The Internet’s Domain Name System (DNS) undertakes a vitally important role in today’s Internet. Originally conceived as a human-friendly way of specifying the location of the other end of an Internet transaction, it became the name of a service point during the transition to a client/server architecture. A domain name was still associated with an IP address, but that 1:1 association was weakened when we started adjusting to IPv4 address exhaustion. The address space is now highly fragmented while the namespace provides the essential common referential framework that defines the Internet itself.

The question here is — is the DNS centralized?

The reason why this is a vitally important question lies in aspects of DNS history.

The early days of the DNS started with a naming system that had a small collection of top-level domains, namely .com, .net, .org, .gov, .edu and.mil. The first wave of expansion of this naming system was through the adoption of the two-letter country codes as Top-Level Domains (TLDs). The Internet Assigned Numbers Authority (IANA), which at the time was synonymous with Jon Postel, would delegate the country code to an entity from the economy in question who applied. If all this sounds a little informal, then you need to bear in mind that we were still telling ourselves that the Internet was just an experiment and sooner or later some adults would come along and replace all these ad hoc arrangements with adult stuff.

But the adults never came, and the Internet continued to gather momentum, and this momentum created more work for the folk running the common infrastructure, including the names registry. While diversifying across other economies alleviated some of the pressure on the name registry, other problems were created. The US Department of Defense was unwilling to continue to fund Internet infrastructure support, and the role was passed over to other US federal agencies. The National Science Foundation (NSF) created the Internet Network Information Center, known as InterNIC, to extend and coordinate directory and database services and information services and provide registration services for non-military Internet participants. NSF awarded the contract to manage InterNIC to three organizations and Network Solutions provided domain name registration services.

The services quickly scaled beyond the NSF funding levels and Network Solutions sought clearance from the NSF to charge a fee for the service, which was levied (as I recall) to USD 75 per name per year. This was intended to create a fund to support the operation of common infrastructure services, but it was established that this represented a form of unofficial taxation that was not permissible. The resolution of this was to allow Network Solutions to retain the revenue from these name registration fees. This windfall revenue was not without its aspects of controversy and much effort was put into diluting the de facto monopoly of the .com, .net and .org name registration service.

The chosen approach was to create competition in the space. Firstly, by creating new generic Top-Level Domains (gTLDs) to open up choices for name applicants, and secondly, by breaking up the name management infrastructure by allowing multiple registrars to act on behalf of end customers and place names into TLD registries.

The intent was largely a statement of faith in basic economic theory that effective competition in a commodity market cures many ills! And when competition fails, including the emergence of scenarios of consolidation and centrality, then we all have a problem.

For this reason, the question of centrality in the DNS remains a critical question.

Now, there are many ways to answer such a question, and here I would like to look at one particular aspect of the DNS, namely the operation of the resolution of DNS names. So, is the resolution of names in the DNS centralized?

This might seem an odd question, in that by design the DNS is a highly decentralized database that has distributed its contents over much of the Internet already. The DNS information model includes the replication of information (in the form of secondary authoritative services) that are intended to address resiliency and scalability issues by removing critical single points of vulnerability within the distributed information structure. The DNS query protocol also allows various forms of query fallback to increase the robustness of name resolution. And finally, recursive name resolvers include caching to maintain a store of cached information close to the client edge. All of this sounds like a highly diverse distributed model of information management that would appear to resist any form of consolidation or centralization.

But is this really the case?

Let’s look at what we can measure in DNS resolution to try and provide some data to answer this question.

Market centrality metrics

Firstly, let’s look for metrics that can be used to describe market centrality and the related topic of market dominance.

- The Australian Consumer and Competition Commission (ACCC) uses a metric of a single entity holding more than 70% of a market as an indicator of market dominance (and is used as a threshold for intervention by the ACCC where it believes that abuse of market power is taking place). In the UK, the legal definition of a monopoly is a firm with more than 25% market share.

- A slightly different metric is the four-firm concentration ratio, where the metric is the combined market share of the four largest suppliers in the market. It could easily be three or five, but the behaviour identified is an incumbent clique. If this measure rises above 50%, then there is some justification for concern about market distortion.

- The Herfindahl-Hirschman Index (HHI) is used in market analysis to indicate the level of competition between market entities. It is the average market share of the market, weighted by market share, and is the sum of the square of the market share (expressed as a percentage) of the top 50 entities. An HHI value above 25% is often taken as an indicator of market skew, and a value above 10% would be considered as a market showing ‘moderate concentration’.

