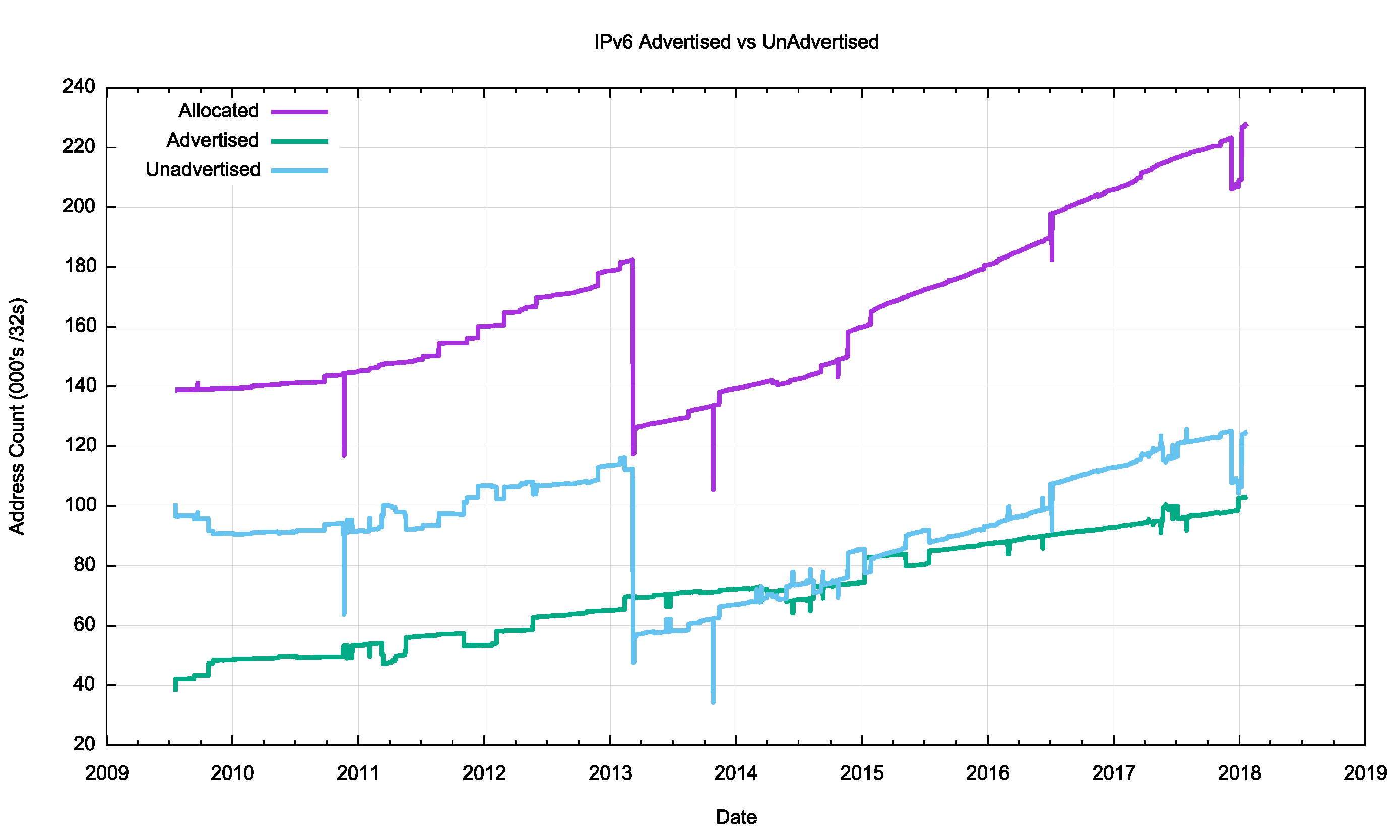

Three of the economies in Table 17 are listed as having received the highest volumes of allocated addresses in 2016, namely China, Russia and Spain have IPv6 deployments that are under 5% of their total user population. To what extent are allocated IPv6 addresses visible as advertised prefixes in the Internet’s routing table?

Figure 12 shows the overall counts of advertised, unadvertised and total allocated address volume for IPv6 since mid-2009. Aside from the obvious discontinuity in early 2013, when a registration of a single /18 national address allocation for the Brazil National Registry of a /18 was replaced by the actual end-user allocations, it’s clear that the pool of unadvertised IPv6 addresses appears to be growing at a faster rate than the pool of advertised addresses in IPv6.

Figure 12 – Allocated, unadvertised and advertised IPv6 addresses

Where is this ending up? We can take a comparable look at the allocated address pools for the top ten economies in IPv6, and the current picture is shown in Table 19.

| Rank | CC | Allocated /48s | % of Allocated /48 | Per capita | National IPv6 use | Economy |

| 1 | US | 2,920,401,219 | 10% | 9.0 | 38% | USA |

| 2 | CN | 1,400,111,130 | 5% | 1.0 | 0% | China |

| 3 | GB | 1,179,713,714 | 4% | 17.8 | 26% | UK |

| 4 | DE | 1,144,717,750 | 4% | 13.9 | 43% | Germany |

| 5 | FR | 793,182,300 | 3% | 12.2 | 21% | France |

| 6 | JP | 636,231,848 | 2% | 5.0 | 24% | Japan |

| 7 | AU | 587,006,962 | 2% | 24.0 | 15% | Australia |

| 8 | IT | 497,942,546 | 2% | 8.4 | 2% | Italy |

| 9 | NL | 402,194,722 | 1% | 23.6 | 12% | Netherlands |

| 10 | SE | 391,774,513 | 1% | 39.5 | 5% | Sweden |

While the United States also tops this list in terms of the total pool of allocated IPv6 addresses, the per capita number is lower than many others on this list. Sweden has a surprisingly high number yet estimates of the population of IPv6-capable users in that economy point to a deployment rate of just 5%, considerably lower than many other economies listed here. But for IPv6 its still relatively early days and no doubt the picture will change as the deployment of IPv6 matures.