An example of market concentration indicators

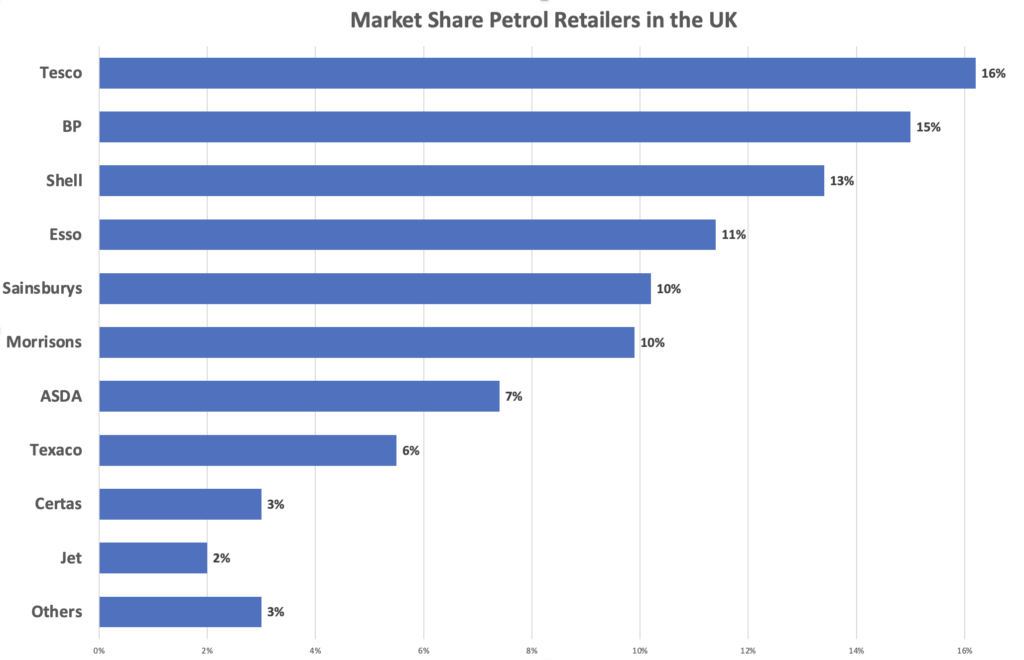

Let’s have a look at an example market and apply these metrics. In this case, I’ll use the retail market share for petrol in the UK. The market share of the 10 largest retailers is shown in Figure 1.

No single retailer dominates the UK market according to these figures, either using the UK threshold of 25% or the Australian threshold of 70%.

The third, fourth and fifth’s firm concentration numbers are 45%, 56% and 66% respectively. This would point to some grounds for concern, but the market does not appear to be overly centralized by this metric.

The HHI index is 11%, which would indicate the onset of concentration, which is not inconsistent with the market concentration values.

The DNS resolution market

I’d like to move on to a very specific part of the DNS environment and ask the question about centrality as it specifically relates to the resolution of DNS names. There are a number of related questions concerning the registry market, although the 1:1 association of registries and Top-Level Domain (TLD) names tends to equate the market share of a TLD name registry to the relative popularity of the TLD as a namespace. Similarly, there is the question of centrality in the market for name registrars, but here the centrality issues are somewhat less obvious. Holding the registration of a million obscure names that are never used is challenging to compare with a registrar that holds the records of a very small set of highly popular names.

With these caveats in mind, let’s look at DNS resolution as a market and use these measurements to assess the degree of concentration in the supply of DNS name resolution services.

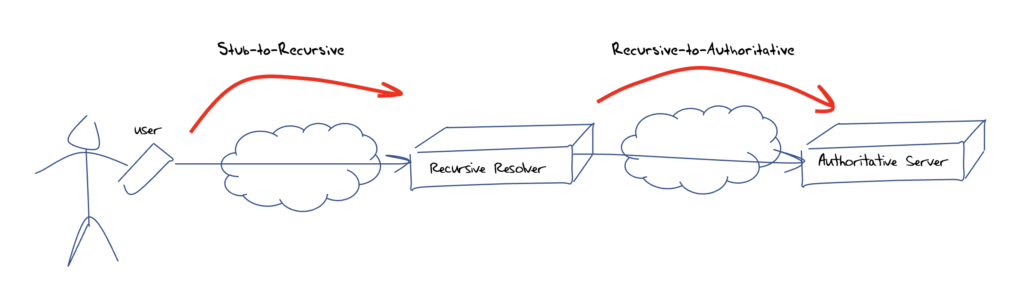

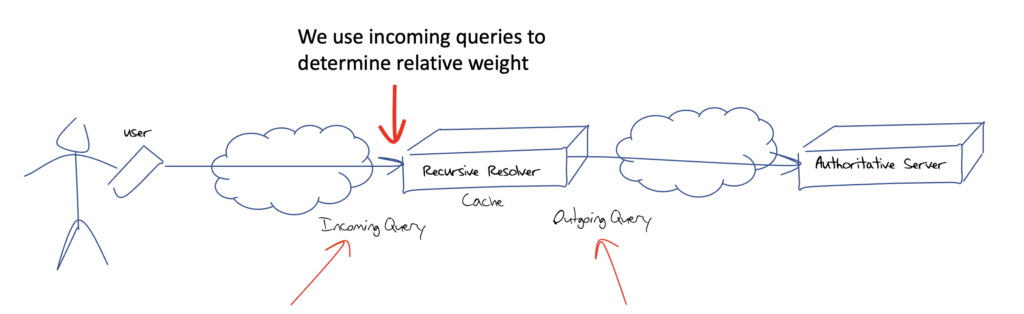

Firstly, we need to look at the nature of name resolution. When a user’s application wishes to resolve a DNS name, the local DNS agent (the stub resolver) will pass the query to a preconfigured recursive resolver. The recursive resolver will then perform a series of queries to various authoritative servers to discover the appropriate server that is authoritative for the DNS name that is being resolved, followed by the actual query for the domain name. When it has assembled the DNS response, it will pass it back to the stub resolver. So, in general, there are two distinct steps in DNS name resolution, ‘stub-to-recursive’ and ‘recursive-to-authoritative’ (Figure 2).

How should we look at the market share (and potential market concentration) of these two steps in DNS name resolution?

For the stub-to-recursive analysis, it’s not the name itself that matters, as recursive resolvers are meant to provide resolution for all names. So, we need to look at a metric of use or dependency. This could be the query counts being presented to each recursive resolver, or even the number of distinct users (or distinct stub resolvers) that use the services of each recursive resolver.

This metric of user population does not apply to authoritative servers, as, in theory, every authoritative server could be queried by any recursive resolver on behalf of any user. Perhaps a query count per authoritative server would make more sense, in that a highly popular name would be equivalent in many ways to a large count of seldomly used names. If we are looking at the market concentration of authoritative server providers the names themselves are not as important as the server operator, so we probably need a way to associate an authoritative server with a provider and look at the query counts for each provider.

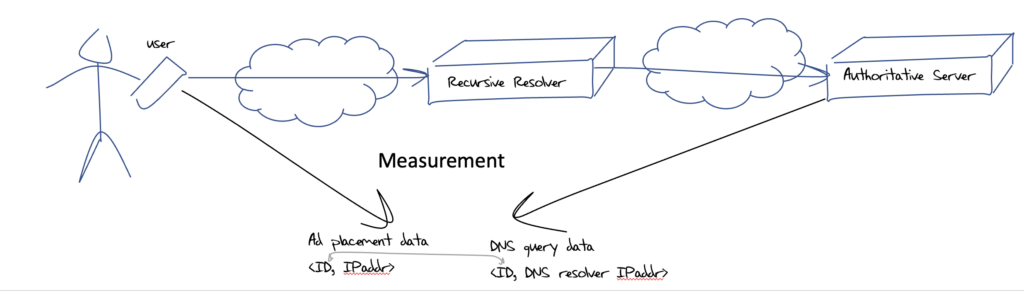

A. Concentration in the recursive resolver market

For this part of the study, we would like to understand the distribution of users per recursive resolver. This is, of course, a challenging question and the approach we’ve used to answer this question is to use a sampling technique. At APNIC Labs we’ve used online ads to distribute a measurement script to millions of distinct users per day. Each invocation of the script generates a unique DNS name to resolve, and the name is uniquely served by our nameservers. By looking at the logs from the authoritative server we can associate a recursive resolver with each user that ran the test and aggregate the data to generate the relative user population served by each recursive resolver (Figure 3).

We need to map the resolver ‘helper’ addresses seen by our authoritative server to a resolver service, and to do this we need to map the various back-end DNS addresses to the front-side recursive resolver service. RIPE Atlas helped here for those cases where the open resolver operator does not publish this information.

We then map resolvers into a number of categories based on the resolver’s IP address. The categories we use are:

- The resolver is in the same Autonomous System (AS) as the end user (ISP’s recursive resolver) (sameas).

- It’s a known Open DNS resolver.