The outlook for the Internet

Once more the set of uncertainties that surround the immediate future of the Internet are considerably greater than the set of predictions that we can be reasonably certain about.

There has been much in the way of progress in the transition to IPv6 in 2017, but that does not necessarily mean that other providers will quickly follow this lead.

While a number of service operators have reached the decision point that the anticipated future costs of NAT deployment are unsustainable for their service platform, there remains a considerable school of thought that says that NATs will cost-effectively absorb some further years of Internet device population growth.

At least that’s the only rationale I can ascribe to a very large number of service providers who are making no visible moves to push out dual-stack services at this point in time. Given that the objective of this transition is not to turn on dual-stack everywhere, but to turn off IPv4, there is still some time to go, and the uncertainty lies in trying to quantify what that time might be.

The period of the past few years has been dominated by the mass marketing of mobile Internet services, and the growth rates for 2014 through to 2016 perhaps might have been the highest so far recorded were it not for the exhaustion of the IPv4 address pool. In address terms, this growth in the IPv4 Internet is being almost completely masked by the use of CGNs in the mobile service provider environment, so that the resultant demands for public addresses in IPv4 are quite low and the real underlying growth rates in the network are occluded by these NATs.

In theory, there is no strict requirement for IPv6 to use NATs, and if the mobile world were deploying dual-stack ubiquitously then this would be evident in the IPv6 address allocation data. And we see this in India, where the rollout of the Jio mobile service through 2016 and into 2017 has now encompassed some 90% of their considerable user population. On the other hand, the other massive user population, that of China, still shows no visible signs of deploying IPv6 as yet.

We should also be seeing IPv6 address demands for deployments of large-scale sensor networks and other forms of deployments that are encompassed under the broad umbrella of the Internet of Things. This does not necessarily imply that the deployment is merely a product of an over-hyped industry, although that is always a possibility. It is more likely to assume that such deployments take place using private IPv4 (or IPv6 ULA addresses) addresses, and once more rely on NATs or application level gateways to interface to the public network.

Time and time again we are lectured that NATs are not a good security device, but, in practice, NATs offer a reasonable front-line defence against network scanning malware, so there may be a larger story behind the use of NATs and device-based networks than just a simple conservative preference to continue to use an IPv4 protocol stack.

We are witnessing an industry that is no longer using technical innovation, openness and diversification as its primary means of propulsion. The widespread use of NATs in IPv4 limit the technical substrate of the Internet to a very restricted model of simple client/server interactions using TCP and UDP. The use of NATs force the interactions into client-initiated transactions, and the model of an open network with considerable flexibility in the way in which communications take place is no longer being sustained in today’s network. Incumbents are entrenching their position and innovation and entrepreneurialism are taking a back seat while we sit out this protracted IPv4/IPv6 transition.

What is happening is that today’s Internet carriage service is provided by a smaller number of very large players, each of whom appears to be assuming a very strong position within their respective markets. The drivers for such larger players tend towards risk aversion, conservatism and increased levels of control across their scope of operation. The same trends of market aggregation are now appearing in content provision, where a small number of content providers are exerting a completely dominant position across the entire Internet.

The evolving makeup of the Internet industry has quite profound implications in terms of network neutrality, the separation of functions of carriage and service provision, investment profiles and expectations of risk and returns on infrastructure investments, and on the openness of the Internet itself. The focus now is turning to the regulatory agenda.

Given the economies of volume in this industry, it was always going to be challenging to sustain an efficient, fully open and competitive industry, but the degree of challenge in this agenda is multiplied many-fold when the underlying platform has run out of the basic currency of IP addresses. The pressures on the larger players within these markets to leverage their incumbency into overarching control gains traction when the stream of new entrants with competitive offerings dries up, and the solutions in such scenarios typically involve some form of public sector intervention directed to restore effective competition and revive the impetus for more efficient and effective offerings in the market.

As the Internet continues to evolve, it is no longer the technically innovative challenger pitted against venerable incumbents in the forms of the traditional industries of telephony, print newspapers, television entertainment and social interaction. The Internet is now the established norm. The days when the Internet was touted as a poster child of disruption in a deregulated space are long since over, and these days we appear to be increasingly looking further afield for a regulatory and governance framework that can continue to challenge the increasing complacency of the newly-established incumbents.

It is unclear how successful we will be in this search. We can but wait and see.

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.

I think access technology has had a big impact for consumers not caring that they are behind NAT. For most people they have never had upload speeds high enough to perform any sort of useful server or p2p functions.