- The resolver address is geo-located to the same CC as the end user (samecc).

- The resolver address is geo-located to a different CC from the end user (diffcc).

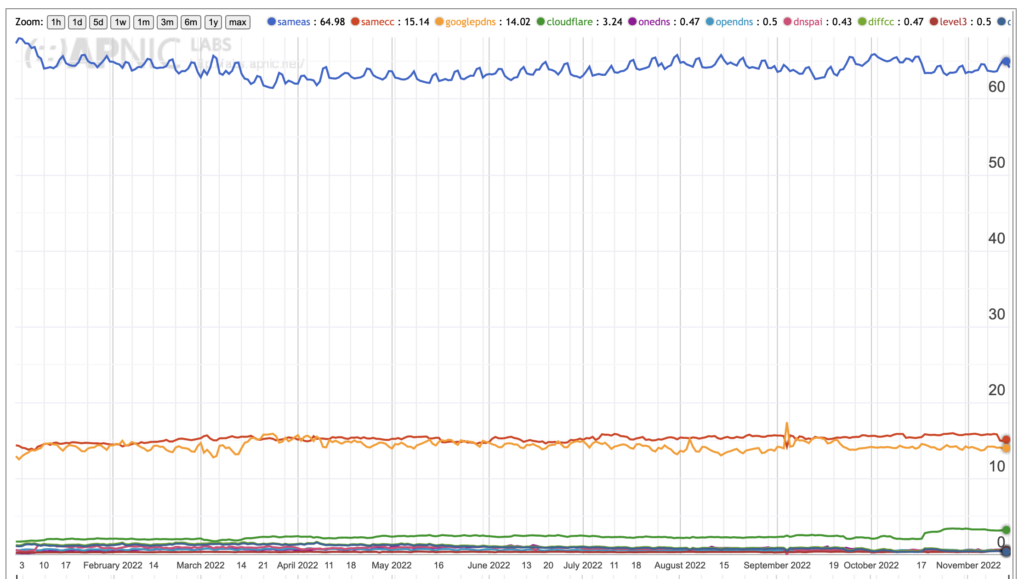

The results of this measurement are shown in Figure 4.

The current resolver use profile is shown in Table 1. Some two-thirds of users direct their queries to the recursive resolver that is operated by their ISP, and 15% of users direct their queries to a recursive resolver that is geolocated to the same economy as they are, which is likely to be their ISP using a recursive resolver in a different AS. A total of 14.0% of users have their queries resolved by Google’s Public DNS resolver, 3.2% of users use Cloudflare’s DNS resolution service, and no other open DNS provider has a share of more than 0.5% of users.

| Resolver | User Share |

| sameas | 65.0% |

| samecc | 15.1% |

| diffcc | 0.5% |

| All Open Resolvers | 20.0% |

| Google Public DNS | 14.0% |

| Cloudflare 1.1.1.1 | 3.2% |

| OneDNS (China) | 0.5% |

| OpenDNS | 0.5% |

| DNSPAI (China) | 0.4% |

| Level3 | 0.5% |

| 114DNS (China) | 0.2% |

| Green Team (Israel) | 0.05% |

| Quad9 | 0.05% |

| Neustar | 0.02% |

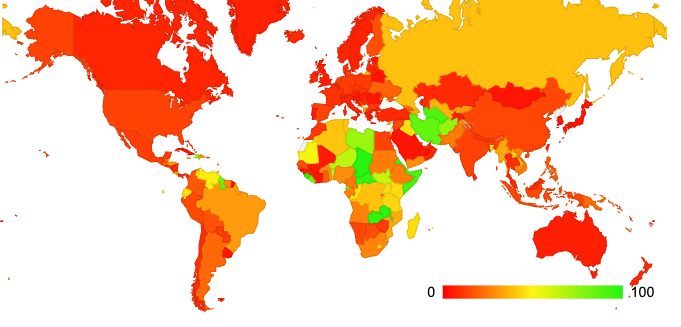

All of the open resolvers collectively have 20% of the market share of DNS resolution. We can map this data into a relative market share in each national economy, looking at the relative importance of open DNS resolver services per economy. This distribution is shown in Figure 5.

This per-economy data indicates that open DNS recursive resolvers are used as the dominant form of DNS resolution in some African economies, Guyana, Iran, Afghanistan, and Turkmenistan. We can observe that open recursive resolvers are not the dominant provider in most economies other than in Africa and a small collection of central Asian economies.

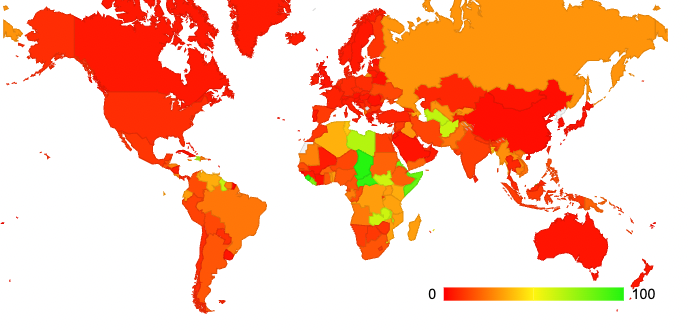

However, we also observe from Table 1 that the use of Google’s service is more than four times larger in terms of market share than the next-largest open DNS recursive resolver provider, so it is useful to take the same per-economy perspective and apply it to the use of Google’s Public DNS (PDNS) service. This distribution is shown in Figure 6.

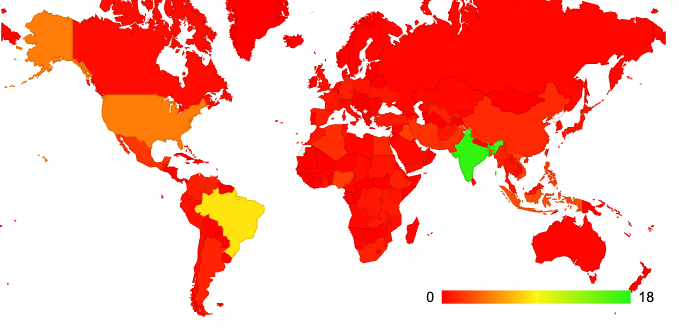

The two distributions are somewhat similar, with the dominant use of Google’s service in parts of central and eastern Africa, Iran, and Afghanistan. We can invert the question and look at this from the perspective of Google’s PDNS service by looking at the distribution of users who use this service (Figure 7).

Here the large user populations of India and Brazil come into play. 17% of all Google PDNS users are located in India, 8% in Brazil, and 5% in the US.

Given that the use of ISP-provided recursive resolution occurs for between 65% to 80% of users (depending on the attribution of the samecc resolver category, which is the same economy but different AS), and the known open resolvers have a 20% market share, Google is not the dominant recursive resolver service provider in most national markets (Figure 6). The HHI Index of the open resolvers as a subset of the DNS recursive resolution market is 4%, and Google’s position is 2%

Is this recursive resolver market centralized? No.

What if we constrain our view to look only at the open DNS resolvers, and omit the DNS services operated by an ISP for their user base?

- Single Entity Dominance: Google has 68.7% of the open DNS resolver market.

- Four-Firm Concentration: Google, Cloudflare, 114 DNS and OpenDNS have a 91.6% market share.

- HHI Index: 49%.

If we constrain our view to just the open resolver market sector we observe a highly centralized environment, with Google having a controlling (or dominant) position.

Caveats and comments

There are a number of caveats to these results based on the nature of the DNS and the nature of the users that are being measured.

What is being measured here?

When a stub resolver generates a query into the DNS it is common for two or more recursive resolvers to be passed the query. In our measurements, the client stub resolver passes the original query to two or more recursive resolvers some 60% of the time.

There is a difference between using the identity of the first resolver to ask the query, which is the resolver that presumably is the first to provide a response to the user, and is therefore the resolver that the user ‘believes’, and the collection of resolvers that ‘see’ the query from the user, which can be considered as the set of resolvers that are able to observe the user’s DNS activity. The figures presented here relate to the set of recursive resolvers that ‘see’ the original query.

When we look at the first resolver to ask the DNS query (which recursive resolver does the user ‘believe’) Google’s market share jumps from 14% to 17%, most likely due to Google’s superior speed, which is probably related to the relative density of Google’s cloud platform.

There is a second effect that we cannot readily measure in this form of experiment. In the DNS, resolution environment caching matters and a DNS recursive resolver with a large user base will tend to out-perform a resolver with a smaller user base, assuming that the cache is enough to hold the data for the time-to-live (TTL) in all cases. However, this observation is qualified by the way in which very large anycast-based DNS recursive resolvers are constructed. If the service is built upon a set of largely independent small DNS resolution engines, then there is no benefit to be derived from the large user population for the compound service. If a compound service uses a common front end with a cache, then caching does have a positive effect on the service.

Who are we measuring?

In a broad-based sampling experiment that we operate in APNIC, we have a relatively broad collection of end user points. These include both end users in retail ISPs, enterprise networks, and other networks that are not so readily classified. A look at the day-by-day detail in Figure 5 shows pronounced peaks in relative usage levels on weekends, while the opposite profile applies to Google’s service, which shows weekday peaks.

It brings into question the intent of this measurement. If the intent of the measurement is a consumer measurement, then we will need to filter the results to look only at consumer networks. It is evident that the use of third-party open recursive resolvers is far higher in enterprise-service networks, while mass-market consumer networks tend to rely heavily on the ISP-provided infrastructure. So, the measurements related to centrality provided above relate to industry-wide measurements and do not reflect the consumer market sector, the enterprise sector, or any other specialized service sector.

In addition, we see the increasing use of user privacy measures, such as Apple’s Private Relay data service, which are intended to obscure the identity and location of the user.

B. Authoritative servers

Now let’s turn our attention to the authoritative server side of DNS name resolution, looking for data that provides some indication of the level of concentration in the market to provide authoritative servers for DNS names.

This is a very different environment from the stub-to-recursive environment. Here, we cannot see users nor are we able to derive general recursive-to-authoritative query profiles from the query data from individual authoritative servers. What we would like to measure is the relative query load presented to each authoritative service provider and assess market centrality based on these query proportions.

The best place to obtain recursive-to-authoritative query profile data is from the recursive resolvers. But this is easier said than done. The issue with these measurements is that data about the recursive-to-authoritative query set is extremely hard to obtain. Recursive resolvers sit in a privileged position in the DNS, as they are exposed to both the identity of the stub resolver (the ‘user’) and the DNS names that they are querying, so it is perfectly reasonable that access to such recursive resolver data is extremely uncommon and typically comes with many caveats and limitations.

At APNIC, we have limited access to the data relating to the use of the 1.1.1.1 recursive resolver under the terms of a collaborative research agreement with Cloudflare. In this case, we do not necessarily know who is querying, but we are given the query name that is being presented to the Cloudflare resolver system. This is pre-cache query data in that it’s not the queries that the recursive resolver makes to authoritative servers, which is essentially a record of local cache misses, but a record of the queries being passed to the recursive resolver for resolution. The market share of Cloudflare’s open resolver service is around 3% of users (Figure 4) which is a non-trivial resolver in the open resolver set (ranked number 2 in terms of market share of open resolvers, as already noted).

The analysis we use here to parse the query data is to find the closest nameserver for each queried name. We are looking for the nameserver that will be used to provide the response to the query. This means resolving the NS records to follow the delegation chain and resolving CNAME and DNAME alias records on the way. We take the IP address of this nameserver and use the routing table to map this address into an origin AS, essentially locating the network operator of the server in question. If there are multiple nameservers for a domain, then we just use the first from the server list. We then resolve this nameserver name and take the first IP address for the nameserver. We then use the current routing table to map this IP address into an Autonomous System Number (ASN) of the network that advertises this prefix.

In this measurement exercise, we intentionally discount the effects of local caching in the resolver. It’s not the actual query rate of the authoritative server that we are using for this metric, but the rate at which users are using responses from this server, whether or not they were generated from the resolver’s cached entry.

We are looking at the query-count weighted ranking of the DNS authoritative server providers. If an authoritative nameserver hosts a very popular domain name, then it’s likely that the query count will be high. If a service operator hosts a very large number of domains on its authoritative server infrastructure, then it’s possible that the query count will be high. In these two situations, a large volume of served names and serving a highly popular name are routing equivalent (in some ways) in terms of ‘share’ of the authoritative server market. So, we will characterize the authoritative service hosting market by their query-based ‘market share’.

The measurement approach we used in this experiment was to take a 24-hour snapshot of queries that were presented to the Cloudflare resolver. We grouped the query names and then performed our own resolution of these names to find the ‘closest’ authoritative nameserver for the query name using a local resolution environment. Arbitrarily, we take the first nameserver name in the nameserver list. At this point, we discard the query names and concentrate on the nameservers. We then resolve the nameserver names to IP addresses and discard the nameserver names. Then we map the IP addresses to ASNs, discard the IP addresses, group the query counts into ASNs and rank by query share.

Mapping query names to authoritative service providers

Let’s take the query name www.apnic.net. The first step is to find the closest nameserver:

$ dig +short NS www.apnic.net

www.apnic.net.cdn.cloudflare.netThis is a mapped domain name that points to a cloud service provided by Cloudflare. We query the cloud prefix to see if it is a delegated domain:

$ dig +short NS cdn cloudflare.net.This is not a delegated domain, so we move up a domain to find the nameservers for the next level up:

$ dig +short NS cloudflare.net.

ns3.cloudflare.net.

ns4.cloudflare.net.

ns5.cloudflare.net.

ns1.cloudflare.net.

ns2.cloudflare.net.

Let’s take the first nameserver name and resolve it to an IP address:

$ dig +short A ns3.cloudflare.net

198.41.222.31Now let’s find the network ASN and AS name of the network that originates a route to this address prefix:

$ originas 198.41.222.31

198.41.222.31 AS13335, CLOUDFLARENET, USIn this case, the query name www.apnic.net maps to a name that is served by Cloudflare.

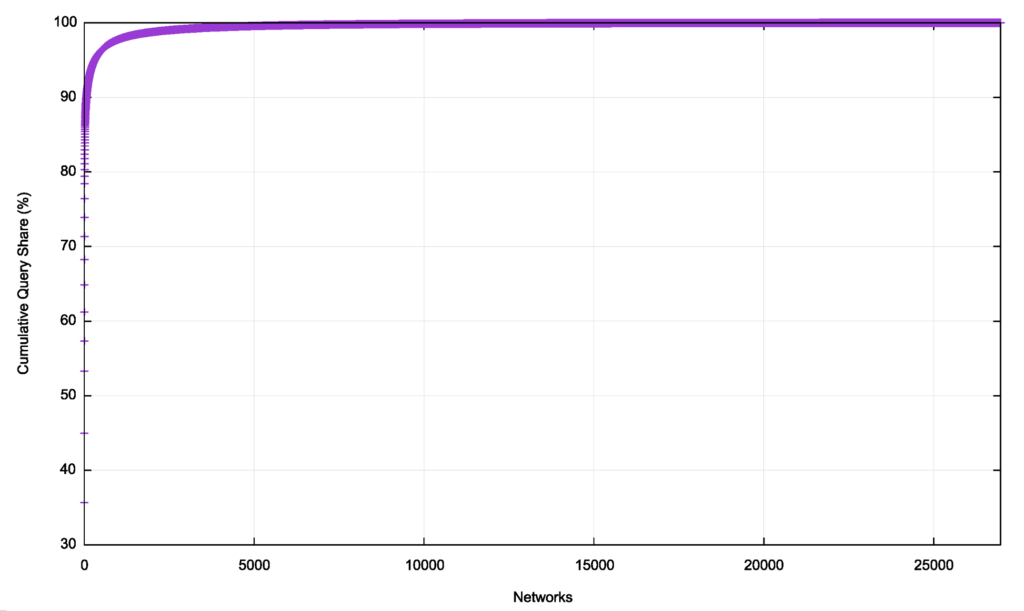

The 24-hour data capture in September 2022 identified 26,971 unique ASNs (out of a total of 75,000 unique ASNs in the routing table). While approximately one-third of networks host at least one queried authoritative nameserver the top 50 ASNs have 89.2% of the query share, a figure that appears to point to some level of consolidation in the nameserver domain.

A cumulative distribution plot bears out this indication of a high degree of centrality in this space (Figure 9).

The 10 largest authoritative nameserver providers are listed in Table 2, ranked by Cloudflare’s relative query count.

| Rank | ASN | Auth server query share | Cumulative | Name |

| 1 | AS16509 | 35.7% | 35.7% | Amazon-O2, US |

| 2 | AS13335 | 9.3% | 45.0% | Cloudflare, US |

| 3 | AS15169 | 8.3% | 33.3% | Google, US |

| 4 | AS21342 | 4.0% | 57.3% | Akamai, US |

| 5 | AS8068 | 3.9% | 61.2% | Microsoft, US |

| 6 | AS397239 | 3.7% | 64.9% | UltraDNS (Neustar), US |

| 7 | AS714 | 3.4% | 68.3% | Apple, US |

| 8 | AS31898 | 3.1% | 71.4% | Oracle, US |

| 9 | N/A | 2.5% | 73.9% | NXDOMAIN |

| 10 | AS62597 | 2.5% | 76.4% | NSone, US |

Let’s look at the ‘market’ of DNS authoritative server providers using this query-weighted ranking.

- Single Entity Dominance: Amazon has 35.7% of the authoritative server market.

- Four-Firm Concentration: Amazon, Cloudflare, Google, and Akamai have a 57.3% market share.

- HHI Index: 15%.

This authoritative server market appears to be a ‘moderately concentrated’ market.

Caveats and Comments

Geopolitical centrality

There are 10 network entities that host the authoritative nameservers that have a query share of three-quarters of the recursive-to-authoritative DNS query volume. Nine out of these ten networks are operated by US entities. The other entity is the Root Server System, which is operated by a larger set of root service operators, who all serve the DNS root zone file.

The root question

Some 2.5% of queries result in NXDOMAIN responses from the root zone. Yet the reports from the root server operators indicate that around 70% of queries seen at the root servers elicit NXDOMAIN responses.

This seems to be somewhat contradictory, but there are some additional considerations that may explain this. DNS queries that are seen at the root servers can be assumed to be queries from recursive resolvers and are the result of cache misses or cache expiration. It may be that the query volume seen by recursive resolvers is considerably greater than the query volume seen by the root servers, and the 2% of queries seen at recursive resolvers corresponds to some 70% of the root server query volume. It also might be the case that the query profile seen at the Cloudflare resolver is anomalous in having a low NXDOMAIN query volume as compared with recursive resolvers located within USP networks.

Amazon and Route 53

The Amazon-O2 number, corresponding to servers in AS16509 is actually two sets of authoritative servers. Amazon has their own authoritative server service, Route 53, and in addition, many users use Amazon’s virtual servers to run their own authoritative servers. In this exercise, we’ve joined two together, which is perhaps misleading.

Limitations

This analysis is based on a single 24-hour data set from a single open recursive resolver service. The query sample set is not completely uniform and there is a potential bias to enterprise use and some browser use

Also, using query volumes as a proxy for some form of market share is not a universally accepted analytic metric

So, while we might suspect that there is some skew in the data, there is no alternative source of information that would allow us to work on this suspected skew.

Conclusions

Is the DNS resolution market centralized? Are most DNS queries handled by a small set of operators in the recursive resolver space? And what about authoritative servers? Is the market for these services highly centralized?

For the recursive resolver market, it appears that the majority use of the ISP-provided recursive resolver offsets the high degree of centralization in the open recursive resolver market, and the global market appears to be appropriately balanced in terms of diversity of providers. The same does not apply when we constrain the scope of this examination to just the open recursive resolvers or look at certain national economies, where there is a high degree of centrality.

We have also looked at the market for authoritative servers, which is a somewhat different picture. Using a query-weighted metric to calculate market share, the largest four service providers account for 57% of queries, and the market for authoritative servers appears to be moderately centralized.

There are several concerns that are associated with a highly centralized market, particularly as it relates to the provision of common infrastructure services, such as the DNS. One is the emergence of critical vulnerabilities where the entirety of the activity, and to be clear, here we are talking about the digital economy, is reliant on the services undertaken by a small clique of providers, or even a single provider. While this is a valid concern in the case of the provision of authoritative servers in the DNS, it is not a concern in the provision of recursive resolution services where ISP-provided services provide a necessary balance to the position of Google’s Public DNS offering.

Another concern is that centralization can lead to monopoly or cartel-like behaviour resulting in price gouging and other forms of market abuse. The issue is one of consumer protection, where price escalation in the provision of essential infrastructure services can cause inefficiencies throughout the entire digital economy. Here, a somewhat anomalous aspect of the recursive resolution is able to allay this concern for consumers. The market for DNS recursive resolution looks like a complete economic failure! None of the service’s clients pays for the service! Users do not, in general, directly pay to have their queries answered, and users do not pay to have their potential future responses held in the cached of recursive resolvers for faster service when needed.

From the consumer perspective, this has the superficial appearance of a free service! Name operators also do not pay recursive resolvers to resolve their names on their behalf. So, nobody pays. The concern that centralization would lead to the emergence of price escalation in this market through the imposition of monopoly rentals seems like a very distant prospect right now. (Yes, there are some specialized DNS resolution services where the client does pay, including so-called ‘scrubbing’ DNS services that preemptively remove the resolution of certain DNS names, but these tend to have a specialized client base and do not seem to have an impact on the larger DNS resolution market, at least so far.)

Is there a potential user impact contained in the emerging centralization of the authoritative nameserver service? To some extent yes, this is a distinct possibility, but for me, this topic is bound up in the larger topic of the nature of monopoly and competition in digital markets. The economic environment of the digital world is far removed from that of the physical industrial world of the 1890s where the concept of regulatory responses to monopolistic behaviours was crystallized in the Sherman Act in the US. It’s sufficiently different that it merits some consideration as a topic on its own in a future article.

The views expressed by the authors of this blog are their own and do not necessarily reflect the views of APNIC. Please note a Code of Conduct applies to this blog.